Question: If the plan in the previous problem wants to fully immunize its position, how much of its portfolio should it allocate to two year zero

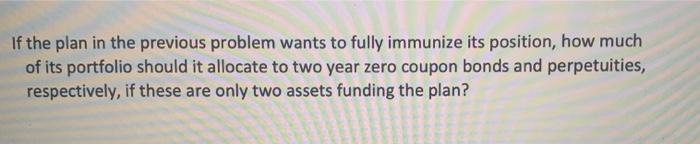

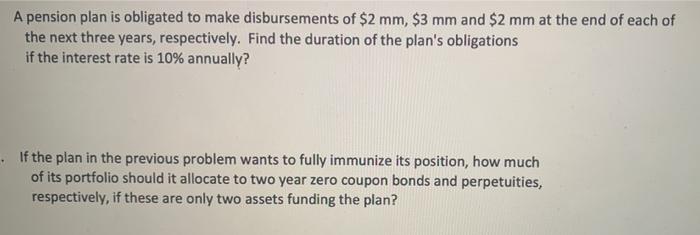

If the plan in the previous problem wants to fully immunize its position, how much of its portfolio should it allocate to two year zero coupon bonds and perpetuities, respectively, if these are only two assets funding the plan? A pension plan is obligated to make disbursements of $2 mm, $3 mm and $2 mm at the end of each of the next three years, respectively. Find the duration of the plants obligations if the interest rate is 10% annually? . If the plan in the previous problem wants to fully immunize its position, how much of its portfolio should it allocate to two year zero coupon bonds and perpetuities, respectively, if these are only two assets funding the plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts