Question: IF this image is too small, please leave your email. i will attach the file thanks. 220 Monthly index nominal returns for US Bonds, US

IF this image is too small, please leave your email.

i will attach the file

thanks.

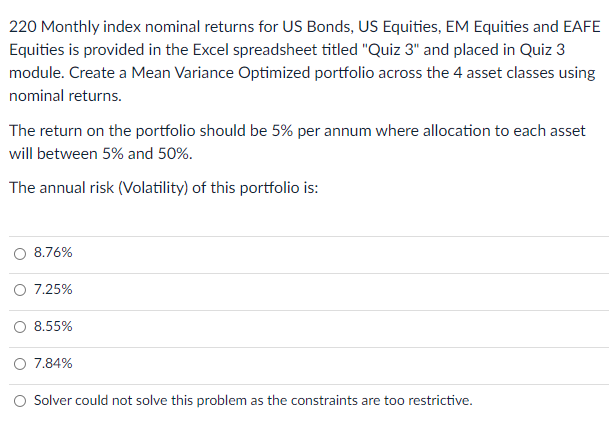

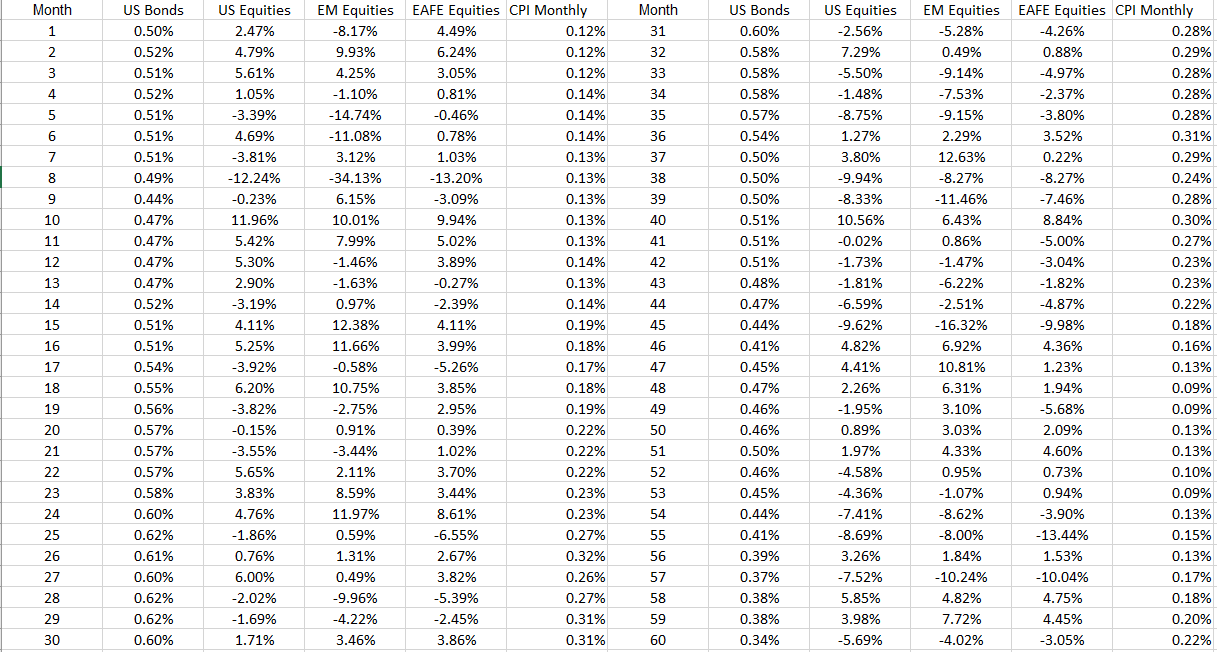

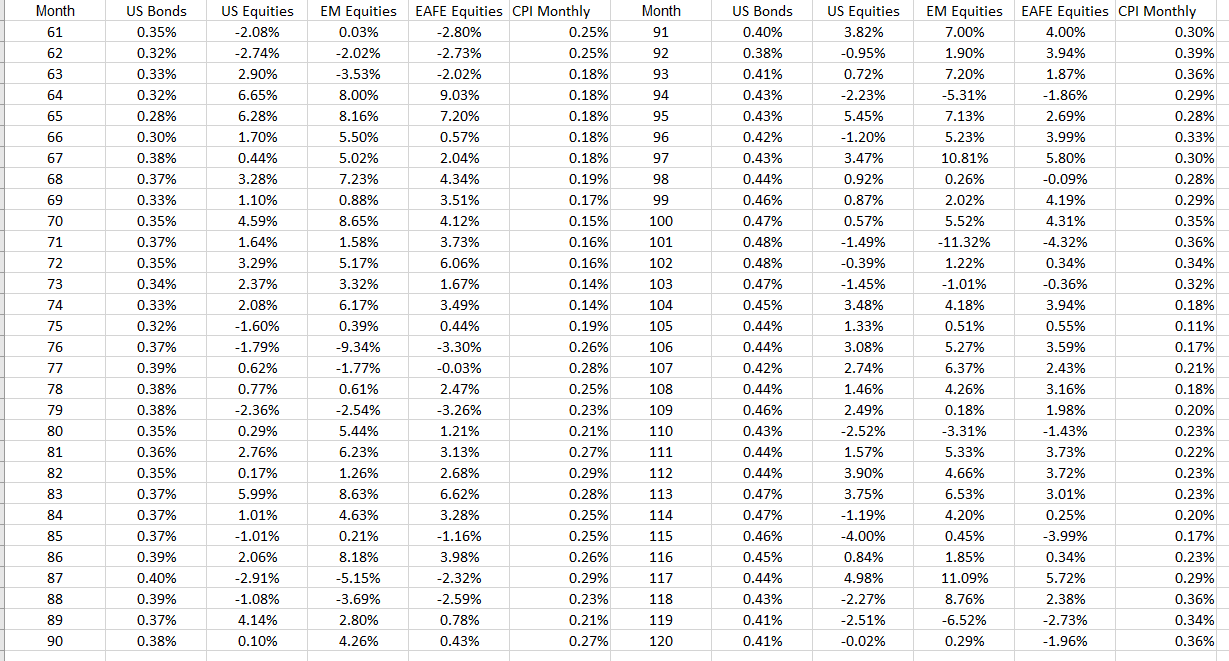

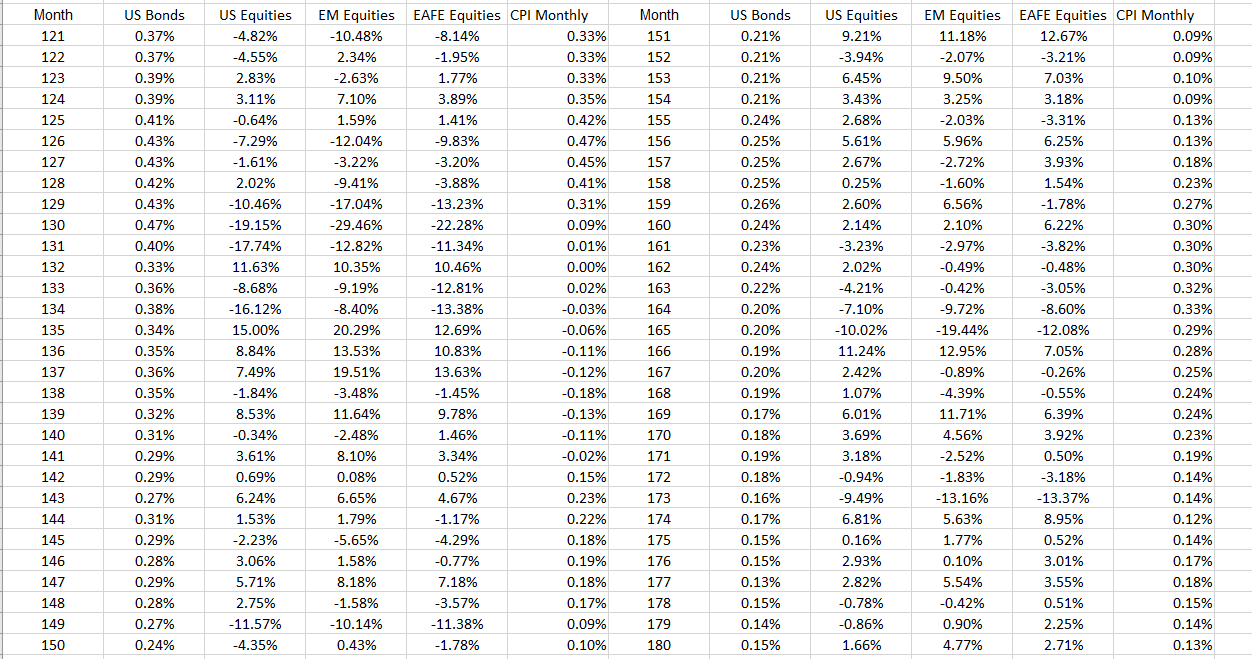

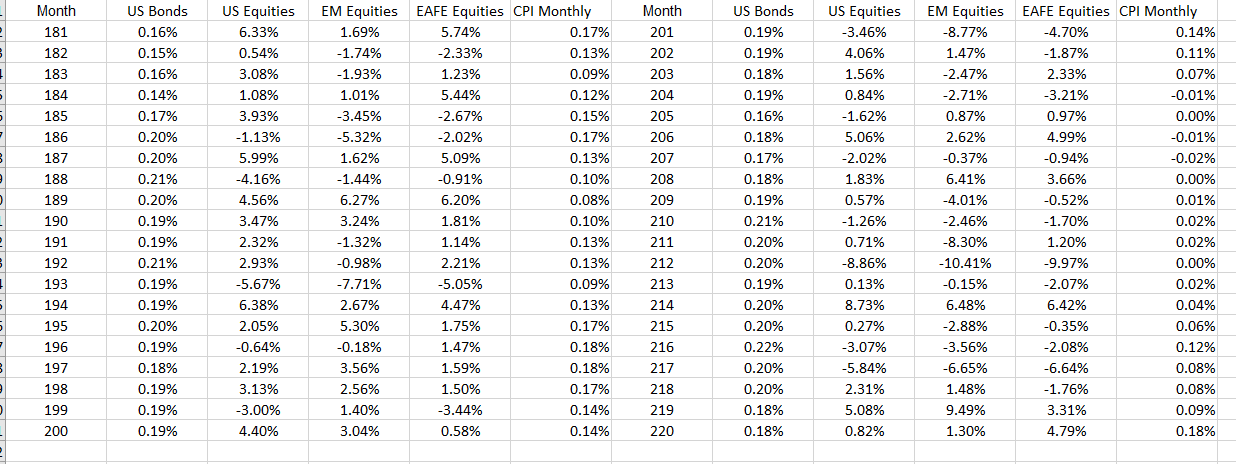

220 Monthly index nominal returns for US Bonds, US Equities, EM Equities and EAFE Equities is provided in the Excel spreadsheet titled "Quiz 3" and placed in Quiz 3 module. Create a Mean Variance Optimized portfolio across the 4 asset classes using nominal returns. The return on the portfolio should be 5% per annum where allocation to each asset will between 5% and 50%. The annual risk (Volatility) of this portfolio is: 8.76% 7.25% 8.55% 0 7.84% Solver could not solve this problem as the constraints are too restrictive. Month 1 Month 31 2 3 32 33 4 34 5 6 7 8 9 35 36 37 38 10 39 40 41 11 12 42 13 43 14 US Bonds 0.50% 0.52% 0.51% 0.52% 0.51% 0.51% 0.51% 0.49% 0.44% 0.47% 0.47% 0.47% 0.47% 0.52% 0.51% 0.51% 0.54% 0.55% 0.56% 0.57% 0.57% 0.57% 0.58% 0.60% 0.62% 0.61% 0.60% 0.62% 0.62% 0.60% 15 16 17 US Equities 2.47% 4.79% 5.61% 1.05% -3.39% 4.69% -3.81% -12.24% -0.23% 11.96% 5.42% 5.30% 2.90% -3.19% 4.11% 5.25% -3.92% 6.20% -3.82% -0.15% -3.55% 5.65% 3.83% 4.76% -1.86% 0.76% 6.00% -2.02% -1.69% 1.71% EM Equities EAFE Equities CPI Monthly -8.17% 4.49% 0.12% 9.93% 6.24% 0.12% 4.25% 3.05% 0.12% -1.10% 0.81% 0.14% -14.74% -0.46% 0.14% -11.08% 0.78% 0.14% 3.12% 1.03% 0.13% -34.13% -13.20% 0.13% 6.15% -3.09% 0.13% 10.01% 9.94% 0.13% 7.99% 5.02% 0.13% -1.46% 3.89% 0.14% -1.63% -0.27% 0.13% 0.97% -2.39% 0.14% 12.38% 4.11% 0.19% 11.66% 3.99% 0.18% -0.58% -5.26% 0.17% 10.75% 3.85% 0.18% -2.75% 2.95% 0.19% 0.91% 0.39% 0.22% -3.44% 1.02% 0.22% 2.11% 3.70% 0.22% 8.59% 3.44% 0.23% 11.97% 8.61% 0.23% 0.59% -6.55% 0.27% 1.31% 2.67% 0.32% 0.49% 3.82% 0.26% -9.96% -5.39% 0.27% -4.22% -2.45% 0.31% 3.46% 3.86% 0.31% 44 45 US Bonds 0.60% 0.58% 0.58% 0.58% 0.57% 0.54% 0.50% 0.50% 0.50% 0.51% 0.51% 0.51% 0.48% 0.47% 0.44% 0.41% 0.45% 0.47% 0.46% 0.46% 0.50% 0.46% 0.45% 0.44% 0.41% 0.39% 0.37% 0.38% 0.38% 0.34% US Equities -2.56% 7.29% -5.50% -1.48% -8.75% 1.27% 3.80% -9.94% -8.33% 10.56% -0.02% -1.73% -1.81% -6.59% -9.62% 4.82% 4.41% 2.26% -1.95% 0.89% 1.97% -4.58% -4.36% -7.41% -8.69% 3.26% -7.52% 5.85% 3.98% -5.69% EM Equities EAFE Equities CPI Monthly -5.28% -4.26% 0.28% 0.49% 0.88% 0.29% -9.14% -4.97% 0.28% -7.53% -2.37% 0.28% -9.15% -3.80% 0.28% 2.29% 3.52% 0.31% 12.63% 0.22% 0.29% -8.27% -8.27% 0.24% -11.46% -7.46% 0.28% 6.43% 8.84% 0.30% 0.86% -5.00% 0.27% -1.47% -3.04% 0.23% -6.22% -1.82% 0.23% -2.51% -4.87% 0.22% -16.32% -9.98% 0.18% 6.92% 4.36% 0.16% 10.81% 1.23% 0.13% 6.31% 1.94% 0.09% 3.10% -5.68% 0.09% 3.03% 2.09% 0.13% 4.33% 4.60% 0.13% 0.95% 0.73% 0.10% -1.07% 0.94% 0.09% -8.62% -3.90% 0.13% -8.00% -13.44% 0.15% 1.84% 1.53% 0.13% - 10.24% -10.04% 0.17% 4.82% 4.75% 0.18% 7.72% 4.45% 0.20% -4.02% -3.05% 0.22% 46 47 18 19 48 49 50 20 51 21 22 52 53 23 24 54 25 26 27 55 56 57 58 28 29 59 30 60 Month 61 62 Month 91 92 93 63 64 65 94 95 96 66 67 68 69 70 71 72 73 74 75 US Bonds 0.35% 0.32% 0.33% 0.32% 0.28% 0.30% 0.38% 0.37% 0.33% 0.35% 0.37% 0.35% 0.34% 0.33% 0.32% 0.37% 0.39% 0.38% 0.38% 0.35% 0.36% 0.35% 0.37% 0.37% 0.37% 0.39% 0.40% 0.39% 0.37% 0.38% US Equities -2.08% -2.74% 2.90% 6.65% 6.28% 1.70% 0.44% 3.28% 1.10% 4.59% 1.64% 3.29% 2.37% 2.08% -1.60% -1.79% 0.62% 0.77% -2.36% 0.29% 2.76% 0.17% 5.99% 1.01% -1.01% 2.06% -2.91% -1.08% 4.14% 0.10% EM Equities EAFE Equities CPI Monthly 0.03% -2.80% 0.25% -2.02% -2.73% 0.25% -3.53% -2.02% 0.18% 8.00% 9.03% 0.18% 8.16% 7.20% 0.18% 5.50% 0.57% 0.18% 5.02% 2.04% 0.18% 7.23% 4.34% 0.19% 0.88% 3.51% 0.17% 8.65% 4.12% 0.15% 1.58% 3.73% 0.16% 5.17% 6.06% 0.16% 3.32% 1.67% 0.14% 6.17% 3.49% 0.14% 0.39% 0.44% 0.19% -9.34% -3.30% 0.26% -1.77% -0.03% 0.28% 0.61% 2.47% 0.25% -2.54% -3.26% 0.23% 5.44% 1.21% 0.21% 6.23% 3.13% 0.27% 1.26% 2.68% 0.29% 8.63% 6.62% 0.28% 4.63% 3.28% 0.25% 0.21% -1.16% 0.25% 8.18% 3.98% 0.26% -5.15% 0.29% -3.69% -2.59% 0.23% 2.80% 0.78% 0.21% 4.26% 0.43% 0.27% US Bonds 0.40% 0.38% 0.41% 0.43% 0.43% 0.42% 0.43% 0.44% 0.46% 0.47% 0.48% 0.48% 0.47% 0.45% 0.44% 0.44% 0.42% 0.44% 0.46% 0.43% 0.44% 0.44% 0.47% 0.47% 0.46% 0.45% 0.44% 0.43% 0.41% 0.41% US Equities 3.82% -0.95% 0.72% -2.23% 5.45% -1.20% 3.47% 0.92% 0.87% 0.57% -1.49% -0.39% -1.45% 3.48% 1.33% 3.08% 2.74% 1.46% 2.49% -2.52% 1.57% 3.90% 3.75% - 1.19% -4.00% 0.84% 4.98% -2.27% -2.51% -0.02% 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 EM Equities EAFE Equities CPI Monthly 7.00% 4.00% 0.30% 1.90% 3.94% 0.39% 7.20% 1.87% 0.36% -5.31% -1.86% 0.29% 7.13% 2.69% 0.28% 5.23% 3.99% 0.33% 10.81% 5.80% 0.30% 0.26% -0.09% 0.28% 2.02% 4.19% 0.29% 5.52% 4.31% 0.35% -11.32% -4.32% 0.36% 1.22% 0.34% 0.34% -1.01% -0.36% 0.32% 4.18% 3.94% 0.18% 0.51% 0.55% 0.11% 5.27% 3.59% 0.17% 6.37% 2.43% 0.21% 4.26% 3.16% 0.18% 0.18% 1.98% 0.20% -3.31% -1.43% 0.23% 5.33% 3.73% 0.22% 4.66% 3.72% 0.23% 6.53% 3.01% 0.23% 4.20% 0.25% 0.20% 0.45% -3.99% 0.17% 1.85% 0.34% 0.23% 11.09% 5.72% 0.29% 8.76% 2.38% 0.36% -6.52% -2.73% 0.34% 0.29% -1.96% 0.36% 76 77 78 79 80 81 82 83 84 85 86 87 -2.32% 88 118 89 90 119 120 Month 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 Month 151 152 153 154 155 156 157 158 159 160 161 162 163 164 US Bonds 0.37% 0.37% 0.39% 0.39% 0.41% 0.43% 0.43% 0.42% 0.43% 0.47% 0.40% 0.33% 0.36% 0.38% 0.34% 0.35% 0.36% 0.35% 0.32% 0.31% 0.29% 0.29% 0.27% 0.31% 0.29% 0.28% 0.29% 0.28% 0.27% 0.24% US Equities -4.82% -4.55% 2.83% 3.11% -0.64% -7.29% -1.61% 2.02% -10.46% -19.15% -17.74% 11.63% -8.68% - 16.12% 15.00% 8.84% 7.49% -1.84% 8.53% -0.34% 3.61% 0.69% 6.24% 1.53% -2.23% 3.06% 5.71% 2.75% -11.57% -4.35% EM Equities EAFE Equities CPI Monthly -10.48% -8.14% 0.33% 2.34% -1.95% 0.33% -2.63% 1.77% 0.33% 7.10% 3.89% 0.35% 1.59% 1.41% 0.42% -12.04% -9.83% 0.47% -3.22% -3.20% 0.45% -9.41% -3.88% 0.41% -17.04% -13.23% 0.31% -29.46% -22.28% 0.09% -12.82% -11.34% 0.01% 10.35% 10.46% 0.00% -9.19% -12.81% 0.02% -8.40% -13.38% -0.03% 20.29% 12.69% -0.06% 13.53% 10.83% -0.11% 19.51% 13.63% -0.12% -3.48% -0.18% 11.64% 9.78% -0.13% -2.48% 1.46% -0.11% 8.10% 3.34% -0.02% 0.08% 0.52% 0.15% 6.65% 4.67% 0.23% 1.79% -1.17% 0.22% -5.65% -4.29% 0.18% 1.58% -0.77% 0.19% 8.18% 7.18% 0.18% -1.58% -3.57% 0.17% -10.14% -11.38% 0.09% 0.43% -1.78% 0.10% US Bonds 0.21% 0.21% 0.21% 0.21% 0.24% 0.25% 0.25% 0.25% 0.26% 0.24% 0.23% 0.24% 0.22% 0.20% 0.20% 0.19% 0.20% 0.19% 0.17% 0.18% 0.19% 0.18% 0.16% 0.17% 0.15% 0.15% 0.13% 0.15% 0.14% 0.15% US Equities 9.21% -3.94% 6.45% 3.43% 2.68% 5.61% 2.67% 0.25% 2.60% 2.14% -3.23% 2.02% -4.21% -7.10% -10.02% 11.24% 2.42% 1.07% 6.01% 3.69% 3.18% -0.94% -9.49% 6.81% 0.16% 2.93% 2.82% -0.78% -0.86% 1.66% EM Equities EAFE Equities CPI Monthly 11.18% 12.67% 0.09% -2.07% -3.21% 0.09% 9.50% 7.03% 0.10% 3.25% 3.18% 0.09% -2.03% -3.31% 0.13% 5.96% 6.25% 0.13% -2.72% 3.93% 0.18% -1.60% 1.54% 0.23% 6.56% -1.78% 0.27% 2.10% 6.22% 0.30% -2.97% -3.82% 0.30% -0.49% -0.48% 0.30% -0.42% -3.05% 0.32% -9.72% -8.60% 0.33% -19.44% -12.08% 0.29% 12.95% 7.05% 0.28% -0.89% -0.26% 0.25% -4.39% 11.71% 6.39% 0.24% 4.56% 3.92% 0.23% -2.52% 0.50% 0.19% -1.83% -3.18% 0.14% -13.16% -13.37% 0.14% 5.63% 8.95% 0.12% 1.77% 0.52% 0.14% 0.10% 3.01% 0.17% 5.54% 3.55% 0.18% -0.42% 0.51% 0.15% 0.90% 2.25% 0.14% 4.77% 2.71% 0.13% -1.45% 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 -0.55% 0.24% 141 142 143 144 145 146 147 148 149 150 Month 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 US Bonds 0.16% 0.15% 0.16% 0.14% 0.17% 0.20% 0.20% 0.21% 0.20% 0.19% 0.19% 0.21% 0.19% 0.19% 0.20% 0.19% 0.18% 0.19% 0.19% 0.19% US Equities 6.33% 0.54% 3.08% 1.08% 3.93% -1.13% 5.99% -4.16% 4.56% 3.47% 2.32% 2.93% -5.67% 6.38% 2.05% -0.64% 2.19% 3.13% -3.00% 4.40% EM Equities EAFE Equities CPI Monthly 1.69% 5.74% 0.17% -1.74% -2.33% 0.13% -1.93% 1.23% 0.09% 1.01% 5.44% 0.12% -3.45% -2.67% 0.15% -5.32% -2.02% 0.17% 1.62% 5.09% 0.13% -1.44% -0.91% 0.10% 6.27% 6.20% 0.08% 3.24% 1.81% 0.10% -1.32% 1.14% 0.13% -0.98% 2.21% 0.13% -7.71% -5.05% 0.09% 2.67% 4.47% 0.13% 5.30% 1.75% 0.17% -0.18% 1.47% 0.18% 3.56% 1.59% 0.18% 2.56% 1.50% 0.17% 1.40% -3.44% 0.14% 3.04% 0.58% 0.14% Month 201 202 203 204 205 206 207 208 209 210 211 212 213 214 US Bonds 0.19% 0.19% 0.18% 0.19% 0.16% 0.18% 0.17% 0.18% 0.19% 0.21% 0.20% 0.20% 0.19% 0.20% 0.20% 0.22% 0.20% 0.20% 0.18% 0.18% US Equities -3.46% 4.06% 1.56% 0.84% -1.62% 5.06% -2.02% 1.83% 0.57% -1.26% 0.71% -8.86% 0.13% 8.73% 0.27% -3.07% -5.84% 2.31% 5.08% 0.82% EM Equities EAFE Equities CPI Monthly -8.77% -4.70% 0.14% 1.47% -1.87% 0.11% -2.47% 2.33% 0.07% -2.71% -3.21% -0.01% 0.87% 0.97% 0.00% 2.62% 4.99% -0.01% -0.37% -0.94% -0.02% 6.41% 3.66% 0.00% -4.01% -0.52% 0.01% -2.46% -1.70% 0.02% -8.30% 1.20% 0.02% -10.41% -9.97% 0.00% -0.15% -2.07% 0.02% 6.48% 6.42% 0.04% -2.88% -0.35% 0.06% -3.56% -2.08% 0.12% -6.65% -6.64% 0.08% 1.48% -1.76% 0.08% 9.49% 3.31% 0.09% 1.30% 4.79% 0.18% 215 216 217 218 219 220 220 Monthly index nominal returns for US Bonds, US Equities, EM Equities and EAFE Equities is provided in the Excel spreadsheet titled "Quiz 3" and placed in Quiz 3 module. Create a Mean Variance Optimized portfolio across the 4 asset classes using nominal returns. The return on the portfolio should be 5% per annum where allocation to each asset will between 5% and 50%. The annual risk (Volatility) of this portfolio is: 8.76% 7.25% 8.55% 0 7.84% Solver could not solve this problem as the constraints are too restrictive. Month 1 Month 31 2 3 32 33 4 34 5 6 7 8 9 35 36 37 38 10 39 40 41 11 12 42 13 43 14 US Bonds 0.50% 0.52% 0.51% 0.52% 0.51% 0.51% 0.51% 0.49% 0.44% 0.47% 0.47% 0.47% 0.47% 0.52% 0.51% 0.51% 0.54% 0.55% 0.56% 0.57% 0.57% 0.57% 0.58% 0.60% 0.62% 0.61% 0.60% 0.62% 0.62% 0.60% 15 16 17 US Equities 2.47% 4.79% 5.61% 1.05% -3.39% 4.69% -3.81% -12.24% -0.23% 11.96% 5.42% 5.30% 2.90% -3.19% 4.11% 5.25% -3.92% 6.20% -3.82% -0.15% -3.55% 5.65% 3.83% 4.76% -1.86% 0.76% 6.00% -2.02% -1.69% 1.71% EM Equities EAFE Equities CPI Monthly -8.17% 4.49% 0.12% 9.93% 6.24% 0.12% 4.25% 3.05% 0.12% -1.10% 0.81% 0.14% -14.74% -0.46% 0.14% -11.08% 0.78% 0.14% 3.12% 1.03% 0.13% -34.13% -13.20% 0.13% 6.15% -3.09% 0.13% 10.01% 9.94% 0.13% 7.99% 5.02% 0.13% -1.46% 3.89% 0.14% -1.63% -0.27% 0.13% 0.97% -2.39% 0.14% 12.38% 4.11% 0.19% 11.66% 3.99% 0.18% -0.58% -5.26% 0.17% 10.75% 3.85% 0.18% -2.75% 2.95% 0.19% 0.91% 0.39% 0.22% -3.44% 1.02% 0.22% 2.11% 3.70% 0.22% 8.59% 3.44% 0.23% 11.97% 8.61% 0.23% 0.59% -6.55% 0.27% 1.31% 2.67% 0.32% 0.49% 3.82% 0.26% -9.96% -5.39% 0.27% -4.22% -2.45% 0.31% 3.46% 3.86% 0.31% 44 45 US Bonds 0.60% 0.58% 0.58% 0.58% 0.57% 0.54% 0.50% 0.50% 0.50% 0.51% 0.51% 0.51% 0.48% 0.47% 0.44% 0.41% 0.45% 0.47% 0.46% 0.46% 0.50% 0.46% 0.45% 0.44% 0.41% 0.39% 0.37% 0.38% 0.38% 0.34% US Equities -2.56% 7.29% -5.50% -1.48% -8.75% 1.27% 3.80% -9.94% -8.33% 10.56% -0.02% -1.73% -1.81% -6.59% -9.62% 4.82% 4.41% 2.26% -1.95% 0.89% 1.97% -4.58% -4.36% -7.41% -8.69% 3.26% -7.52% 5.85% 3.98% -5.69% EM Equities EAFE Equities CPI Monthly -5.28% -4.26% 0.28% 0.49% 0.88% 0.29% -9.14% -4.97% 0.28% -7.53% -2.37% 0.28% -9.15% -3.80% 0.28% 2.29% 3.52% 0.31% 12.63% 0.22% 0.29% -8.27% -8.27% 0.24% -11.46% -7.46% 0.28% 6.43% 8.84% 0.30% 0.86% -5.00% 0.27% -1.47% -3.04% 0.23% -6.22% -1.82% 0.23% -2.51% -4.87% 0.22% -16.32% -9.98% 0.18% 6.92% 4.36% 0.16% 10.81% 1.23% 0.13% 6.31% 1.94% 0.09% 3.10% -5.68% 0.09% 3.03% 2.09% 0.13% 4.33% 4.60% 0.13% 0.95% 0.73% 0.10% -1.07% 0.94% 0.09% -8.62% -3.90% 0.13% -8.00% -13.44% 0.15% 1.84% 1.53% 0.13% - 10.24% -10.04% 0.17% 4.82% 4.75% 0.18% 7.72% 4.45% 0.20% -4.02% -3.05% 0.22% 46 47 18 19 48 49 50 20 51 21 22 52 53 23 24 54 25 26 27 55 56 57 58 28 29 59 30 60 Month 61 62 Month 91 92 93 63 64 65 94 95 96 66 67 68 69 70 71 72 73 74 75 US Bonds 0.35% 0.32% 0.33% 0.32% 0.28% 0.30% 0.38% 0.37% 0.33% 0.35% 0.37% 0.35% 0.34% 0.33% 0.32% 0.37% 0.39% 0.38% 0.38% 0.35% 0.36% 0.35% 0.37% 0.37% 0.37% 0.39% 0.40% 0.39% 0.37% 0.38% US Equities -2.08% -2.74% 2.90% 6.65% 6.28% 1.70% 0.44% 3.28% 1.10% 4.59% 1.64% 3.29% 2.37% 2.08% -1.60% -1.79% 0.62% 0.77% -2.36% 0.29% 2.76% 0.17% 5.99% 1.01% -1.01% 2.06% -2.91% -1.08% 4.14% 0.10% EM Equities EAFE Equities CPI Monthly 0.03% -2.80% 0.25% -2.02% -2.73% 0.25% -3.53% -2.02% 0.18% 8.00% 9.03% 0.18% 8.16% 7.20% 0.18% 5.50% 0.57% 0.18% 5.02% 2.04% 0.18% 7.23% 4.34% 0.19% 0.88% 3.51% 0.17% 8.65% 4.12% 0.15% 1.58% 3.73% 0.16% 5.17% 6.06% 0.16% 3.32% 1.67% 0.14% 6.17% 3.49% 0.14% 0.39% 0.44% 0.19% -9.34% -3.30% 0.26% -1.77% -0.03% 0.28% 0.61% 2.47% 0.25% -2.54% -3.26% 0.23% 5.44% 1.21% 0.21% 6.23% 3.13% 0.27% 1.26% 2.68% 0.29% 8.63% 6.62% 0.28% 4.63% 3.28% 0.25% 0.21% -1.16% 0.25% 8.18% 3.98% 0.26% -5.15% 0.29% -3.69% -2.59% 0.23% 2.80% 0.78% 0.21% 4.26% 0.43% 0.27% US Bonds 0.40% 0.38% 0.41% 0.43% 0.43% 0.42% 0.43% 0.44% 0.46% 0.47% 0.48% 0.48% 0.47% 0.45% 0.44% 0.44% 0.42% 0.44% 0.46% 0.43% 0.44% 0.44% 0.47% 0.47% 0.46% 0.45% 0.44% 0.43% 0.41% 0.41% US Equities 3.82% -0.95% 0.72% -2.23% 5.45% -1.20% 3.47% 0.92% 0.87% 0.57% -1.49% -0.39% -1.45% 3.48% 1.33% 3.08% 2.74% 1.46% 2.49% -2.52% 1.57% 3.90% 3.75% - 1.19% -4.00% 0.84% 4.98% -2.27% -2.51% -0.02% 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 EM Equities EAFE Equities CPI Monthly 7.00% 4.00% 0.30% 1.90% 3.94% 0.39% 7.20% 1.87% 0.36% -5.31% -1.86% 0.29% 7.13% 2.69% 0.28% 5.23% 3.99% 0.33% 10.81% 5.80% 0.30% 0.26% -0.09% 0.28% 2.02% 4.19% 0.29% 5.52% 4.31% 0.35% -11.32% -4.32% 0.36% 1.22% 0.34% 0.34% -1.01% -0.36% 0.32% 4.18% 3.94% 0.18% 0.51% 0.55% 0.11% 5.27% 3.59% 0.17% 6.37% 2.43% 0.21% 4.26% 3.16% 0.18% 0.18% 1.98% 0.20% -3.31% -1.43% 0.23% 5.33% 3.73% 0.22% 4.66% 3.72% 0.23% 6.53% 3.01% 0.23% 4.20% 0.25% 0.20% 0.45% -3.99% 0.17% 1.85% 0.34% 0.23% 11.09% 5.72% 0.29% 8.76% 2.38% 0.36% -6.52% -2.73% 0.34% 0.29% -1.96% 0.36% 76 77 78 79 80 81 82 83 84 85 86 87 -2.32% 88 118 89 90 119 120 Month 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 Month 151 152 153 154 155 156 157 158 159 160 161 162 163 164 US Bonds 0.37% 0.37% 0.39% 0.39% 0.41% 0.43% 0.43% 0.42% 0.43% 0.47% 0.40% 0.33% 0.36% 0.38% 0.34% 0.35% 0.36% 0.35% 0.32% 0.31% 0.29% 0.29% 0.27% 0.31% 0.29% 0.28% 0.29% 0.28% 0.27% 0.24% US Equities -4.82% -4.55% 2.83% 3.11% -0.64% -7.29% -1.61% 2.02% -10.46% -19.15% -17.74% 11.63% -8.68% - 16.12% 15.00% 8.84% 7.49% -1.84% 8.53% -0.34% 3.61% 0.69% 6.24% 1.53% -2.23% 3.06% 5.71% 2.75% -11.57% -4.35% EM Equities EAFE Equities CPI Monthly -10.48% -8.14% 0.33% 2.34% -1.95% 0.33% -2.63% 1.77% 0.33% 7.10% 3.89% 0.35% 1.59% 1.41% 0.42% -12.04% -9.83% 0.47% -3.22% -3.20% 0.45% -9.41% -3.88% 0.41% -17.04% -13.23% 0.31% -29.46% -22.28% 0.09% -12.82% -11.34% 0.01% 10.35% 10.46% 0.00% -9.19% -12.81% 0.02% -8.40% -13.38% -0.03% 20.29% 12.69% -0.06% 13.53% 10.83% -0.11% 19.51% 13.63% -0.12% -3.48% -0.18% 11.64% 9.78% -0.13% -2.48% 1.46% -0.11% 8.10% 3.34% -0.02% 0.08% 0.52% 0.15% 6.65% 4.67% 0.23% 1.79% -1.17% 0.22% -5.65% -4.29% 0.18% 1.58% -0.77% 0.19% 8.18% 7.18% 0.18% -1.58% -3.57% 0.17% -10.14% -11.38% 0.09% 0.43% -1.78% 0.10% US Bonds 0.21% 0.21% 0.21% 0.21% 0.24% 0.25% 0.25% 0.25% 0.26% 0.24% 0.23% 0.24% 0.22% 0.20% 0.20% 0.19% 0.20% 0.19% 0.17% 0.18% 0.19% 0.18% 0.16% 0.17% 0.15% 0.15% 0.13% 0.15% 0.14% 0.15% US Equities 9.21% -3.94% 6.45% 3.43% 2.68% 5.61% 2.67% 0.25% 2.60% 2.14% -3.23% 2.02% -4.21% -7.10% -10.02% 11.24% 2.42% 1.07% 6.01% 3.69% 3.18% -0.94% -9.49% 6.81% 0.16% 2.93% 2.82% -0.78% -0.86% 1.66% EM Equities EAFE Equities CPI Monthly 11.18% 12.67% 0.09% -2.07% -3.21% 0.09% 9.50% 7.03% 0.10% 3.25% 3.18% 0.09% -2.03% -3.31% 0.13% 5.96% 6.25% 0.13% -2.72% 3.93% 0.18% -1.60% 1.54% 0.23% 6.56% -1.78% 0.27% 2.10% 6.22% 0.30% -2.97% -3.82% 0.30% -0.49% -0.48% 0.30% -0.42% -3.05% 0.32% -9.72% -8.60% 0.33% -19.44% -12.08% 0.29% 12.95% 7.05% 0.28% -0.89% -0.26% 0.25% -4.39% 11.71% 6.39% 0.24% 4.56% 3.92% 0.23% -2.52% 0.50% 0.19% -1.83% -3.18% 0.14% -13.16% -13.37% 0.14% 5.63% 8.95% 0.12% 1.77% 0.52% 0.14% 0.10% 3.01% 0.17% 5.54% 3.55% 0.18% -0.42% 0.51% 0.15% 0.90% 2.25% 0.14% 4.77% 2.71% 0.13% -1.45% 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 -0.55% 0.24% 141 142 143 144 145 146 147 148 149 150 Month 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 US Bonds 0.16% 0.15% 0.16% 0.14% 0.17% 0.20% 0.20% 0.21% 0.20% 0.19% 0.19% 0.21% 0.19% 0.19% 0.20% 0.19% 0.18% 0.19% 0.19% 0.19% US Equities 6.33% 0.54% 3.08% 1.08% 3.93% -1.13% 5.99% -4.16% 4.56% 3.47% 2.32% 2.93% -5.67% 6.38% 2.05% -0.64% 2.19% 3.13% -3.00% 4.40% EM Equities EAFE Equities CPI Monthly 1.69% 5.74% 0.17% -1.74% -2.33% 0.13% -1.93% 1.23% 0.09% 1.01% 5.44% 0.12% -3.45% -2.67% 0.15% -5.32% -2.02% 0.17% 1.62% 5.09% 0.13% -1.44% -0.91% 0.10% 6.27% 6.20% 0.08% 3.24% 1.81% 0.10% -1.32% 1.14% 0.13% -0.98% 2.21% 0.13% -7.71% -5.05% 0.09% 2.67% 4.47% 0.13% 5.30% 1.75% 0.17% -0.18% 1.47% 0.18% 3.56% 1.59% 0.18% 2.56% 1.50% 0.17% 1.40% -3.44% 0.14% 3.04% 0.58% 0.14% Month 201 202 203 204 205 206 207 208 209 210 211 212 213 214 US Bonds 0.19% 0.19% 0.18% 0.19% 0.16% 0.18% 0.17% 0.18% 0.19% 0.21% 0.20% 0.20% 0.19% 0.20% 0.20% 0.22% 0.20% 0.20% 0.18% 0.18% US Equities -3.46% 4.06% 1.56% 0.84% -1.62% 5.06% -2.02% 1.83% 0.57% -1.26% 0.71% -8.86% 0.13% 8.73% 0.27% -3.07% -5.84% 2.31% 5.08% 0.82% EM Equities EAFE Equities CPI Monthly -8.77% -4.70% 0.14% 1.47% -1.87% 0.11% -2.47% 2.33% 0.07% -2.71% -3.21% -0.01% 0.87% 0.97% 0.00% 2.62% 4.99% -0.01% -0.37% -0.94% -0.02% 6.41% 3.66% 0.00% -4.01% -0.52% 0.01% -2.46% -1.70% 0.02% -8.30% 1.20% 0.02% -10.41% -9.97% 0.00% -0.15% -2.07% 0.02% 6.48% 6.42% 0.04% -2.88% -0.35% 0.06% -3.56% -2.08% 0.12% -6.65% -6.64% 0.08% 1.48% -1.76% 0.08% 9.49% 3.31% 0.09% 1.30% 4.79% 0.18% 215 216 217 218 219 220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts