Question: If we computed a mean-efficient portfolio that targets a standard deviation of 0.08 but does not allow short sales, the linear relationship between beta and

If we computed a mean-efficient portfolio that targets a standard deviation of 0.08 but does not allow short sales, the linear relationship between beta and mean return is no longer a perfect straight line:

- This statement is true

- this statement is false

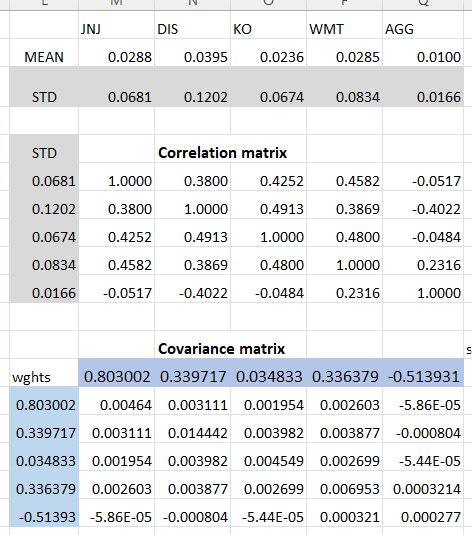

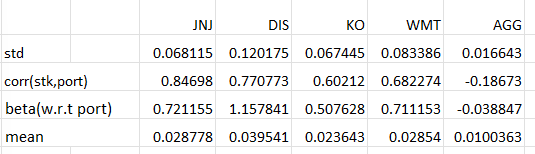

\begin{tabular}{|c|r|r|r|r|r|} \hline & JN & \multicolumn{2}{|c|}{ DIS } & \multicolumn{2}{|c|}{ KO } \\ \hline MEAN & 0.0288 & 0.0395 & 0.0236 & 0.0285 & 0.0100 \\ \hline STD & 0.0681 & 0.1202 & 0.0674 & 0.0834 & 0.0166 \\ \hline & & & & & \\ \hline STD & & Correlation matrix & & \\ \hline 0.0681 & 1.0000 & 0.3800 & 0.4252 & 0.4582 & -0.0517 \\ \hline 0.1202 & 0.3800 & 1.0000 & 0.4913 & 0.3869 & -0.4022 \\ \hline 0.0674 & 0.4252 & 0.4913 & 1.0000 & 0.4800 & -0.0484 \\ \hline 0.0834 & 0.4582 & 0.3869 & 0.4800 & 1.0000 & 0.2316 \\ \hline 0.0166 & -0.0517 & -0.4022 & -0.0484 & 0.2316 & 1.0000 \\ \hline & & & & & \\ \hline wghts & 0.803002 & 0.339717 & 0.034833 & 0.336379 & -0.513931 \\ \hline 0.803002 & 0.00464 & 0.003111 & 0.001954 & 0.002603 & 5.86E05 \\ \hline 0.339717 & 0.003111 & 0.014442 & 0.003982 & 0.003877 & -0.000804 \\ \hline 0.034833 & 0.001954 & 0.003982 & 0.004549 & 0.002699 & 5.44E05 \\ \hline 0.336379 & 0.002603 & 0.003877 & 0.002699 & 0.006953 & 0.0003214 \\ \hline-0.51393 & 5.86E05 & -0.000804 & 5.44E05 & 0.000321 & 0.000277 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|r|} \hline & JNJ & DIS & KO & WMT & AGG \\ \hline std & 0.068115 & 0.120175 & 0.067445 & 0.083386 & 0.016643 \\ \hline corr(stk,port) & 0.84698 & 0.770773 & 0.60212 & 0.682274 & -0.18673 \\ \hline beta(w.r.t port) & 0.721155 & 1.157841 & 0.507628 & 0.711153 & -0.038847 \\ \hline mean & 0.028778 & 0.039541 & 0.023643 & 0.02854 & 0.0100363 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts