Question: If the variable cost per unit is $50, the current price is $140, and the monthly required return is 3.5%. What is the break-even Probability

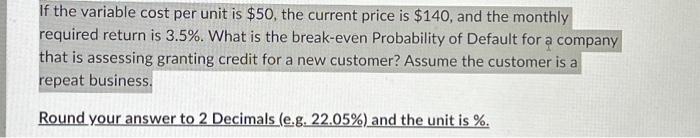

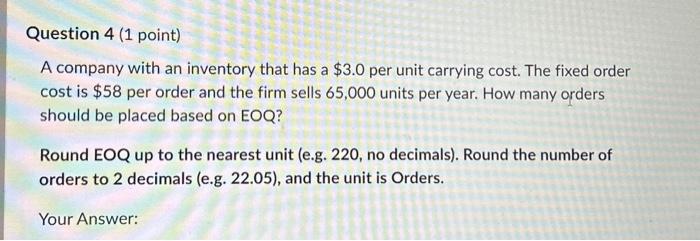

If the variable cost per unit is $50, the current price is $140, and the monthly required return is 3.5%. What is the break-even Probability of Default for a company that is assessing granting credit for a new customer? Assume the customer is a repeat business. Round your answer to 2 Decimals (e.g. 22.05% ) and the unit is %. Question 4 (1 point) A company with an inventory that has a $3.0 per unit carrying cost. The fixed order cost is $58 per order and the firm sells 65,000 units per year. How many orders should be placed based on EOQ? Round EOQ up to the nearest unit (e.g. 220, no decimals). Round the number of orders to 2 decimals (e.g. 22.05), and the unit is Orders. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts