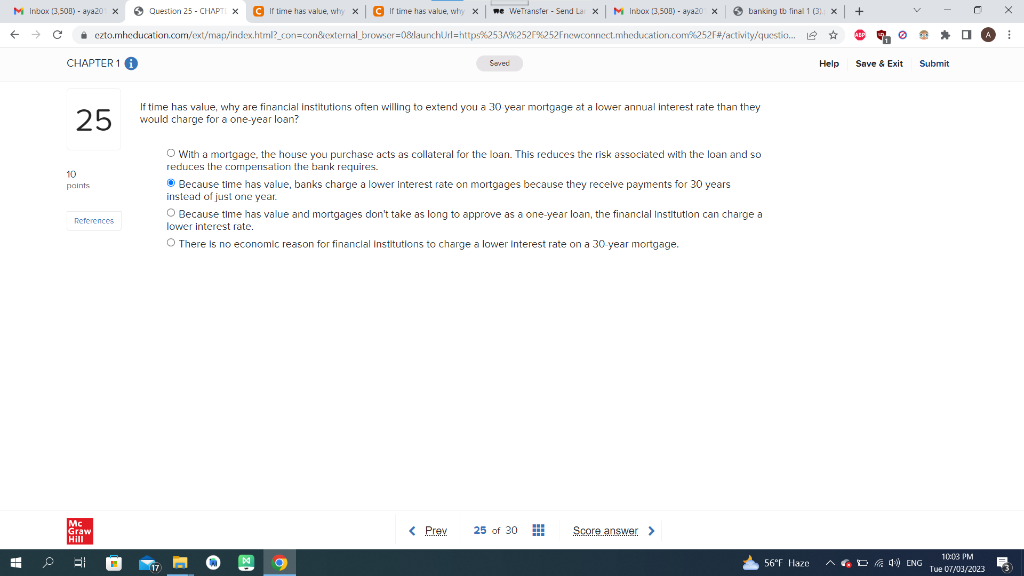

Question: If time has value, why are financial institutions often villing to extend you a 30 year mortgage at a lower annual interest rate than they

If time has value, why are financial institutions often villing to extend you a 30 year mortgage at a lower annual interest rate than they would charge for a one-year loan? With a mortgage, the house you purchase acts as collateral for the loan. This reduces the risk associated with the loan and so reduces the compensation the bank requires. Because time has value, banks charge a lower interest rate on mortgages because they receive payments for 30 years instead of just one year. Because time has value and mortgages don't take as long to approve as a one-year loan, the financlal institution can charge a lower interest rate. There is no economic reason for financlal institutions to charge a lower interest rate on a 30 year mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts