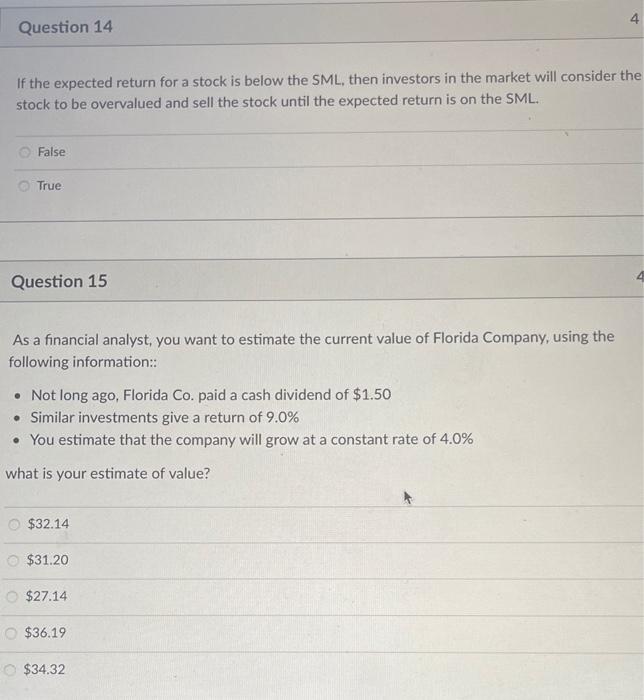

Question: If the expected return for a stock is below the SML, then investors in the market will consider the stock to be overvalued and sell

If the expected return for a stock is below the SML, then investors in the market will consider the stock to be overvalued and sell the stock until the expected return is on the SML. False True Question 15 As a financial analyst, you want to estimate the current value of Florida Company, using the following information:: - Not long ago, Florida Co. paid a cash dividend of $1.50 - Similar investments give a return of 9.0% - You estimate that the company will grow at a constant rate of 4.0% what is your estimate of value? $32.14$31.20$27.14$36.19$34.32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts