Question: If the markets are efficient, then why is asset allocation still considered important? because the majority of market gains tend to occur only over long

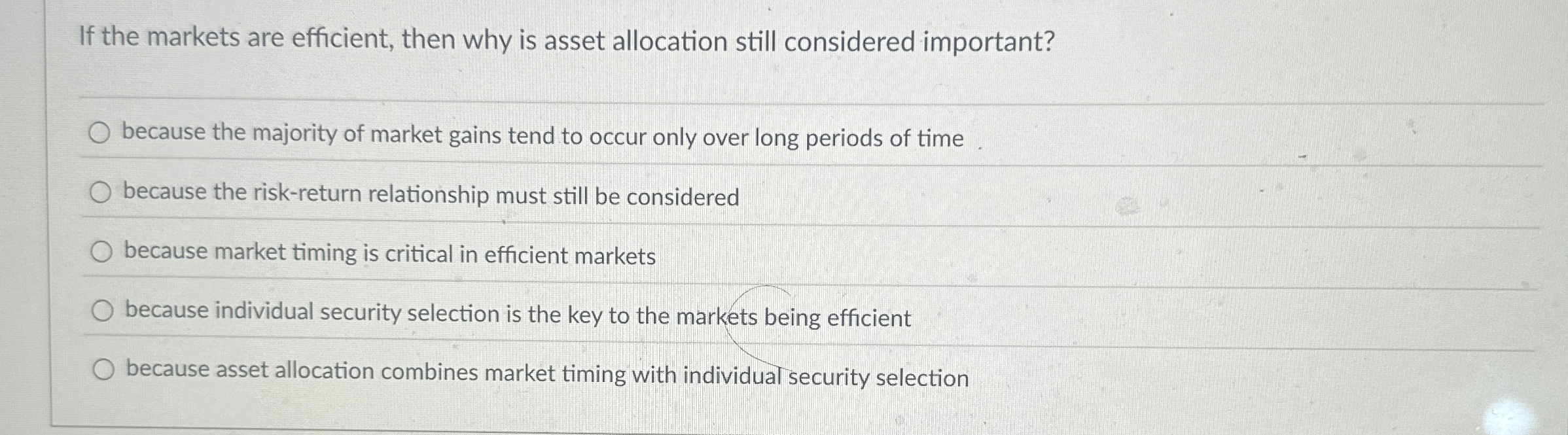

If the markets are efficient, then why is asset allocation still considered important?

because the majority of market gains tend to occur only over long periods of time

because the riskreturn relationship must still be considered

because market timing is critical in efficient markets

because individual security selection is the key to the markets being efficient

because asset allocation combines market timing with individual security selection

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock