Question: if you can answer all that will be great QUESTION 1 COBRA is triggered when An employee resigns from employment An employee retires Employment is

if you can answer all that will be great

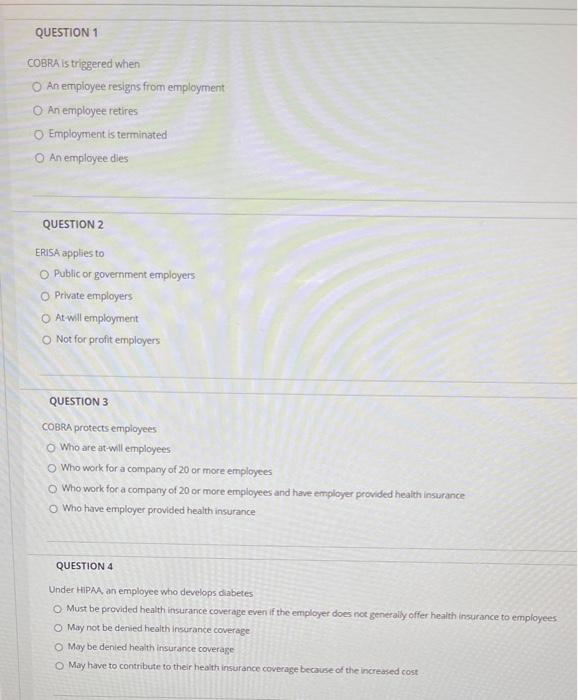

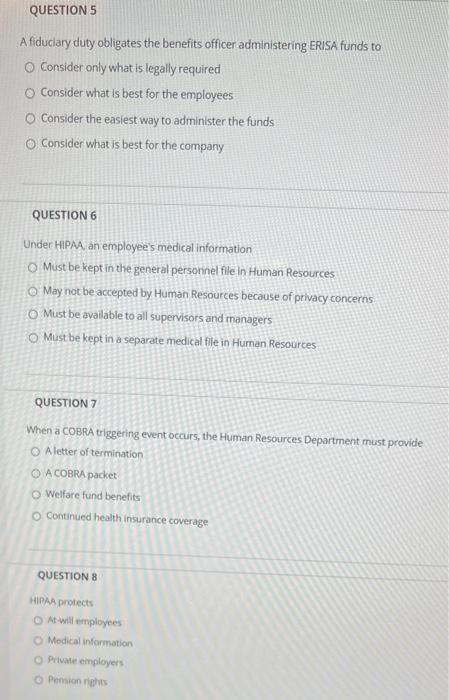

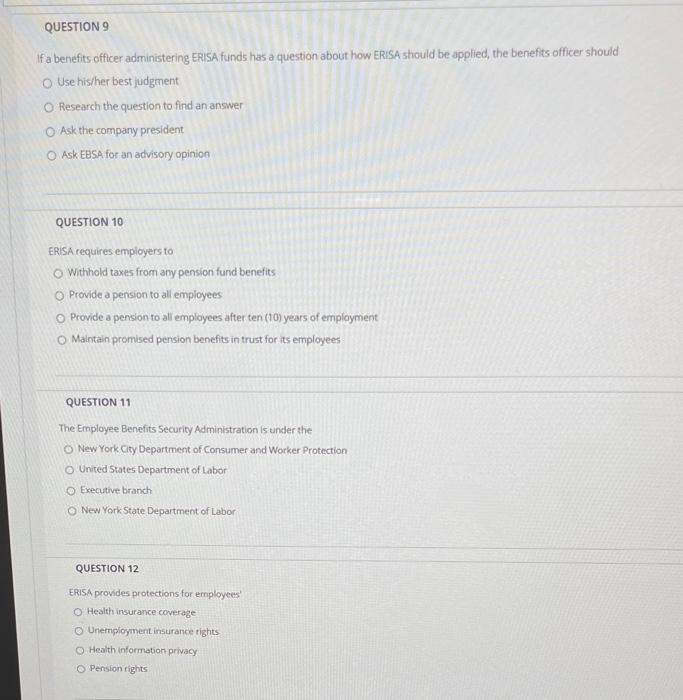

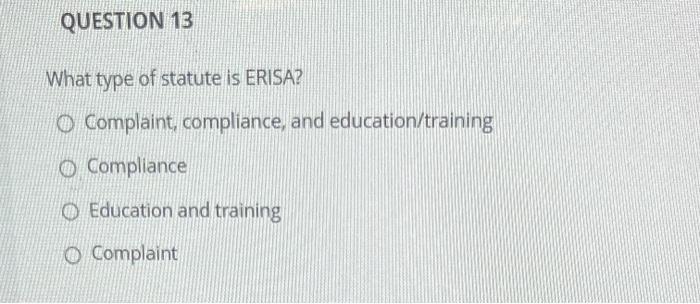

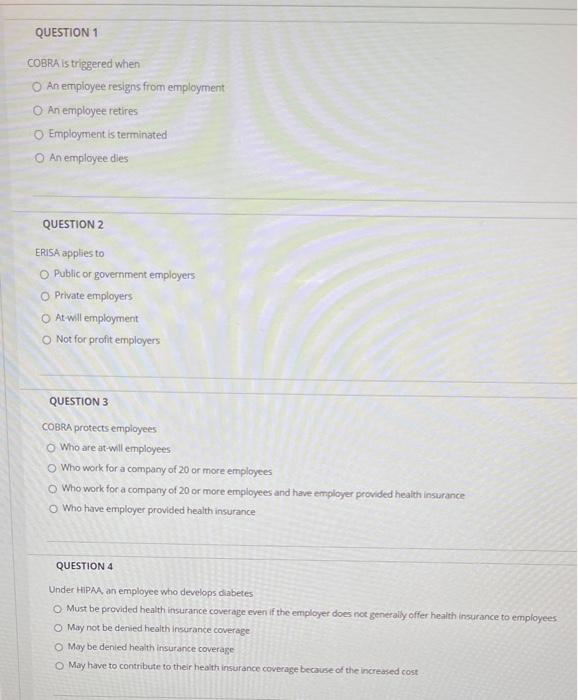

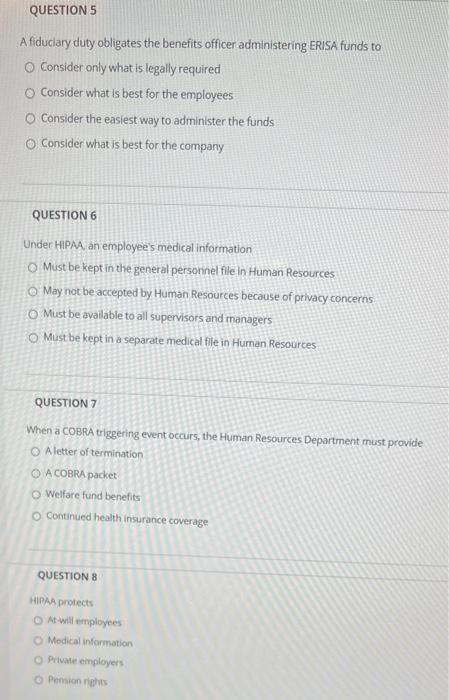

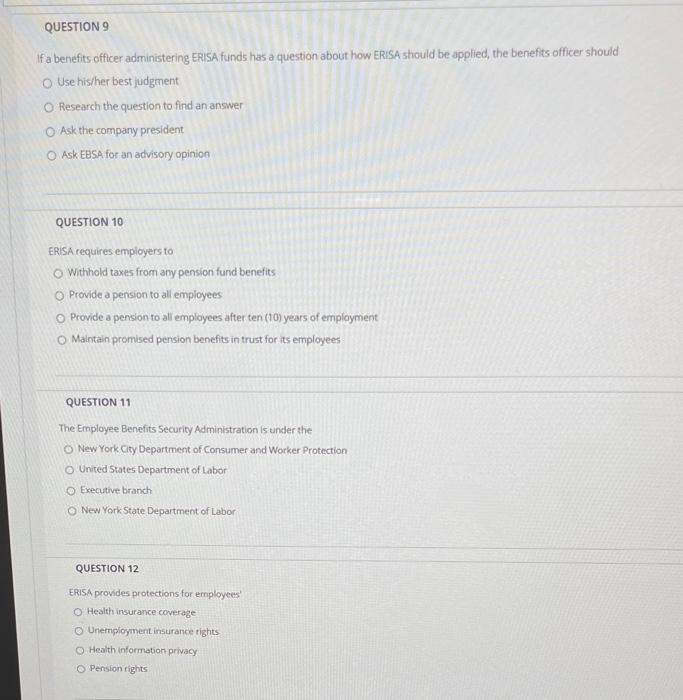

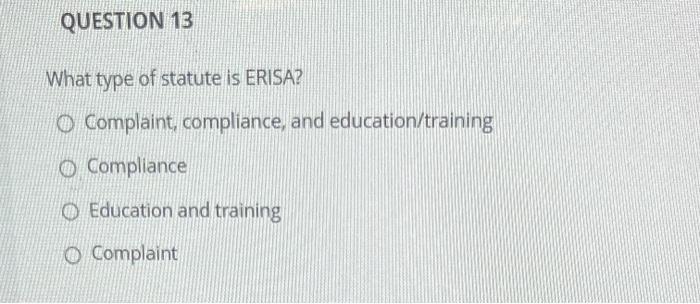

QUESTION 1 COBRA is triggered when An employee resigns from employment An employee retires Employment is terminated An employee dies QUESTION 2 ERISA applies to O Public or government employers Private employers At will employment Not for profit employers QUESTION 3 COBRA protects employees Who are at will employees Who work for a company of 20 or more employees Who work for a company of 20 or more employees and have employer provided health insurance Who have employer provided health insurance QUESTION 4 Under HIPAA an employee who develops diabetes Must be provided health insurance coverage even if the employer does not generally offer health Insurance to employees May not be denied health insurance coverage May be denied health insurance coverage May have to contribute to their health insurance coverage because of the increased cost QUESTION 5 A fiduciary duty obligates the benefits officer administering ERISA funds to O Consider only what is legally required Consider what is best for the employees O Consider the easiest way to administer the funds O Consider what is best for the company QUESTION 6 Under HIPAA, an employee's medical information O Must be kept in the general personnel file in Human Resources May not be accepted by Human Resources because of privacy concerns O Must be available to all supervisors and managers O Must be kept in a separate medical file in Human Resources QUESTION 7 When a COBRA triggering event occurs the Human Resources Department must provide O Aletter of termination O A COBRA packet Welfare fund benefits Continued health insurance coverage QUESTION 8 HIPAA protects At will employees Medical information Private employers Pensioni QUESTION 9 If a benefits officer administering ERISA funds has a question about how ERISA should be applied, the benefits officer should Use his/her best judgment O Research the question to find an answer Ask the company president O Ask EBSA for an advisory opinion QUESTION 10 ERISA requires employers to o Withhold taxes from any pension fund benefits O Provide a pension to all employees Provide a pension to all employees after ten (10) years of employment O Maintain promised pension benefits in trust for its employees QUESTION 11 The Employee Benefits Security Administration is under the o New York City Department of Consumer and Worker Protection United States Department of Labor Executive branch New York State Department of Labor QUESTION 12 ERISA provides protections for employees! Health insurance coverage Unemployment insurance rights Health information privacy Pension rights QUESTION 13 What type of statute is ERISA? O Complaint, compliance, and education/training O Compliance O Education and training O Complaint

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock