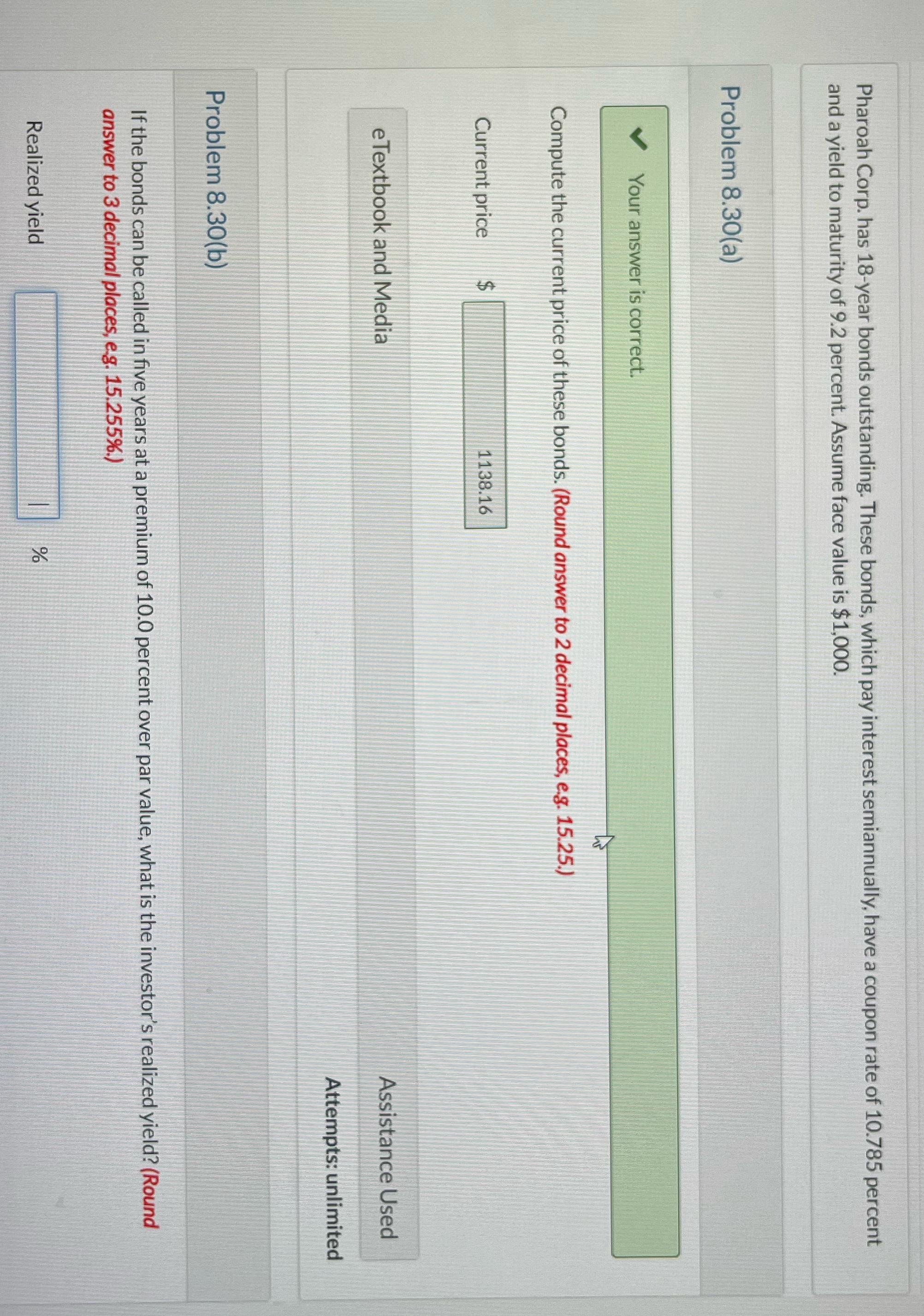

Question: If the bonds can be called in five years at a premium of 10.0 percent over par value, what is the investors realized rate? Pharoah

If the bonds can be called in five years at a premium of 10.0 percent over par value, what is the investors realized rate?

Pharoah Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 10.785 percent and a yield to maturity of 9.2 percent. Assume face value is $1,000. Problem 8.30(a) V Your answer is correct. Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Current price 1138.16 e Textbook and Media Assistance Used Attempts: unlimited Problem 8.30(b) If the bonds can be called in five years at a premium of 10.0 percent over par value, what is the investor's realized yield? (Round answer to 3 decimal places, e g. 15.255%.) Realized yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts