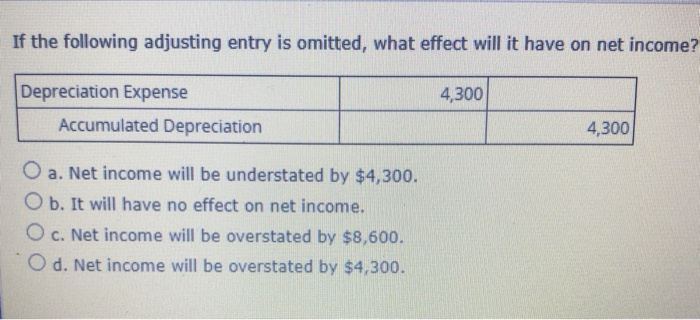

Question: If the following adjusting entry is omitted, what effect will it have on net income? 4,300 Depreciation Expense Accumulated Depreciation 4,300 O a. Net income

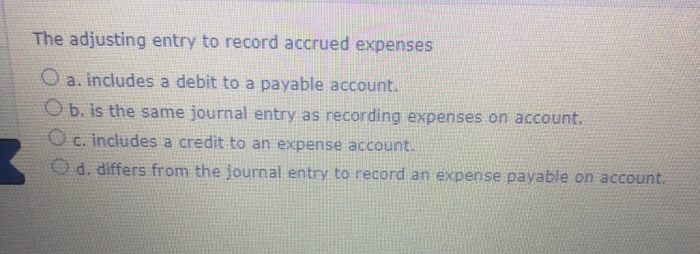

If the following adjusting entry is omitted, what effect will it have on net income? 4,300 Depreciation Expense Accumulated Depreciation 4,300 O a. Net income will be understated by $4,300. O b. It will have no effect on net income. O c. Net income will be overstated by $8,600. O d. Net income will be overstated by $4,300. The adjusting entry to record accrued expenses O a. includes a debit to a payable account. O b. is the same journal entry as recording expenses on account. O c. includes a credit to an expense account. d. differs from the journal entry to record an expense payable on account

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock