Question: If you can answer it asap that would be great. Thanks! Q1 During an accounting period a Start-Up company had the following transactions : Purchases

If you can answer it asap that would be great. Thanks!

If you can answer it asap that would be great. Thanks!

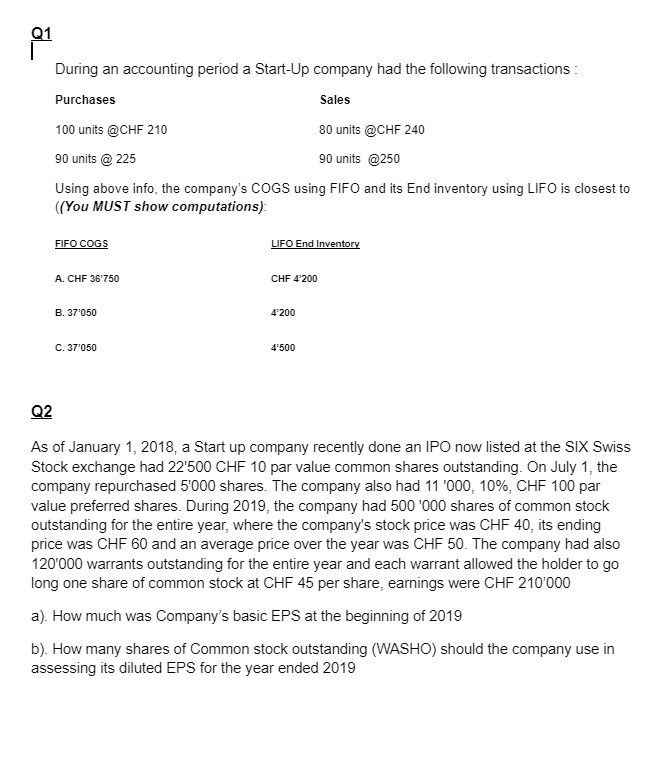

Q1 During an accounting period a Start-Up company had the following transactions : Purchases Sales 100 units @CHF 210 80 units @CHF 240 90 units @ 225 90 units @250 Using above info, the company's COGS using FIFO and its End inventory using LIFO is closest to ((You MUST show computations): FIFO COGS LIFO End Inventory A. CHF 36750 CHF 4200 B. 37050 4200 C. 37'050 4'500 Q2 As of January 1, 2018, a Start up company recently done an IPO now listed at the SIX Swiss Stock exchange had 22'500 CHF 10 par value common shares outstanding. On July 1, the company repurchased 5'000 shares. The company also had 11 '000, 10%, CHF 100 par value preferred shares. During 2019, the company had 500 '000 shares of common stock outstanding for the entire year, where the company's stock price was CHF 40, its ending price was CHF 60 and an average price over the year was CHF 50. The company had also 120'000 warrants outstanding for the entire year and each warrant allowed the holder to go long one share of common stock at CHF 45 per share, earnings were CHF 210'000 a). How much was Company's basic EPS at the beginning of 2019 b). How many shares of Common stock outstanding (WASHO) should the company use in assessing its diluted EPS for the year ended 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts