Question: If you could please demonstrate how to work this type of problem I would appreciate it thank you! 5. Problem 10.09 (WACC) eBook The Paulson

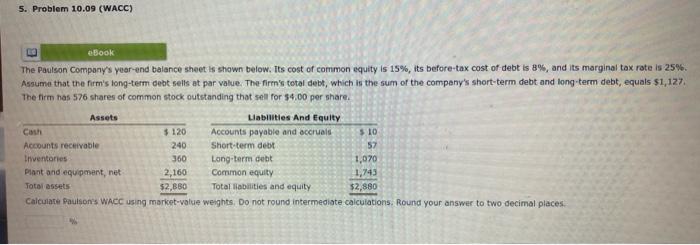

5. Problem 10.09 (WACC) eBook The Paulson Company's year and balance sheet is shown below. Its cost of common equity is 15%, its before-tax cost of debt is 8%, and its marginal tax rate is 25% Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,127 The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accrual $ 10 Accounts receivable 240 Short-term det 57 Inventories 360 Long-term debit 1,070 Plant and equipment, net 2,160 Common equity 1,745 Total assets $2,800 Total liabilities and equity $2,880 Calculate Paulson's WACC using market value weights. Do not found intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts