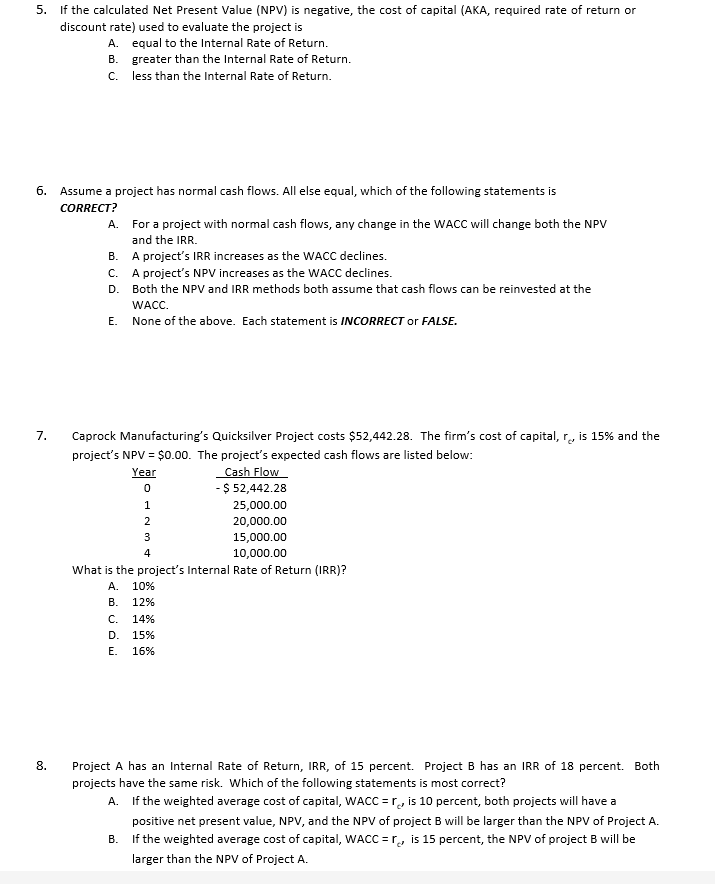

Question: If the calculated Net Present Value ( NPV ) is negative, the cost of capital ( AKA , required rate of return or discount rate

If the calculated Net Present Value NPV is negative, the cost of capital AKA required rate of return or

discount rate used to evaluate the project is

A equal to the Internal Rate of Return.

B greater than the Internal Rate of Return.

C less than the Internal Rate of Return.

Assume a project has normal cash flows. All else equal, which of the following statements is

CORRECT?

A For a project with normal cash flows, any change in the WACC will change both the NPV

and the IRR.

B A project's IRR increases as the WACC declines.

C A project's NPV increases as the WACC declines.

D Both the NPV and IRR methods both assume that cash flows can be reinvested at the

WACC.

E None of the above. Each statement is INCORRECT or FALSE.

Caprock Manufacturing's Quicksilver Project costs $ The firm's cost of capital, is and the

project's NPV $ The project's expected cash flows are listed below:

What is the project's Internal Rate of Return IRR

A

B

C

D

E

Project A has an Internal Rate of Return, IRR, of percent. Project B has an IRR of percent. Both

projects have the same risk. Which of the following statements is most correct?

A If the weighted average cost of capital, WACC is percent, both projects will have a

positive net present value, NPV and the NPV of project B will be larger than the NPV of Project A

B If the weighted average cost of capital, WACC is percent, the NPV of project will be

larger than the NPV of Project A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock