Question: If using Excel could you please include screenshots of the formulas used? Required Information [The following information applies to the questions displayed below.) Suppose your

If using Excel could you please include screenshots of the formulas used?

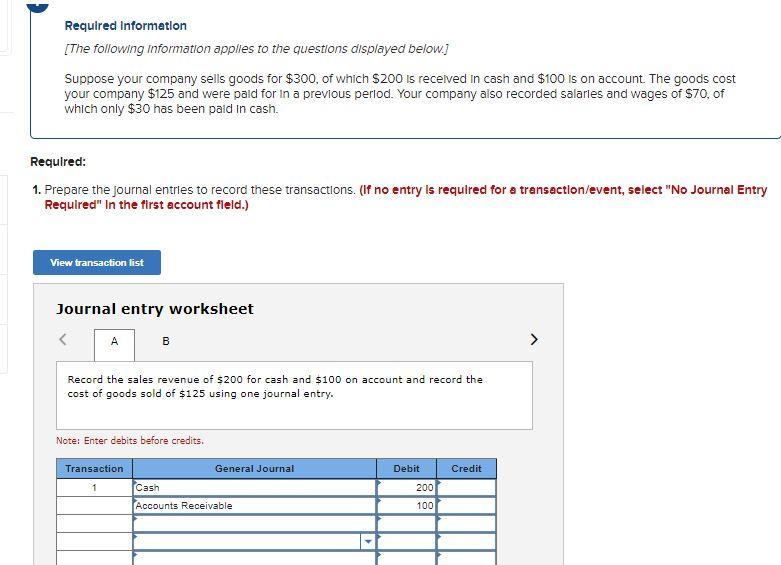

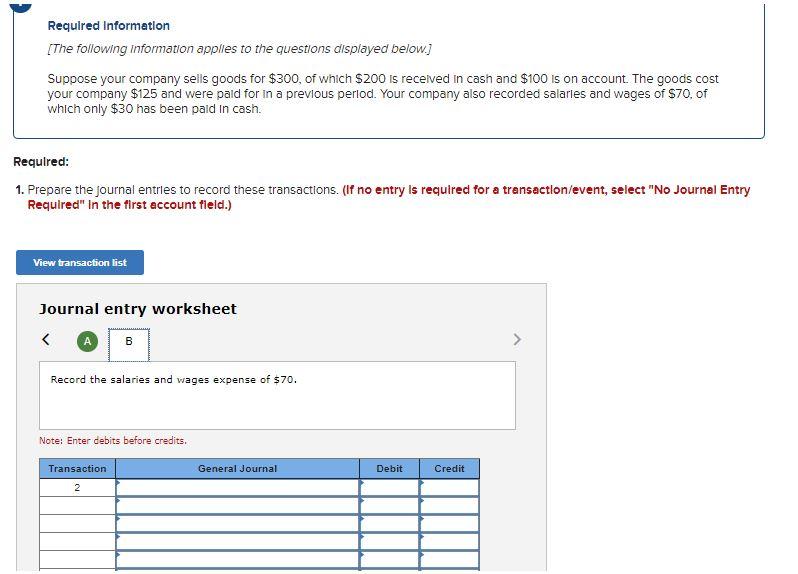

Required Information [The following information applies to the questions displayed below.) Suppose your company sells goods for $300, of which 200 is received in cash and $100 is on accountThe goods cost your company $125 and were paid for in a previous period. Your company also recorded salaries and wages of $70, of which only $30 has been paid in cash. Required: 1. Prepare the journal entries to record these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet Record the sales revenue of $200 for cash and $100 on account and record the cost of goods sold of $125 using one journal entry Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Cash 200 Accounts Receivable 100 Required Information [The following information applies to the questions displayed below.) Suppose your company sells goods for $300, of which $200 is received in cash and $100 is on account. The goods cost your company $125 and were paid for in a previous period. Your company also recorded salaries and wages of S70. of which only $30 has been paid in cash. Required: 1. Prepare the journal entries to record these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts