Question: if you could please answer all parts that would be greatly appreciated thank you!! :) Salmone Company reported the following purchases and sales for its

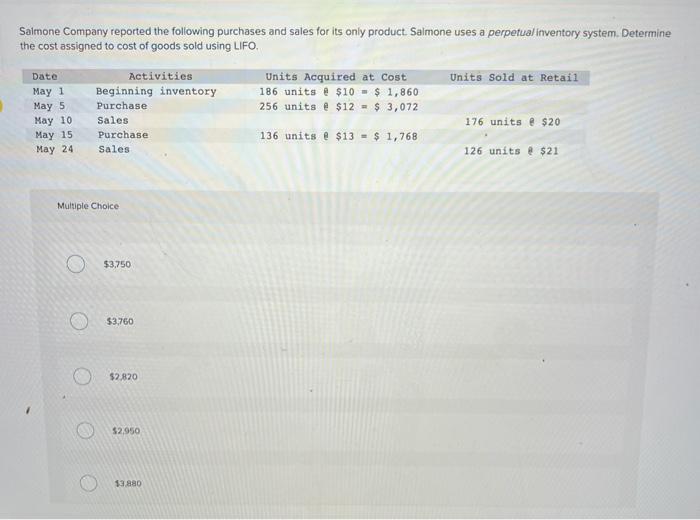

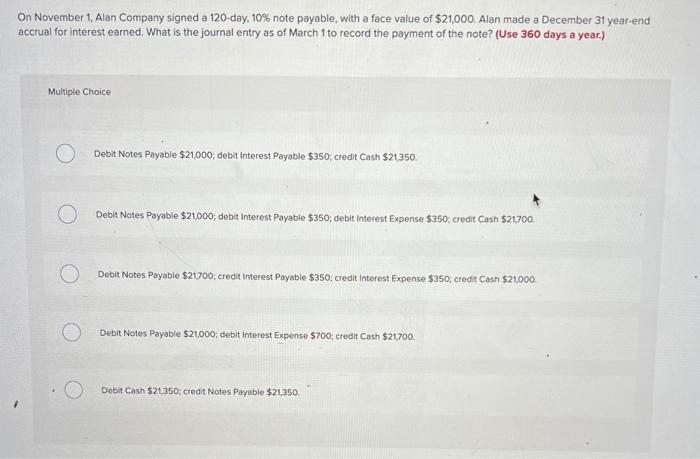

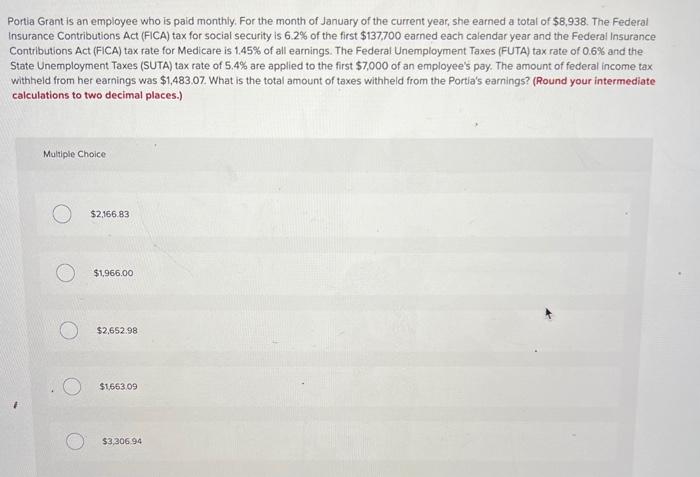

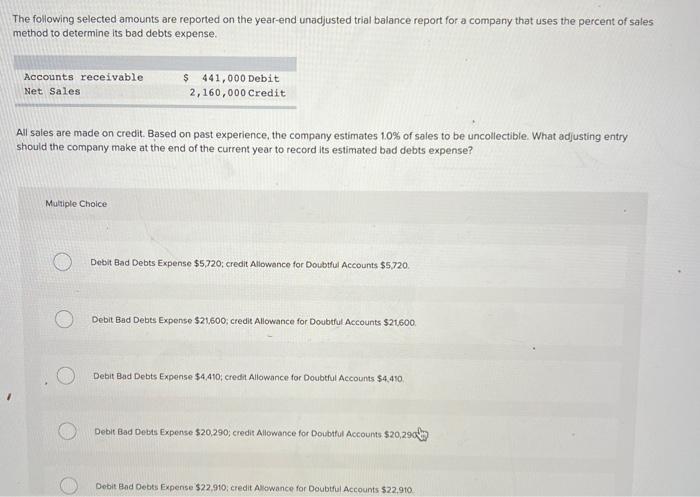

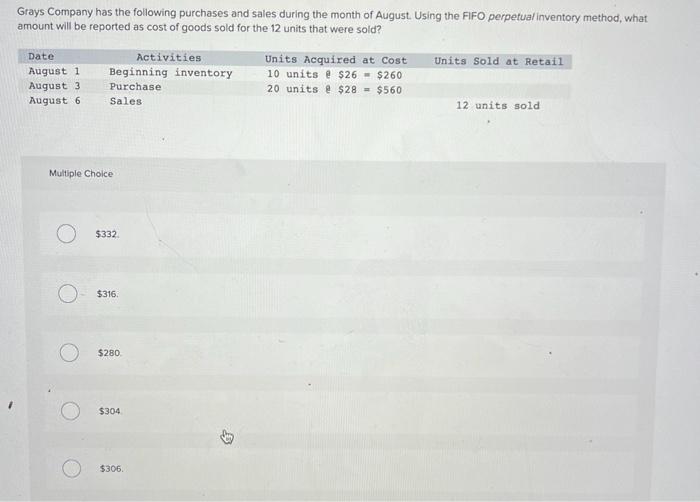

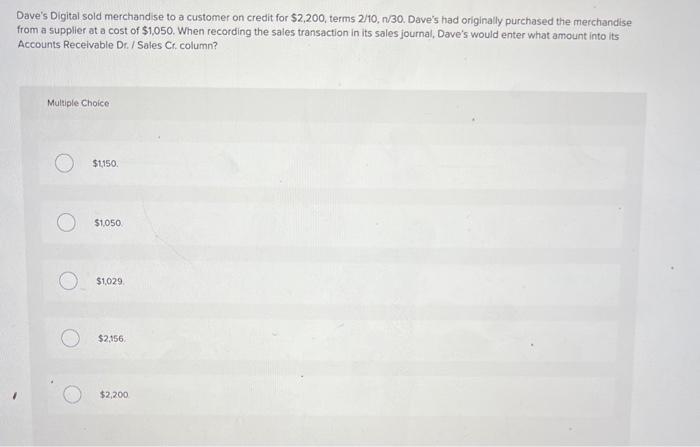

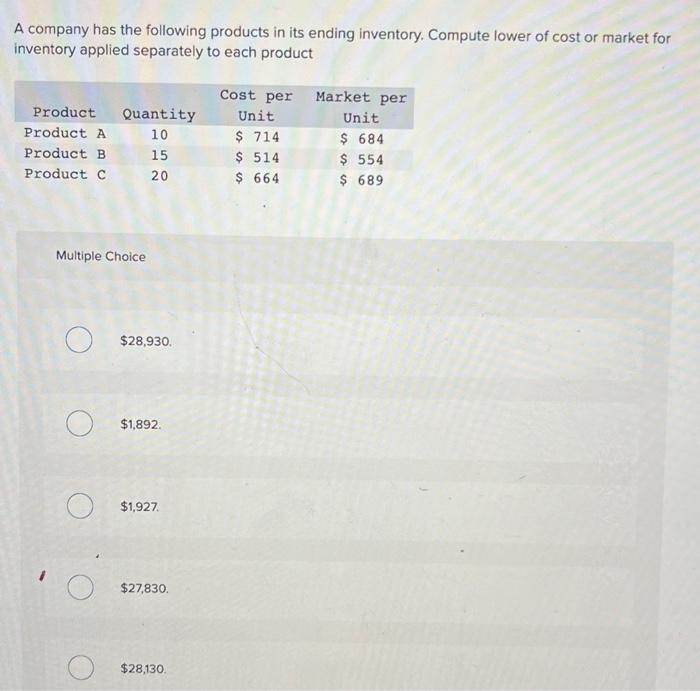

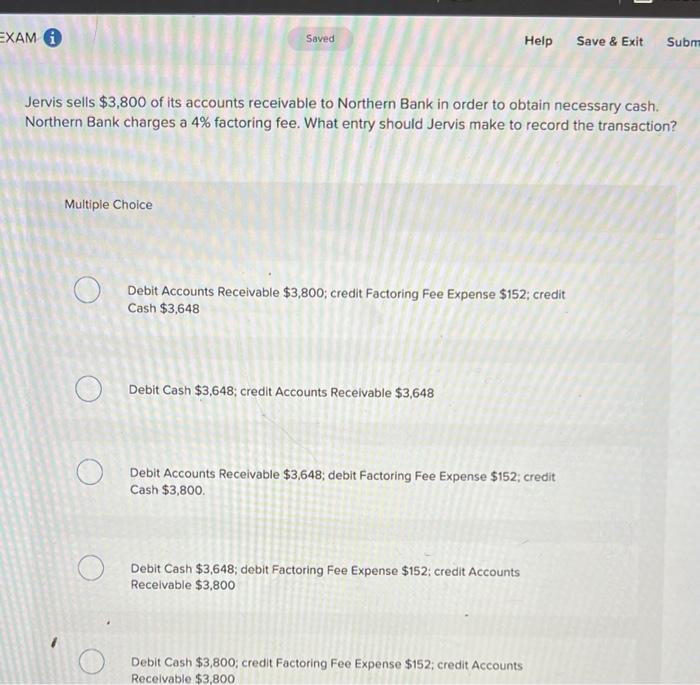

Salmone Company reported the following purchases and sales for its only product Salmone uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using LIFO. Units sold at Retail Date May 1 May 5 May 10 May 15 May 24 Activities Beginning inventory Purchase Sales Purchase Sales Units Acquired at Cost 186 units @ $10 - $ 1,860 256 units @ $12 - $ 3,072 176 units & $20 136 units @ $13 - $ 1,768 126 units & $21 Multiple Choice $3,750 $3.760 o $2.820 52,950 13.880 On November 1, Alan Company signed a 120-day, 10% note payable, with a face value of $21,000, Alan made a December 31 year-end accrual for interest earned. What is the journal entry as of March 1 to record the payment of the note? (Use 360 days a year.) Multiple Choice Debit Notes Payable $21,000, debit interest Payable $350 credit Cash $21,350 Debli Notes Payable $21,000; debit Interest Payable $350; debit interest Expense $350 credit Cash $21700 Debit Notes Payable $21700: credit Interest Payable $350;credit Interest Expense $350 Credit Cash $21000, Debit Notes Payable $21,000; debit interest Expense $700, credit Cash $21700. Debit Cash $21.350: credit Notes Payable $21,350 Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $8,938. The Federal Insurance Contributions Act (FICA) tax for social security is 6.2% of the first $137.700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The Federal Unemployment Taxes (FUTA) tax rate of 0.6% and the State Unemployment Taxes (SUTA) tax rate of 5,4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,483.07. What is the total amount of taxes withheld from the Portla's earnings? (Round your intermediate calculations to two decimal places.) Multiple Choice O $2.166.83 $1,966.00 $2,652.98 $166309 $3,306.94 The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense. Accounts receivable Net Sales $441,000 Debit 2,160,000 Credit All sales are made on credit. Based on past experience, the company estimates 10% of sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Multiple Choice Debit Bad Debts Expense $5720; credit Allowance for Doubtful Accounts $5720 Debit Bad Debts Expense $21,600; credit Allowance for Doubtful Accounts $21,600 Debit Bed Debts Expense $4,410 credit Allowance for Doubtful Accounts $4,490 Debit Bed Debts Expense $20.290, credit Allowance for Doubtful Accounts $20,29% Debit Bad Debts Expense $22,910, credit Allowance for Doubtful Accounts $22.910 Grays Company has the following purchases and sales during the month of August. Using the FIFO perpetual inventory method, what amount will be reported as cost of goods sold for the 12 units that were sold? Activities Units Acquired at Cost Units sold at Retail August 1 Beginning inventory 10 units e $26 - $260 August 3 Purchase 20 units & $28. = $560 August 6 Sales 12 units sold Date Multiple Choice $332 $316 $280 $304 $306 Dave's Digital sold merchandise to a customer on credit for $2,200, terms 2/10, 1/30. Dave's had originally purchased the merchandise from a supplier at a cost of $1,050. When recording the sales transaction in its sales journal, Dave's would enter what amount into its Accounts Receivable Dr. / Sales Cr. column? Multiple Choice $1150 a 0 $1,050 $1,029 $2,156 $2,200 A company has the following products in its ending inventory. Compute lower of cost or market for inventory applied separately to each product Product Product A Product B Product C Quantity 10 15 20 Cost per Market per Unit Unit $ 714 $ 684 $ 514 $ 554 $ 664 $ 689 Multiple Choice $28,930 $1,892 $1,927 O $27,830 $28,130 EXAM O Saved Help Save & Exit Subm Jervis sells $3,800 of its accounts receivable to Northern Bank in order to obtain necessary cash. Northern Bank charges a 4% factoring fee. What entry should Jervis make to record the transaction? Multiple Choice Debit Accounts Receivable $3,800; credit Factoring Fee Expense $152; credit Cash $3,648 O Debit Cash $3,648; credit Accounts Receivable $3,648 O Debit Accounts Receivable $3,648; debit Factoring Fee Expense $152; credit Cash $3,800. Debit Cash $3,648; debit Factoring Fee Expense $152; credit Accounts Receivable $3,800 Debit Cash $3,800; credit Factoring Fee Expense $152; credit Accounts Receivable $3,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts