Question: IF YOU CAN PLEASE EXPLAIN THE PROCESS I WOULD APPRECIATE IT GREATLY. E12-13 (Supplement B) Computing and Reporting Cash Flow Effects of Sale of Plant

IF YOU CAN PLEASE EXPLAIN THE PROCESS I WOULD APPRECIATE IT GREATLY.

E12-13 (Supplement B) Computing and Reporting Cash Flow Effects of Sale of Plant and Equipment

During two recent years Perez Construction, Inc., disposed of the following plant and equipment:

| Year 1 | Year 2 | |||||

| Plant and equipment (at cost) | $ | 76,800 | $ | 17,100 | ||

| Accumulated depreciation on equipment disposed of | 43,985 | 5,573 | ||||

| Cash received | 21,464 | 15,763 | ||||

| Gain (loss) on sale | (11,351 | ) | 4,236 | |||

|

| ||||||

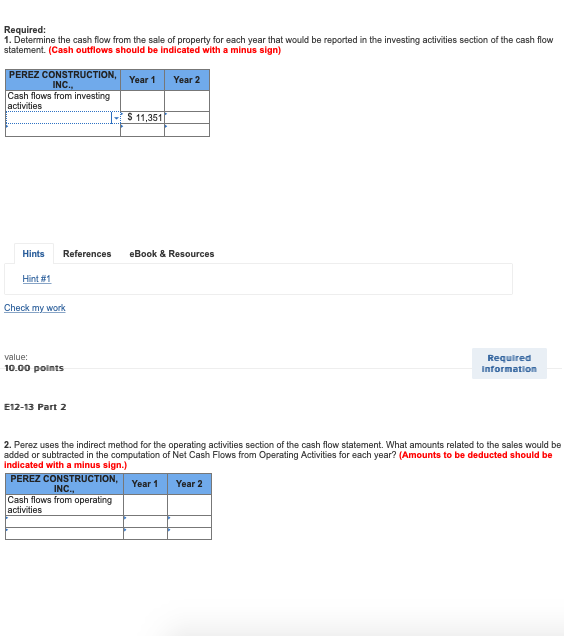

Required: . Determine the cash flow from the sale of property for each year that would be reported in the investing activities section of the cash flow statement. (Cash outflows should be indicated with a minus sign) PEREZ CONSTRUCTIYear 1 Year 2 PEREZ CONSTRUCTION INC. Cash flows from investing activities S11,351 Hints References eBook & Resources Hint #1 Check my work value: Required Information 10.00 points E12-13 Part 2 2. Perez uses the indirect method for the operating activities section of the cash flow statement. What amounts related to the sales would be added or subtracted in the computation of Net Cash Flows from Operating Activities for each year? (Amounts to be deducted should be indicated with a minus sign.) PEREZ CONSTRUCTION. r 1 Year 2 INC Cash flows from operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts