Question: If you could please answer both questions it would be appreciated I am out of questions and I have to pay 3$ for each. Thank

If you could please answer both questions it would be appreciated I am out of questions and I have to pay 3$ for each. Thank you

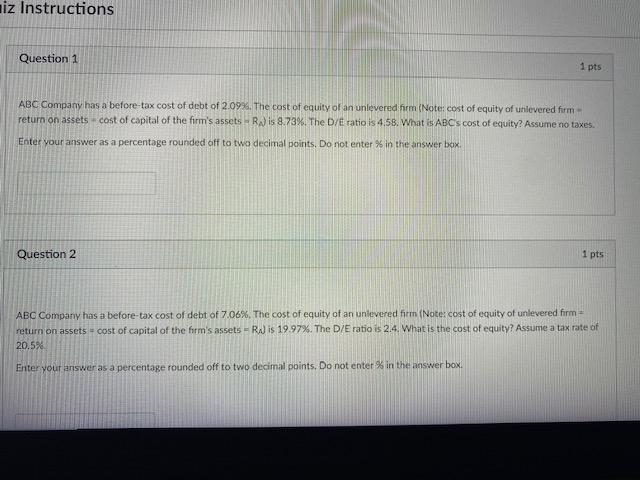

iz Instructions Question 1 1 pts ABC Company has a before-tax cost of debt of 2.09%. The cost of equity of an unlevered firm (Note: cost of equity of unlevered firm return on assets cost of capital of the firm's assets -RA) is 8.73%. The D/E ratio is 4.58. What is ABCs cost of equity? Assume no taxes Enter your answer as a percentage rounded off to two decimal points. Do not enter % in the answer box Question 2 1 pts ABC Company has a before tax cost of debt of 7.06%. The cost of equity of an unlevered firm (Note: cost of equity of unlevered form return on assets cost of capital of the firm's assets-Rw is 19.97%. The D/E ratio is 24. What is the cost of equity? Assume a tax rate of 20.5% Enter your answer as a percentage rounded off to two decimal points. Do not enter in the answer box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts