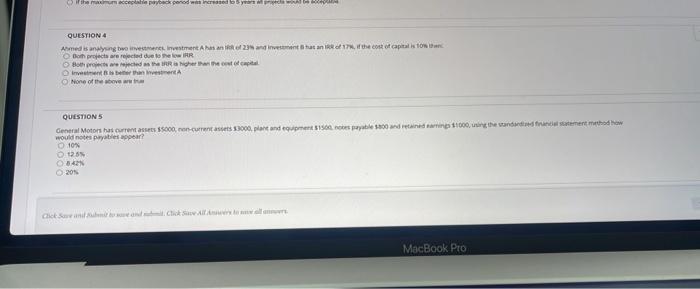

Question: if the maximum acceptable payback penod was increased to 5 years at pripect whe QUESTION 4 Ahmed is analysing two investments, Investment A has an

if the maximum acceptable payback penod was increased to 5 years at pripect whe QUESTION 4 Ahmed is analysing two investments, Investment A has an iR of 23% and investment has an IRR of 17%, if the cost of capital is 10% O Both projects are rejected due to the low IRR cost of capital Both projects are rejected as the IRR is higher Investment is better than investment A None of the above are t QUESTIONS General Motors has current assets $5000, non-current assets 13000, plant and equipment $1500 notes payable $800 and retained earnings 11000, using the standardized financial statement method how would notes payables appear? O 10% 12.5% 0842% 20% Click Save and to sove and. Click Save All Answers to all MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts