Question: If the average return for the S&P500 is 1% and the standard deviation of annual returns is 18 % , what is the 95% prediction

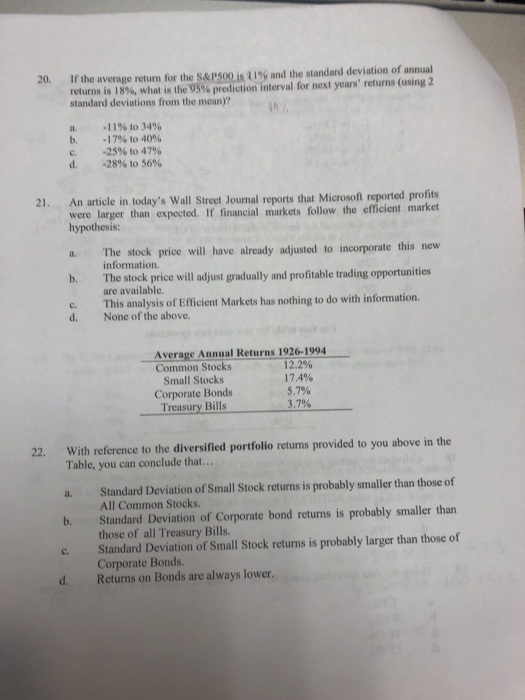

If the average return for the S&P500 is 1% and the standard deviation of annual returns is 18 % , what is the 95% prediction interval for next years' returns (using 2 standard deviations from the mean)? 20. 7 11% to 34 % -17% to 40% -25% to 479% -28% to 56 % a. b. c. d. An article in today's Wall Street Journal reports that Microsoft reported profits were larger than expected. If financial markets follow the efficient market hypothesis 21. The stock price will have already adjusted to incorporate this new a. information. The stock price will adjust gradually and profitable trading opportunities are available. This analysis of Efficient Markets has nothing to do with information. None of the above. b. c. d. Average Annual Returns 1926-1994 12.2% Common Stocks Small Stocks Corporate Bonds Treasury Bills 17.4% 5.7% 3.7% With reference to the diversified portfolio returns provided to you above in the Table, you can conclude that... 22 Standard Deviation of Small Stock returns is probably smaller than those of All Common Stocks. Standard Deviation of Corporate bond returns is probably smaller than those of all Treasury Bills. Standard Deviation of Small Stock returns is probably larger than those of a. b. c. Corporate Bonds. Returns on Bonds are always lower. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts