Question: If you could explain how you solved for it, I would appreciate it. Recording Entries for Bonds with Warrants On July 1 of Year 1,

If you could explain how you solved for it, I would appreciate it.

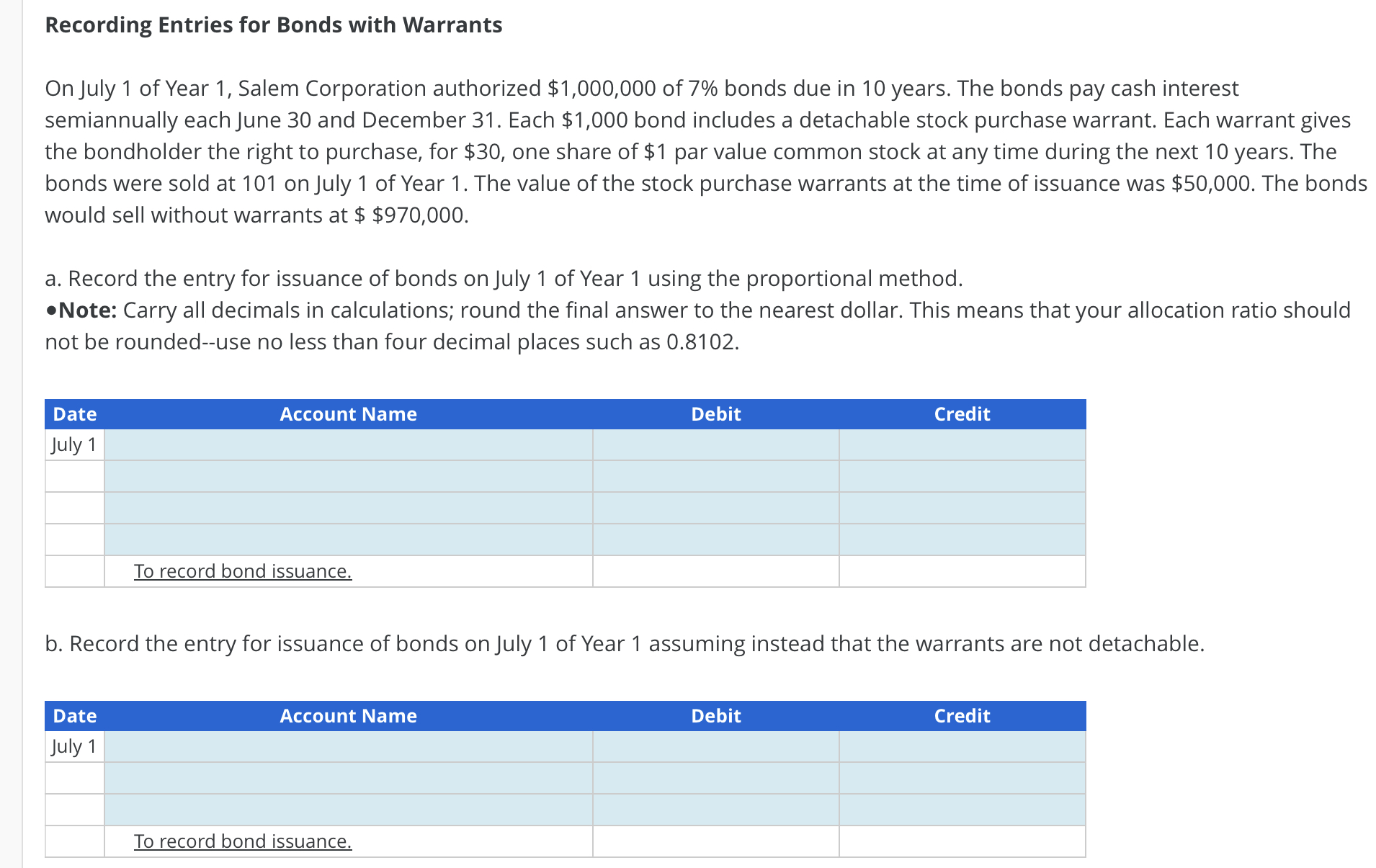

Recording Entries for Bonds with Warrants On July 1 of Year 1, Salem Corporation authorized $1,000,000 of 7% bonds due in 10 years. The bonds pay cash interest semiannually each June 30 and December 31. Each $1,000 bond includes a detachable stock purchase warrant. Each warrant gives the bondholder the right to purchase, for $30, one share of $1 par value common stock at any time during the next 10 years. The bonds were sold at 101 on July 1 of Year 1 . The value of the stock purchase warrants at the time of issuance was $50,000. The bonds would sell without warrants at $970,000. a. Record the entry for issuance of bonds on July 1 of Year 1 using the proportional method. -Note: Carry all decimals in calculations; round the final answer to the nearest dollar. This means that your allocation ratio should not be rounded--use no less than four decimal places such as 0.8102 . b. Record the entry for issuance of bonds on July 1 of Year 1 assuming instead that the warrants are not detachable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts