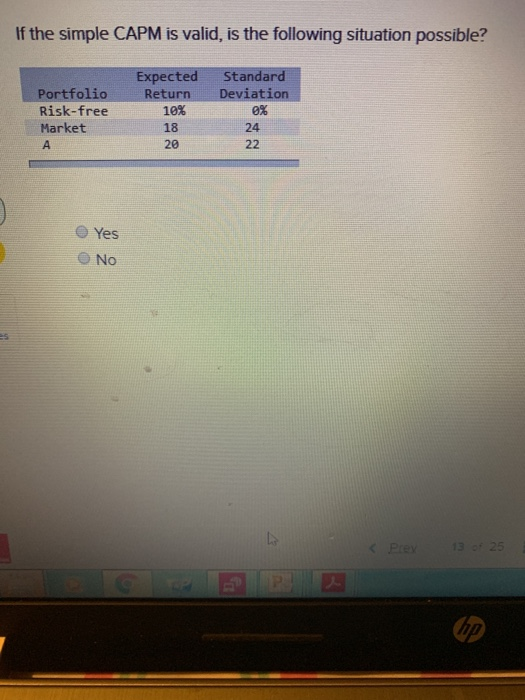

Question: If the simple CAPM is valid, is the following situation possible? Exp ected Standard Portfolio Risk-free Market viation 8% Return De 10% 18 20 24

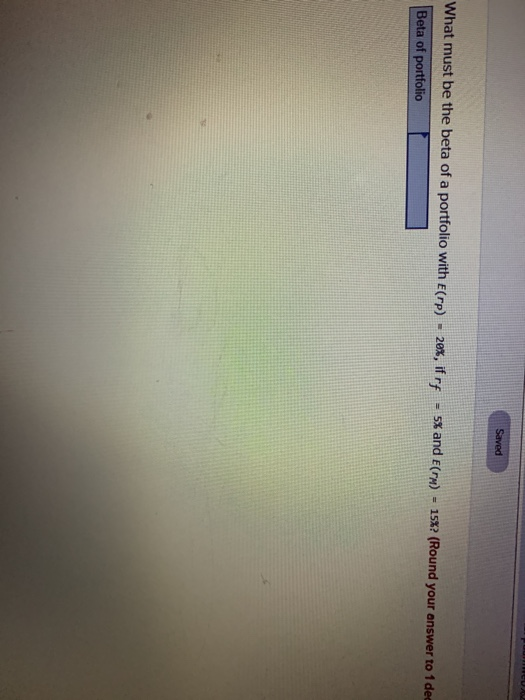

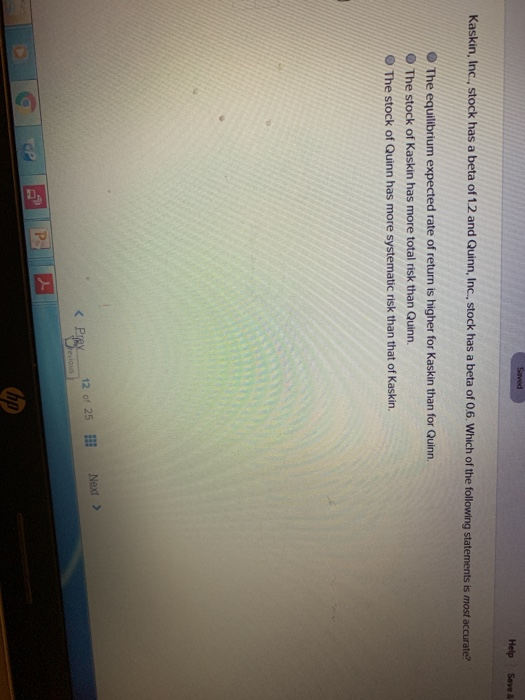

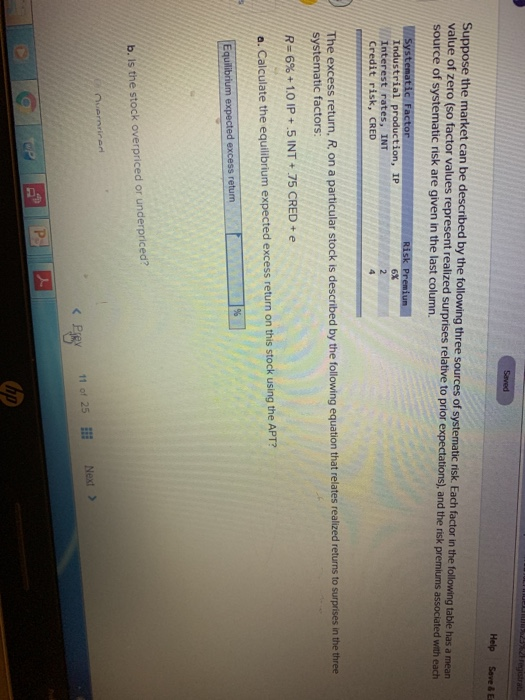

If the simple CAPM is valid, is the following situation possible? Exp ected Standard Portfolio Risk-free Market viation 8% Return De 10% 18 20 24 O Yes No 25 what must be the beta of a portfolio with E (rp)-20%, if rf Beta of portfolico -5x and E (m)-15%? (Round your answer to 1 de Help Save & Kaskin, Inc., stock has a beta of 1.2 and Quinn, Inc, stock has a beta of 06. Which of the following statements is most accurate? The equilibrium expected rate of return is higher for Kaskin than for Quinn. The stock of Kaskin has more total risk than Quinn. The stock of Quinn has more systematic risk than that of Kaskin. 12 of 25l Next Help Save & E Suppose the market can be described by the following three sources of systematic risk Each factor in the following table has a mean value of zero (so factor values represent realized surprtises relative to prior expectations), and the risk premiuasocated tch source of systematic risk are given in the last column. and the risk premiums associated with each sk Premiun uction, IP 6% Credit risk, CRED The excess return, R, on a particular stock is described by the following equation that relates realized returns to surprises in the three systematic factors: R 6% + 1.0 IP + .5 INT + 75 CRED + e a. Calculate the equilibrium expected excess return on this stock using the APT? b. Is the stock overpriced or underpriced?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts