Question: If this could be done in excel, I would appreciate it or at least the steps with formulas so I can follow along Thank you

If this could be done in excel, I would appreciate it or at least the steps with formulas so I can follow along

Thank you

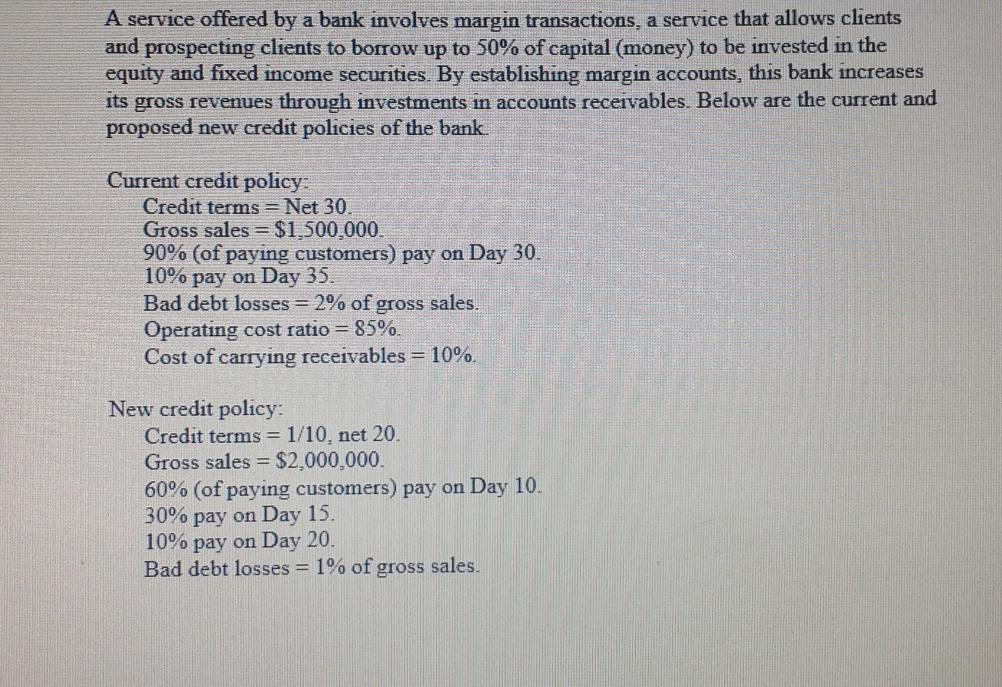

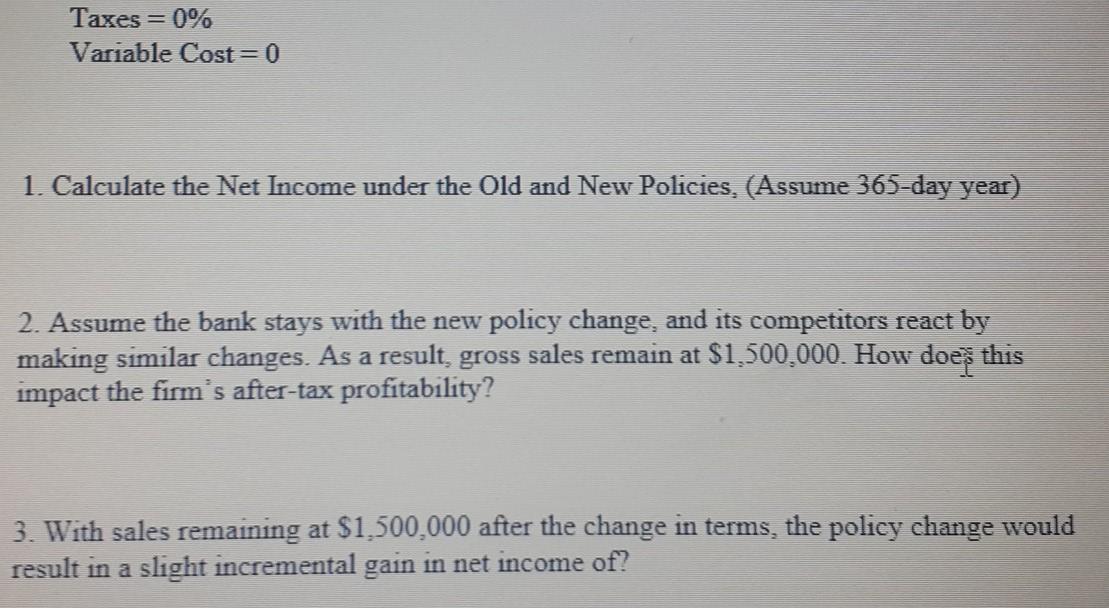

A service offered by a bank involves margin transactions, a service that allows clients and prospecting clients to borrow up to 50% of capital (money) to be invested in the equity and fixed income securities. By establishing margin accounts, this bank increases its gross revenues through investments in accounts receivables. Below are the current and proposed new credit policies of the bank. Current credit policy: Credit terms = Net 30. Gross sales = $1,500,000. 90% (of paying customers) pay on Day 30. 10% pay on Day 35. Bad debt losses = 2% of gross sales. Operating cost ratio = 85% Cost of carrying receivables = 10%. New credit policy: Credit terms = 1/10, net 20. Gross sales = $2,000,000. 60% (of paying customers) pay on Day 10. 30% pay on Day 15. 10% pay on Day 20. Bad debt losses = 1% of gross sales. Taxes = 0% Variable Cost=0 1. Calculate the Net Income under the Old and New Policies. (Assume 365-day year) 2. Assume the bank stays with the new policy change, and its competitors react by making similar changes. As a result, gross sales remain at $1,500,000. How doe this impact the firm's after-tax profitability? 3. With sales remaining at $1,500,000 after the change in terms, the policy change would result in a slight incremental gain in net income of? A service offered by a bank involves margin transactions, a service that allows clients and prospecting clients to borrow up to 50% of capital (money) to be invested in the equity and fixed income securities. By establishing margin accounts, this bank increases its gross revenues through investments in accounts receivables. Below are the current and proposed new credit policies of the bank. Current credit policy: Credit terms = Net 30. Gross sales = $1,500,000. 90% (of paying customers) pay on Day 30. 10% pay on Day 35. Bad debt losses = 2% of gross sales. Operating cost ratio = 85% Cost of carrying receivables = 10%. New credit policy: Credit terms = 1/10, net 20. Gross sales = $2,000,000. 60% (of paying customers) pay on Day 10. 30% pay on Day 15. 10% pay on Day 20. Bad debt losses = 1% of gross sales. Taxes = 0% Variable Cost=0 1. Calculate the Net Income under the Old and New Policies. (Assume 365-day year) 2. Assume the bank stays with the new policy change, and its competitors react by making similar changes. As a result, gross sales remain at $1,500,000. How doe this impact the firm's after-tax profitability? 3. With sales remaining at $1,500,000 after the change in terms, the policy change would result in a slight incremental gain in net income of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts