Question: If you can answer it asap that would be great. Thanks! Q1 Your pension Fund manager estimates that the corporate sponsor will make CHF 10

If you can answer it asap that would be great. Thanks!

If you can answer it asap that would be great. Thanks!

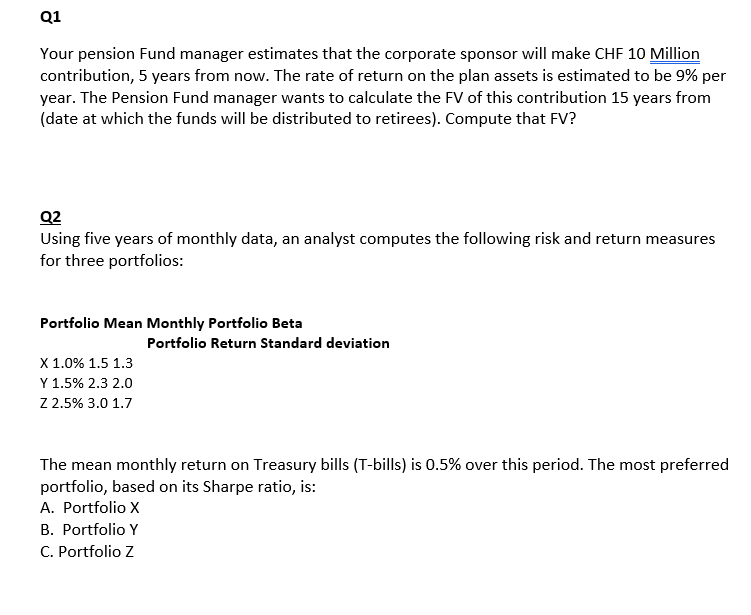

Q1 Your pension Fund manager estimates that the corporate sponsor will make CHF 10 Million contribution, 5 years from now. The rate of return on the plan assets is estimated to be 9% per year. The Pension Fund manager wants to calculate the FV of this contribution 15 years from (date at which the funds will be distributed to retirees). Compute that FV? Q2 Using five years of monthly data, an analyst computes the following risk and return measures for three portfolios: Portfolio Mean Monthly Portfolio Beta Portfolio Return Standard deviation X 1.0% 1.5 1.3 Y 1.5% 2.3 2.0 Z 2.5% 3.0 1.7 The mean monthly return on Treasury bills (T-bills) is 0.5% over this period. The most preferred portfolio, based on its Sharpe ratio, is: A. Portfolio X B. Portfolio Y C. Portfolio Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts