Question: If you can show your work as well, it will help me a lot understanding where to start and what to do. Thank you for

If you can show your work as well, it will help me a lot understanding where to start and what to do. Thank you for your time!

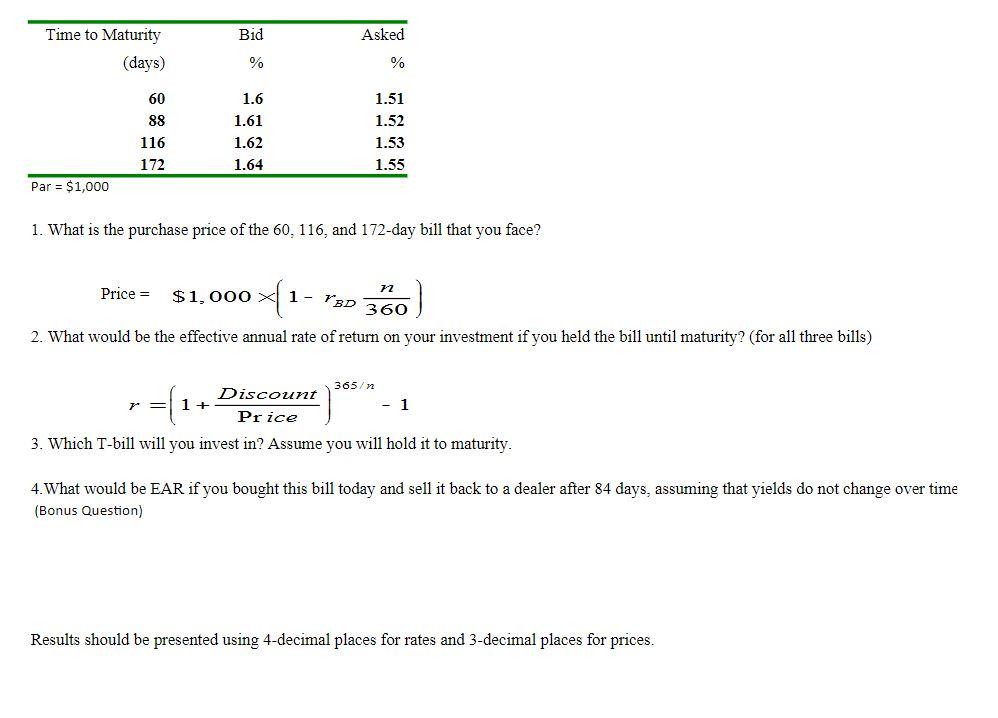

Bid Asked Time to Maturity (days) % % 60 88 116 172 1.6 1.61 1.62 1.64 1.51 1.52 1.53 1.55 Par = $1,000 1. What is the purchase price of the 60, 116, and 172-day bill that you face? 72 Price = $1,000 x{1 1 - TBD 360 2. What would be the effective annual rate of return on your investment if you held the bill until maturity? (for all three bills) 365 Discount 7=11+ - 1 Price 3. Which T-bill will you invest in? Assume you will hold it to maturity. 4. What would be EAR if you bought this bill today and sell it back to a dealer after 84 days, assuming that yields do not change over time (Bonus Question) Results should be presented using 4-decimal places for rates and 3-decimal places for prices. Bid Asked Time to Maturity (days) % % 60 88 116 172 1.6 1.61 1.62 1.64 1.51 1.52 1.53 1.55 Par = $1,000 1. What is the purchase price of the 60, 116, and 172-day bill that you face? 72 Price = $1,000 x{1 1 - TBD 360 2. What would be the effective annual rate of return on your investment if you held the bill until maturity? (for all three bills) 365 Discount 7=11+ - 1 Price 3. Which T-bill will you invest in? Assume you will hold it to maturity. 4. What would be EAR if you bought this bill today and sell it back to a dealer after 84 days, assuming that yields do not change over time (Bonus Question) Results should be presented using 4-decimal places for rates and 3-decimal places for prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts