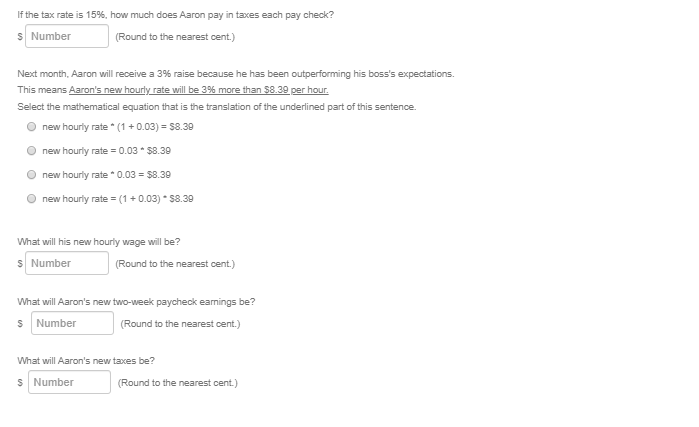

Question: If the tax rate is 15%, how much does Aaron pay in taxes each pay check? S Number (Round to the nearest cent.) Next month,

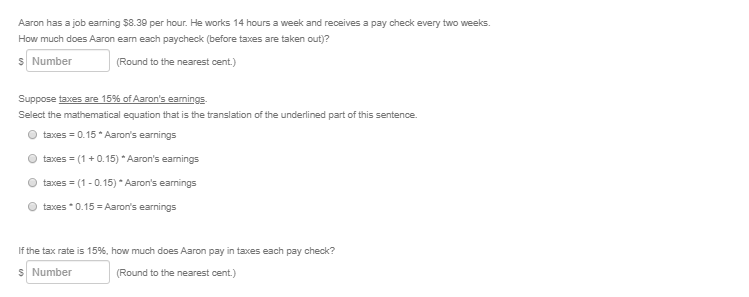

If the tax rate is 15%, how much does Aaron pay in taxes each pay check? S Number (Round to the nearest cent.) Next month, Aaron will receive a 3% raise because he has been outperforming his boss's expectations. This means Aaron's new hourly rate will be 3% more than $8.30 per hour. Select the mathematical equation that is the translation of the underlined part of this sentence. O new hourly rate * (1 + 0.03) = $8.39 new hourly rate = 0.03 * $8.39 new hourly rate * 0.03 = $8.39 O new hourly rate = (1 + 0.03) * $8.39 What will his new hourly wage will be? S Number (Round to the nearest cent.) What will Aaron's new two-week paycheck earnings be? Number (Round to the nearest cent.) What will Aaron's new taxes be? Number (Round to the nearest cent.)Aaron has a job earning $8.39 per hour. He works 14 hours a week and receives a pay check every two weeks. How much does Aaron eam each paycheck (before taxes are taken out)? S Number (Round to the nearest cent.) Suppose taxes are 15% of Aaron's earnings. Select the mathematical equation that is the translation of the underlined part of this sentence. O taxes = 0.15 * Aaron's earnings O taxes = (1 + 0.15) * Aaron's earnings O taxes = (1 - 0.15) * Aaron's earnings O taxes * 0.15 = Aaron's earnings If the tax rate is 15%, how much does Aaron pay in taxes each pay check? Number (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts