Question: if you answer it with excel please show formula Pacific Marine Transport Corporation is considering the purchase of a new bulk carrier for $10 million.

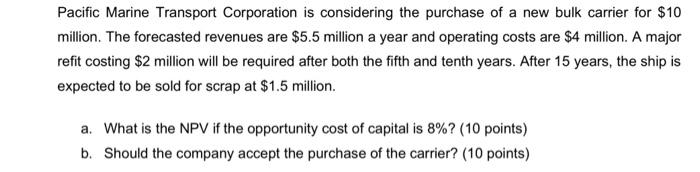

Pacific Marine Transport Corporation is considering the purchase of a new bulk carrier for $10 million. The forecasted revenues are $5.5 million a year and operating costs are $4 million. A major refit costing $2 million will be required after both the fifth and tenth years. After 15 years, the ship is expected to be sold for scrap at $1.5 million. a. What is the NPV if the opportunity cost of capital is 8%? (10 points) b. Should the company accept the purchase of the carrier? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts