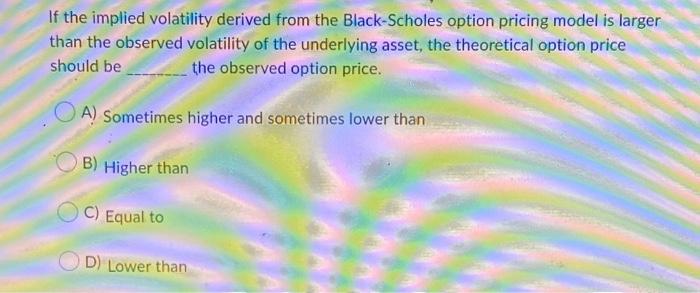

Question: If the implied volatility derived from the Black-Scholes option pricing model is larger than the observed volatility of the underlying asset, the theoretical option price

If the implied volatility derived from the Black-Scholes option pricing model is larger than the observed volatility of the underlying asset, the theoretical option price should be the observed option price. A) Sometimes higher and sometimes lower than B) Higher than C) Equal to D) Lower than

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts