Question: If you could explain how you solved for it, I would really appreciate it. Recording Payroll and Related Deductions Ryan Company paid salaries for the

If you could explain how you solved for it, I would really appreciate it.

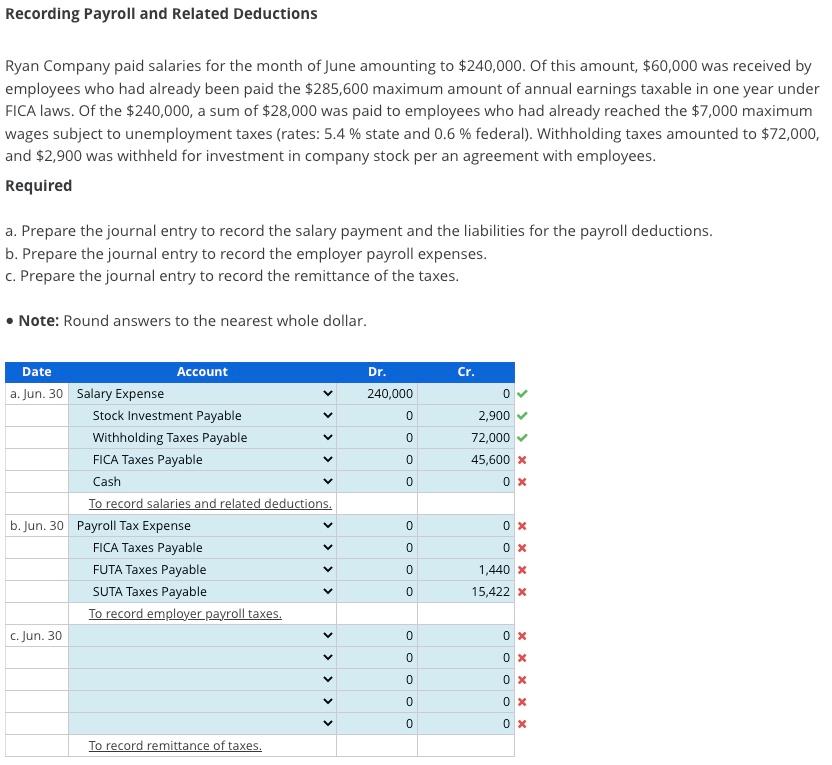

Recording Payroll and Related Deductions Ryan Company paid salaries for the month of June amounting to $240,000. Of this amount, $60,000 was received by employees who had already been paid the $285,600 maximum amount of annual earnings taxable in one year under FICA laws. Of the $240,000, a sum of $28,000 was paid to employees who had already reached the $7,000 maximum wages subject to unemployment taxes (rates: 5.4% state and 0.6% federal). Withholding taxes amounted to $72,000, and $2,900 was withheld for investment in company stock per an agreement with employees. Required a. Prepare the journal entry to record the salary payment and the liabilities for the payroll deductions. b. Prepare the journal entry to record the employer payroll expenses. c. Prepare the journal entry to record the remittance of the taxes. - Note: Round answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts