Question: If the return on stock A in year 1 was 9 %, in year 2 was 11 %, in year 3 was 4% and

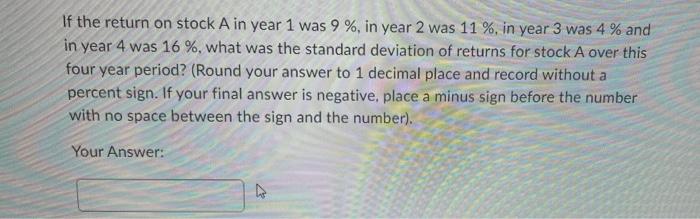

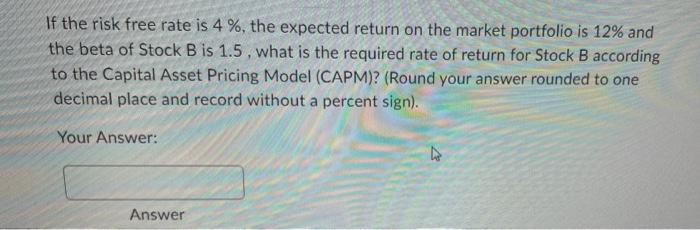

If the return on stock A in year 1 was 9 %, in year 2 was 11 %, in year 3 was 4% and in year 4 was 16 %, what was the standard deviation of returns for stock A over this four year period? (Round your answer to 1 decimal place and record without a percent sign. If your final answer is negative, place a minus sign before the number with no space between the sign and the number). Your Answer: If the risk free rate is 4 %, the expected return on the market portfolio is 12% and the beta of Stock B is 1.5, what is the required rate of return for Stock B according to the Capital Asset Pricing Model (CAPM)? (Round your answer rounded to one decimal place and record without a percent sign). Your Answer: 4 Answer

Step by Step Solution

There are 3 Steps involved in it

Answer Solution 1 Standard deviations 86 Calculations ii Standard devia... View full answer

Get step-by-step solutions from verified subject matter experts