Question: If the return on the S&P 500 is Consider the well-diversified portfolio 12% and the yield on Treasury bills is 1%, what is the

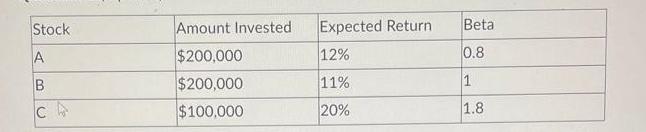

If the return on the S&P 500 is Consider the well-diversified portfolio 12% and the yield on Treasury bills is 1%, what is the required return on this portfolio? Stock A B CA Amount Invested $200,000 $200,000 $100,000 Expected Return 12% 11% 20% Beta 0.8 1 1.8

Step by Step Solution

There are 3 Steps involved in it

ANSWER To calculate the required return on a welldiversified portfolio we need to use the ... View full answer

Get step-by-step solutions from verified subject matter experts