Question: If the below-listed events happen - how does it affect the following financial statements? 1 - Statement of Profit & Loss and other comprehensive income

If the below-listed events happen - how does it affect the following financial statements?

1 - Statement of Profit & Loss and other comprehensive income

2 - Statement of financial position

3 - Statement of changes in equity

***Events:

- During the financial year, one of the office buildings was revaluated upwards by 30,000.

- 400,000 preference shares were issued at $1 per share on 3 July 2018. The share issue cost amounted to 4,000.

- Assume the income tax rate is 30%.

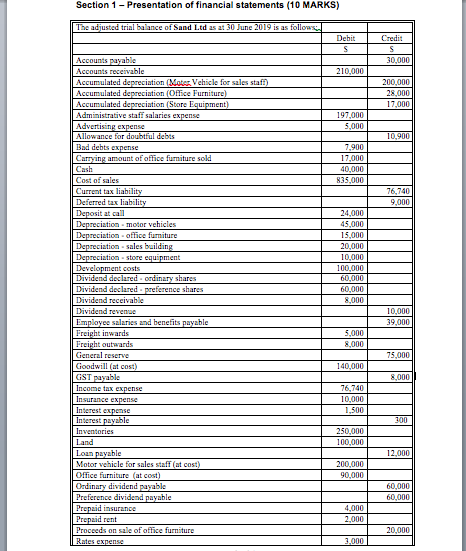

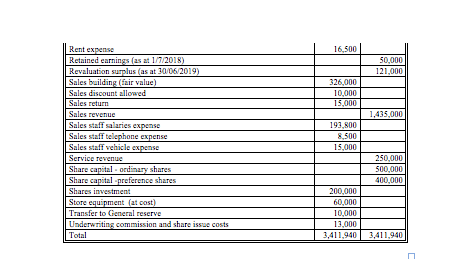

Section 1 - Presentation of financial statements (10 MARKS) he adjusted trial balance of Sand Ltd as at 30 June Debit Credi Accounts receivable Accumulated depreciation (KotVehicle for sales s Accumulated depreciation (Office Furniture Accumulated depreciation (Store Administrative stafi salaries expense Advertising expense 10,000 197,000 5,000 Bad debts expense 900 amount of office furniture sold 40,000 835,000 urrent tax liabil 9,00 4,000 45,000 t at cal reciation motor vehicles reciation office furniture reciation- sales baildi 0,000 Development costs Dividend declared 60,000 60,000 ,000 erence shares Dividend receivable Dividend revenae Emplovee szlaries and benefits payable 10,000 39,000 5,000 ,000 enerzl reserve Goodwill (at cost) 140,000 able ,000 76,740 0,000 1,500 250,000 100,000 Land Loan payable Motor vehicle for sales staff (at cost Office furniture (at cost) Ordinary dividend payable Preference dividend payable 90,000 60,000 60,000 4,000 Proceeds on sale of office furniture 16,500 50,000 Salas iligEavale Sales discount allowed 15 1,435,000 193,800 Sales staff telephone expense Shares investment 00,000 60,000 Transfer to General reserve derwriting commission and share issue costs Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts