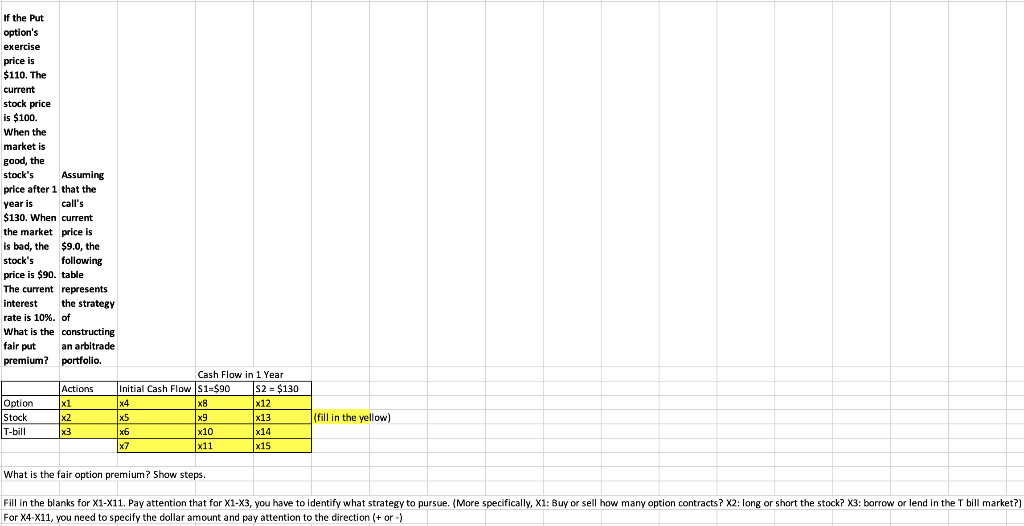

Question: If the Put option's exercise price is $110. The . current stock price is $100. When the market is good, the stock's Assuming price after

If the Put option's exercise price is $110. The . current stock price is $100. When the market is good, the stock's Assuming price after 1 that the year is call's $130. When current the market price is is bad, the $9.0, the stock's following price is $90. table The current represents interest the strategy rate is 10%. of What is the constructing fair put an arbitrade premium? portfolio ? . Cash Flow in 1 Year Actions Initial Cash Flow S1 $90 S2 = $130 Option x1 X4 x8 x12 Stock x2 X5 x9 X13 T-bill x3 X6 x10 x14 X7 x11 x15 (fill in the yellow) What is the fair option premium? Show steps. Fill in the blanks for X1-X11. Pay attention that for X1-X3, you have to identify what strategy to pursue. (More specifically, X1: Buy or sell how many option contracts? X2: long or short the stock? X3: borrow or lend in the T bill market?) For X4-X11, you need to specify the dollar amount and pay attention to the direction (+ or -) If the Put option's exercise price is $110. The . current stock price is $100. When the market is good, the stock's Assuming price after 1 that the year is call's $130. When current the market price is is bad, the $9.0, the stock's following price is $90. table The current represents interest the strategy rate is 10%. of What is the constructing fair put an arbitrade premium? portfolio ? . Cash Flow in 1 Year Actions Initial Cash Flow S1 $90 S2 = $130 Option x1 X4 x8 x12 Stock x2 X5 x9 X13 T-bill x3 X6 x10 x14 X7 x11 x15 (fill in the yellow) What is the fair option premium? Show steps. Fill in the blanks for X1-X11. Pay attention that for X1-X3, you have to identify what strategy to pursue. (More specifically, X1: Buy or sell how many option contracts? X2: long or short the stock? X3: borrow or lend in the T bill market?) For X4-X11, you need to specify the dollar amount and pay attention to the direction (+ or -)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts