Question: If the risk-adjusted net present value is positive, 1. the internal rate of return exceeds the firm's cost of capital 2. the internal rate of

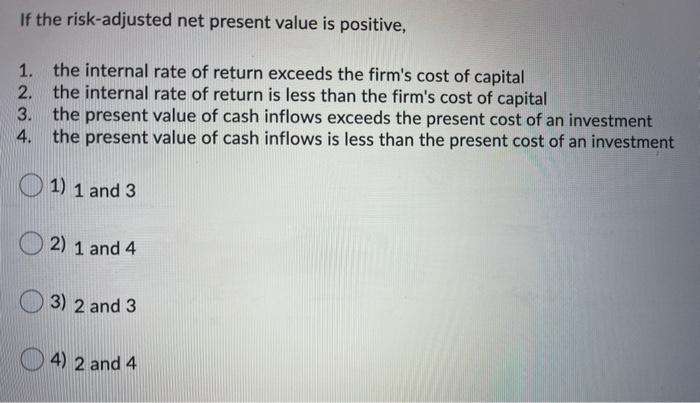

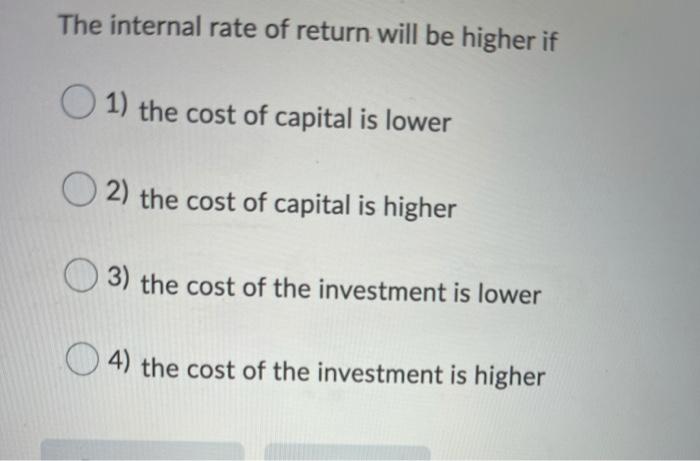

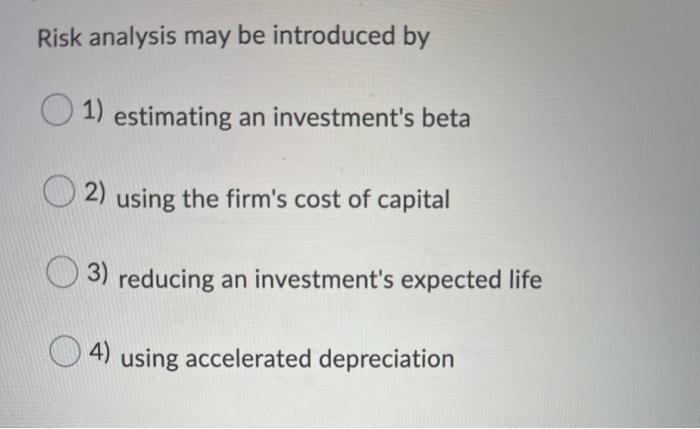

If the risk-adjusted net present value is positive, 1. the internal rate of return exceeds the firm's cost of capital 2. the internal rate of return is less than the firm's cost of capital 3. the present value of cash inflows exceeds the present cost of an investment 4. the present value of cash inflows is less than the present cost of an investment 1) 1 and 3 2) 1 and 4 3) 2 and 3 4) 2 and 4 The internal rate of return will be higher if 1) the cost of capital is lower O2) the cost of capital is higher 3) the cost of the investment is lower 4) the cost of the investment is higher Risk analysis may be introduced by 1) estimating an investment's beta 2) using the firm's cost of capital 3) reducing an investment's expected life 4) using accelerated depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts