Question: if you can answer all 3 questions i would really apprecciate it. thank you! 20. The Isberg Company just paid a dividend of $0.75 per

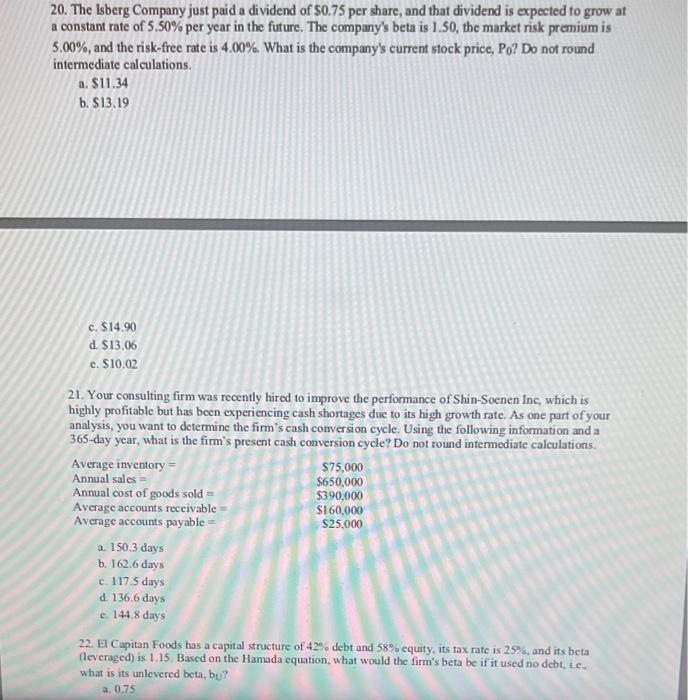

20. The Isberg Company just paid a dividend of $0.75 per share, and that dividend is expected to grow at a constant rate of 5.50% per year in the future. The company's beta is 1.50, the market risk premium is 5.00%, and the risk-free rate is 4.00%. What is the company's current stock price, Po? Do not round intermediate calculations. a. $11.34 b. $13.19 c. $14.90 d $13.06 c. $10.02 21. Your consulting firm was recently hired to improve the performance of Shin-Soenen Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle? Do not round intermediate calculations Average inventory = $75,000 Annual sales $650,000 Annual cost of goods sold = $390,000 Average accounts receivable $160.000 Average accounts payable = S25.000 a. 150.3 days b. 162.6 days c. 117.5 days d. 136.6 days e 144.8 days 22. El Capitan Foods has a capital structure of 42% debt and 58% equity, its tax rate is 25%, and its beta (leveraged) is 1.15. Based on the Hamada equation, what would the firm's beta be if it used no debt, i.e. what is its unlevered beta, bu? a. 0.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts