Question: if you can put the formula next to the answer, that would help me understand how you got to the conclusion that you got please.

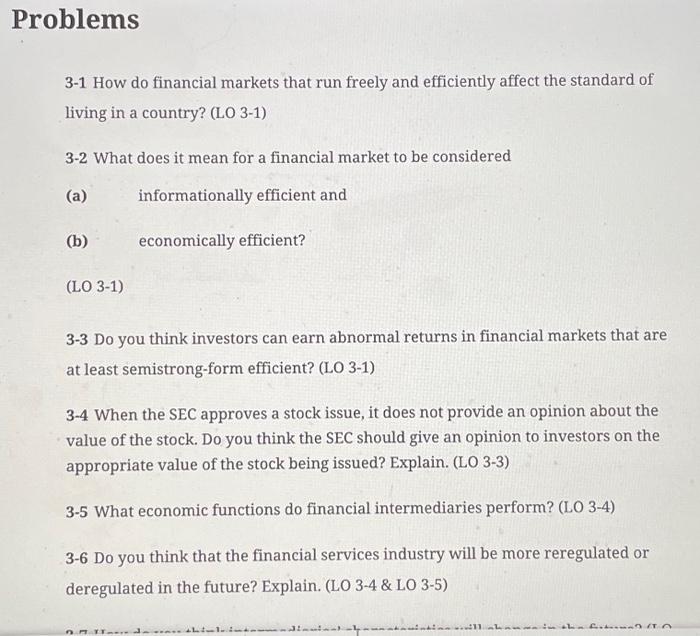

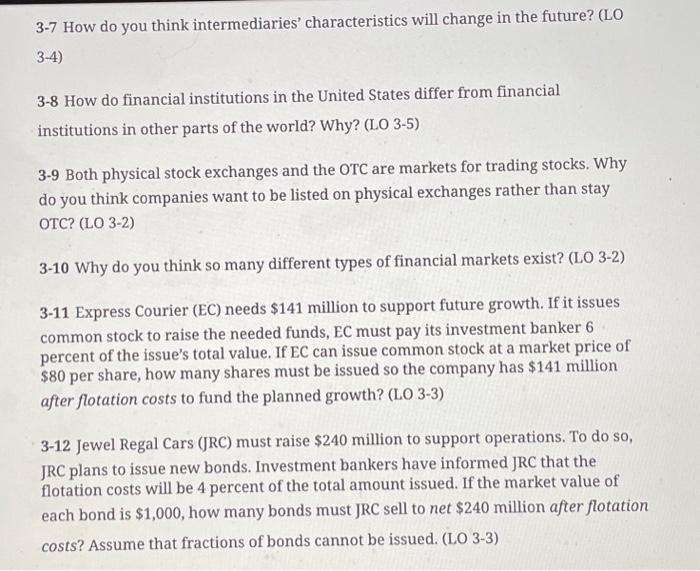

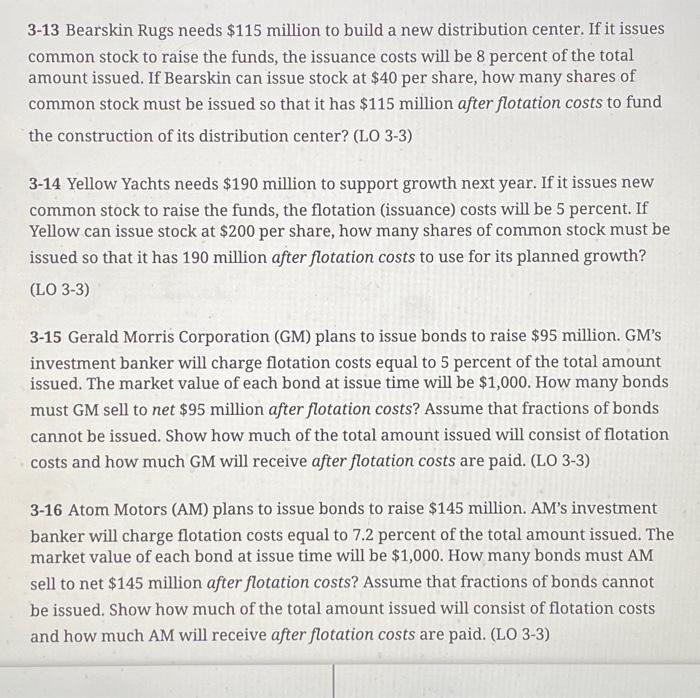

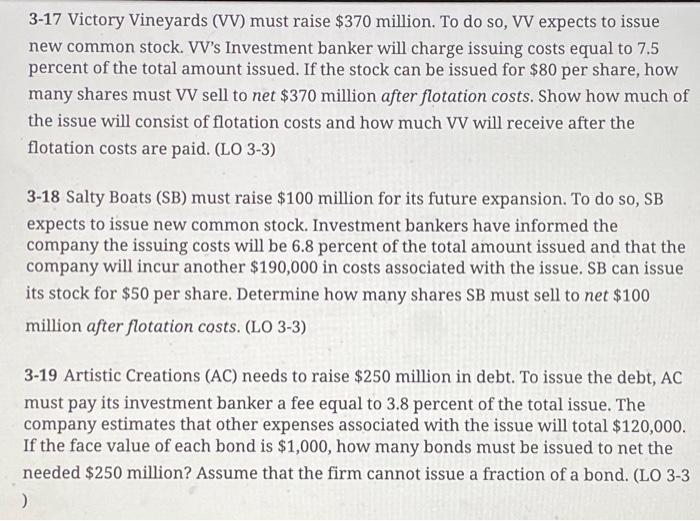

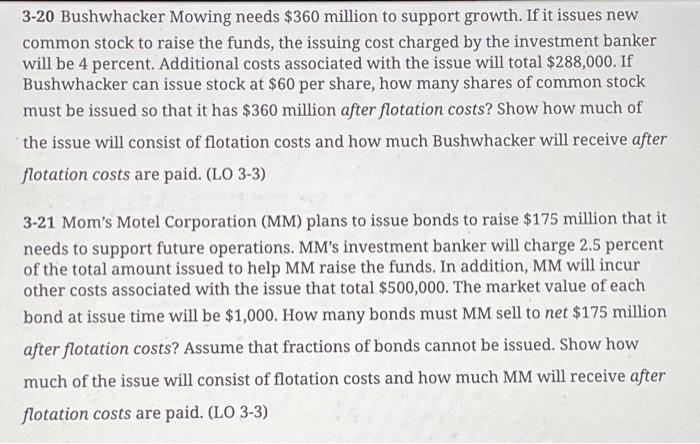

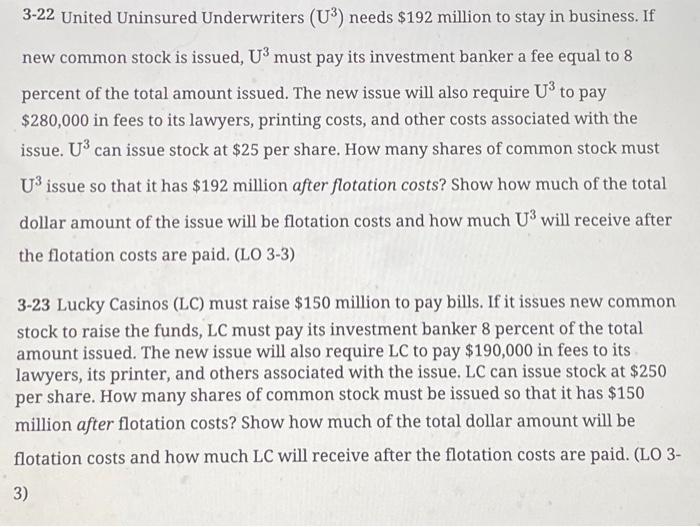

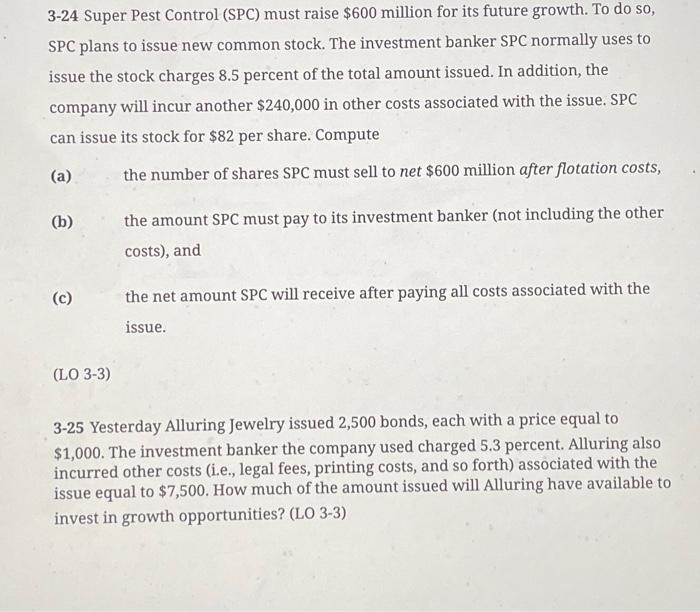

olorems 3-1 How do financial markets that run freely and efficiently affect the standard of living in a country? (LO 3-1) 3-2 What does it mean for a financial market to be considered (a) informationally efficient and (b) economically efficient? (LO 3-1) 3-3 Do you think investors can earn abnormal returns in financial markets that are at least semistrong-form efficient? (LO 3-1) 3-4 When the SEC approves a stock issue, it does not provide an opinion about the value of the stock. Do you think the SEC should give an opinion to investors on the appropriate value of the stock being issued? Explain. (LO 3-3) 3-5 What economic functions do financial intermediaries perform? (LO 3-4) 3-6 Do you think that the financial services industry will be more reregulated or deregulated in the future? Explain. (LO 3-4 \& LO 3-5) 3-20 Bushwhacker Mowing needs $360 million to support growth. If it issues new common stock to raise the funds, the issuing cost charged by the investment banker will be 4 percent. Additional costs associated with the issue will total $288,000. If Bushwhacker can issue stock at $60 per share, how many shares of common stock must be issued so that it has $360 million after flotation costs? Show how much of the issue will consist of flotation costs and how much Bushwhacker will receive after flotation costs are paid. (LO 3-3) 3-21 Mom's Motel Corporation (MM) plans to issue bonds to raise $175 million that it needs to support future operations. MM's investment banker will charge 2.5 percent of the total amount issued to help MM raise the funds. In addition, MM will incur other costs associated with the issue that total $500,000. The market value of each bond at issue time will be $1,000. How many bonds must MM sell to net $175 million after flotation costs? Assume that fractions of bonds cannot be issued. Show how much of the issue will consist of flotation costs and how much MM will receive after flotation costs are paid. (LO 3-3) 3-22 United Uninsured Underwriters (U3) needs $192 million to stay in business. If new common stock is issued, U3 must pay its investment banker a fee equal to 8 percent of the total amount issued. The new issue will also require U3 to pay $280,000 in fees to its lawyers, printing costs, and other costs associated with the issue. U3 can issue stock at $25 per share. How many shares of common stock must U3 issue so that it has $192 million after flotation costs? Show how much of the total dollar amount of the issue will be flotation costs and how much U3 will receive after the flotation costs are paid. ( LO33) 3-23 Lucky Casinos (LC) must raise $150 million to pay bills. If it issues new common stock to raise the funds, LC must pay its investment banker 8 percent of the total amount issued. The new issue will also require LC to pay $190,000 in fees to its lawyers, its printer, and others associated with the issue. LC can issue stock at $250 per share. How many shares of common stock must be issued so that it has $150 million after flotation costs? Show how much of the total dollar amount will be flotation costs and how much LC will receive after the flotation costs are paid. (LO 33) 3-24 Super Pest Control (SPC) must raise $600 million for its future growth. To do so, SPC plans to issue new common stock. The investment banker SPC normally uses to issue the stock charges 8.5 percent of the total amount issued. In addition, the company will incur another $240,000 in other costs associated with the issue. SPC can issue its stock for $82 per share. Compute (a) the number of shares SPC must sell to net $600 million after flotation costs, (b) the amount SPC must pay to its investment banker (not including the other costs), and (c) the net amount SPC will receive after paying all costs associated with the issue. (LO 3-3) 3-25 Yesterday Alluring Jewelry issued 2,500 bonds, each with a price equal to $1,000. The investment banker the company used charged 5.3 percent. Alluring also incurred other costs (i.e., legal fees, printing costs, and so forth) associated with the issue equal to $7,500. How much of the amount issued will Alluring have available to invest in growth opportunities? (LO 3-3) 3-7 How do you think intermediaries' characteristics will change in the future? (LO 3-4) 3-8 How do financial institutions in the United States differ from financial institutions in other parts of the world? Why? (LO 3-5) 3-9 Both physical stock exchanges and the OTC are markets for trading stocks. Why do you think companies want to be listed on physical exchanges rather than stay OTC? (LO 3-2) 3-10 Why do you think so many different types of financial markets exist? (LO 3-2) 3-11 Express Courier (EC) needs $141 million to support future growth. If it issues common stock to raise the needed funds, EC must pay its investment banker 6 percent of the issue's total value. If EC can issue common stock at a market price of $80 per share, how many shares must be issued so the company has $141 million after flotation costs to fund the planned growth? (LO 3-3) 3-12 Jewel Regal Cars (JRC) must raise $240 million to support operations. To do so, JRC plans to issue new bonds. Investment bankers have informed JRC that the flotation costs will be 4 percent of the total amount issued. If the market value of each bond is $1,000, how many bonds must JRC sell to net $240 million after flotation costs? Assume that fractions of bonds cannot be issued. (LO 3-3) 3-13 Bearskin Rugs needs $115 million to build a new distribution center. If it issues common stock to raise the funds, the issuance costs will be 8 percent of the total amount issued. If Bearskin can issue stock at $40 per share, how many shares of common stock must be issued so that it has $115 million after flotation costs to fund the construction of its distribution center? (LO 3-3) 3-14 Yellow Yachts needs $190 million to support growth next year. If it issues new common stock to raise the funds, the flotation (issuance) costs will be 5 percent. If Yellow can issue stock at $200 per share, how many shares of common stock must be issued so that it has 190 million after flotation costs to use for its planned growth? (LO 3-3) 3-15 Gerald Morris Corporation (GM) plans to issue bonds to raise \$95 million. GM's investment banker will charge flotation costs equal to 5 percent of the total amount issued. The market value of each bond at issue time will be $1,000. How many bonds must GM sell to net $95 million after flotation costs? Assume that fractions of bonds cannot be issued. Show how much of the total amount issued will consist of flotation costs and how much GM will receive after flotation costs are paid. (LO 3-3) 3-16 Atom Motors (AM) plans to issue bonds to raise \$145 million. AM's investment banker will charge flotation costs equal to 7.2 percent of the total amount issued. The market value of each bond at issue time will be $1,000. How many bonds must AM sell to net $145 million after flotation costs? Assume that fractions of bonds cannot be issued. Show how much of the total amount issued will consist of flotation costs and how much AM will receive after flotation costs are paid. (LO 3-3) 3-17 Victory Vineyards (VV) must raise $370 million. To do so, VV expects to issue new common stock. VV's Investment banker will charge issuing costs equal to 7.5 percent of the total amount issued. If the stock can be issued for $80 per share, how many shares must VV sell to net $370 million after flotation costs. Show how much of the issue will consist of flotation costs and how much VV will receive after the flotation costs are paid. (LO 3-3) 3-18 Salty Boats (SB) must raise $100 million for its future expansion. To do so, SB expects to issue new common stock. Investment bankers have informed the company the issuing costs will be 6.8 percent of the total amount issued and that the company will incur another $190,000 in costs associated with the issue. SB can issue its stock for $50 per share. Determine how many shares SB must sell to net $100 million after flotation costs. (LO 3-3) 3-19 Artistic Creations (AC) needs to raise $250 million in debt. To issue the debt, AC must pay its investment banker a fee equal to 3.8 percent of the total issue. The company estimates that other expenses associated with the issue will total $120,000. If the face value of each bond is $1,000, how many bonds must be issued to net the needed $250 million? Assume that the firm cannot issue a fraction of a bond. (LO 3-3 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts