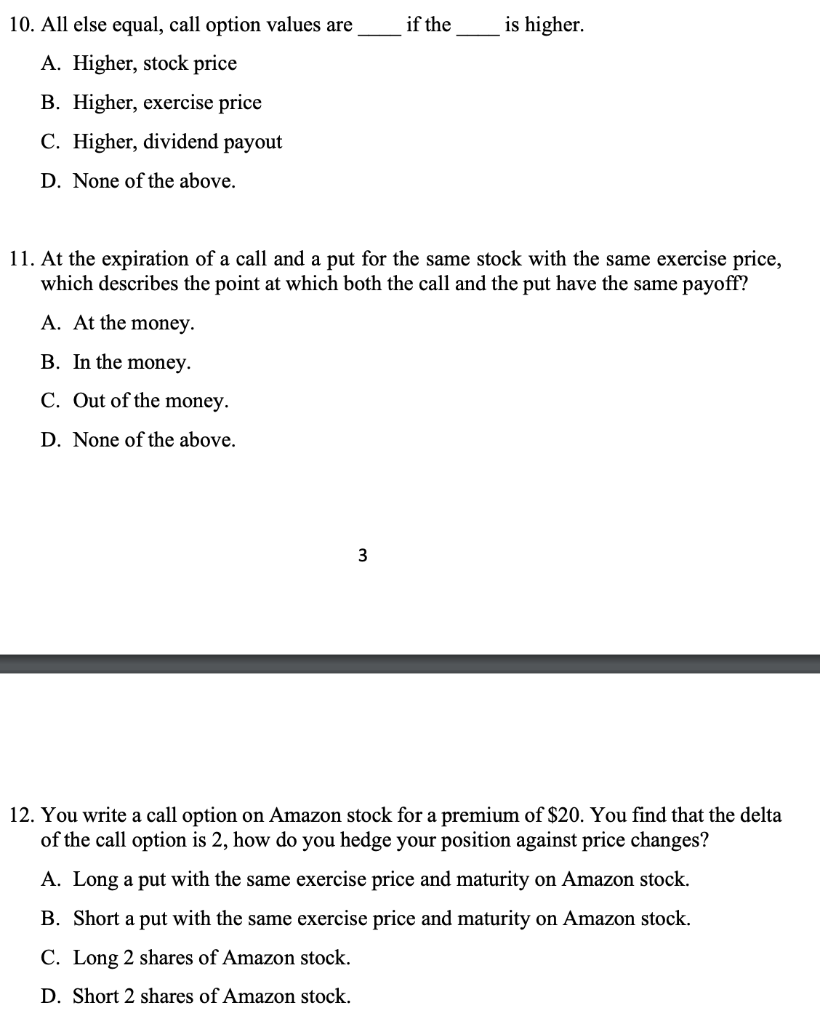

Question: if the is higher. 10. All else equal, call option values are A. Higher, stock price B. Higher, exercise price C. Higher, dividend payout D.

if the is higher. 10. All else equal, call option values are A. Higher, stock price B. Higher, exercise price C. Higher, dividend payout D. None of the above. 11. At the expiration of a call and a put for the same stock with the same exercise price, which describes the point at which both the call and the put have the same payoff? A. At the money. B. In the money. C. Out of the money. D. None of the above. 12. You write a call option on Amazon stock for a premium of $20. You find that the delta of the call option is 2, how do you hedge your position against price changes? A. Long a put with the same exercise price and maturity on Amazon stock. B. Short a put with the same exercise price and maturity on Amazon stock. C. Long 2 shares of Amazon stock. D. Short 2 shares of Amazon stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts