Question: If two firms have the same return on assets, the firm with the greater use of debt will have the higher return on equity. A

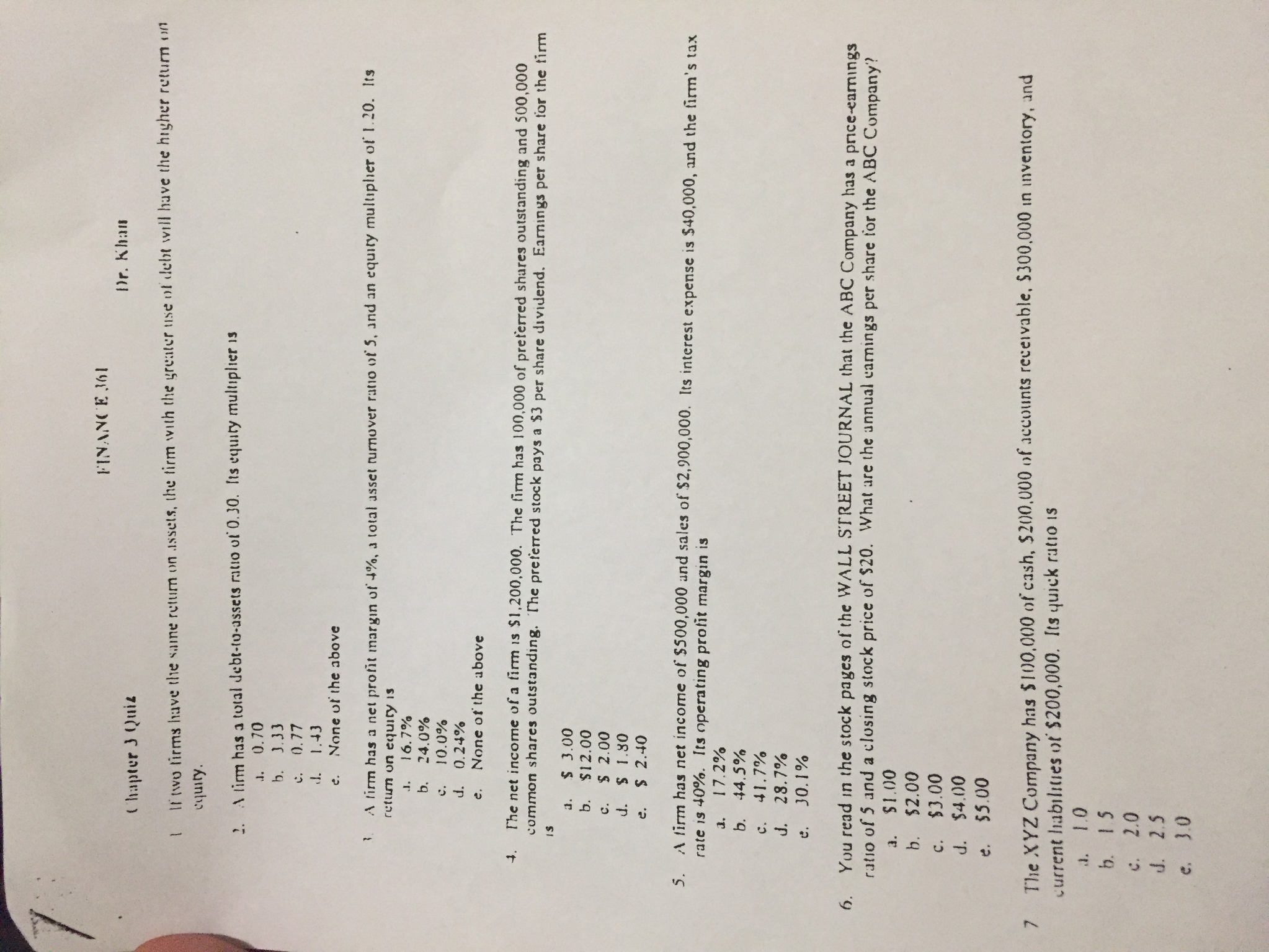

If two firms have the same return on assets, the firm with the greater use of debt will have the higher return on equity. A firm has a total debt-to-assets ratio of 0.30. Its equity multiplier is 0.70 0.33 0.77 1.43 None of the above A firm has a net profit margin of 4%, a total asset turnover ratio of 5, and an equity multiplier of 1.20. Its return on equity is 16.7% 24.0% 10.0% 0.24% None of the above The net income of a firm is $1, 200,000. The firm has 100,000 of preferred shares outstanding and 500,000 common shares outstanding. The preferred stock pays a $3 per share dividend. Earnings per share for the firm is $ 3.00 $ 12.00 $ 2.00 $ 1.80 $ 2.40 A firm has net income of $500,000 and sales of $2, 900,000. Its interest expense is $40,000, and the firm's tax rate is 40%. Its operating profit margin is 17.2% 44.5% 41.7% 28.7% 30.1% You read in the stock pages of the WALL STREET JOURNAL that the ABC Company has a price-earnings ratio of 5 and a closing stock price of $20. What are the annual earnings per share for the ABC Company? $1.00 $2.00 $3.00 $4.00 $5.00 The XYZ Company has $100,000 of cash, $200,000 of accounts receivable, $300.000 in inventory, and current liabilities of $200,000. Its quick ratio is 1.0 1.5 2.0 2.5 3.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts