Question: If you could also explain how you solved for it, I would appreciate it. Reporting Litigation Contingencies Koll's Company is preparing its annual financial statements

If you could also explain how you solved for it, I would appreciate it.

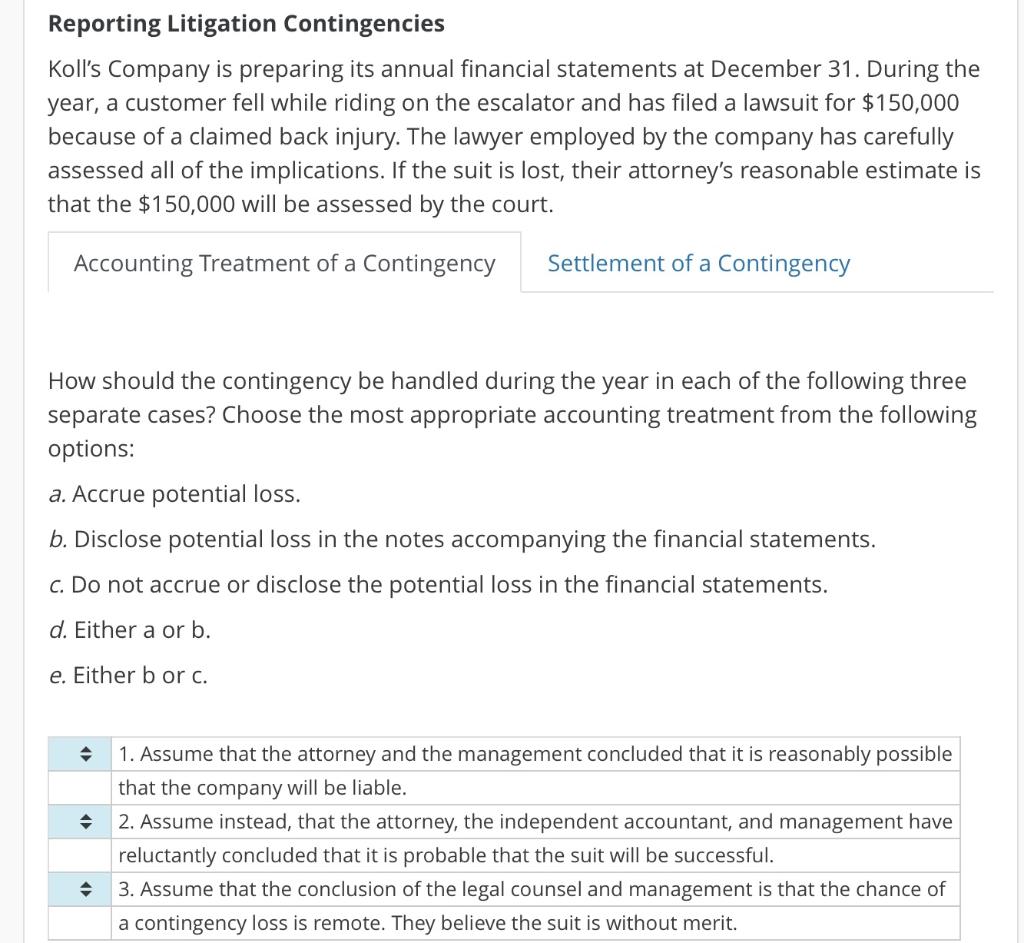

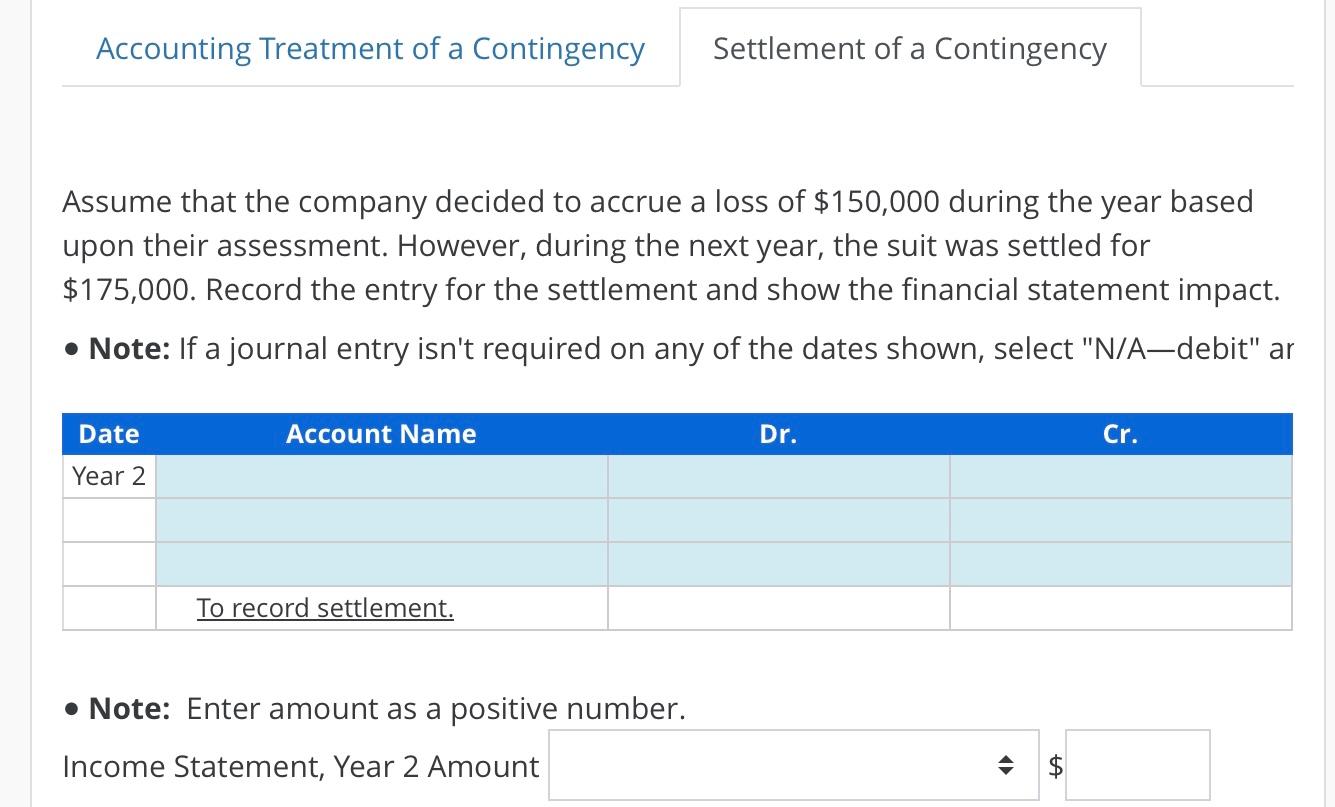

Reporting Litigation Contingencies Koll's Company is preparing its annual financial statements at December 31 . During the year, a customer fell while riding on the escalator and has filed a lawsuit for $150,000 because of a claimed back injury. The lawyer employed by the company has carefully assessed all of the implications. If the suit is lost, their attorney's reasonable estimate is that the $150,000 will be assessed by the court. How should the contingency be handled during the year in each of the following three separate cases? Choose the most appropriate accounting treatment from the following options: a. Accrue potential loss. b. Disclose potential loss in the notes accompanying the financial statements. c. Do not accrue or disclose the potential loss in the financial statements. d. Either a or b. e. Either b or c. Assume that the company decided to accrue a loss of $150,000 during the year based upon their assessment. However, during the next year, the suit was settled for $175,000. Record the entry for the settlement and show the financial statement impact. - Note: If a journal entry isn't required on any of the dates shown, select "N/A-debit" ar - Note: Enter amount as a positive number. Income Statement, Year 2 Amount $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts