Question: If you could please help me understand and solve this question step by step it would be appreciated! Ventana Inc. sells a single product for

If you could please help me understand and solve this question step by step it would be appreciated!

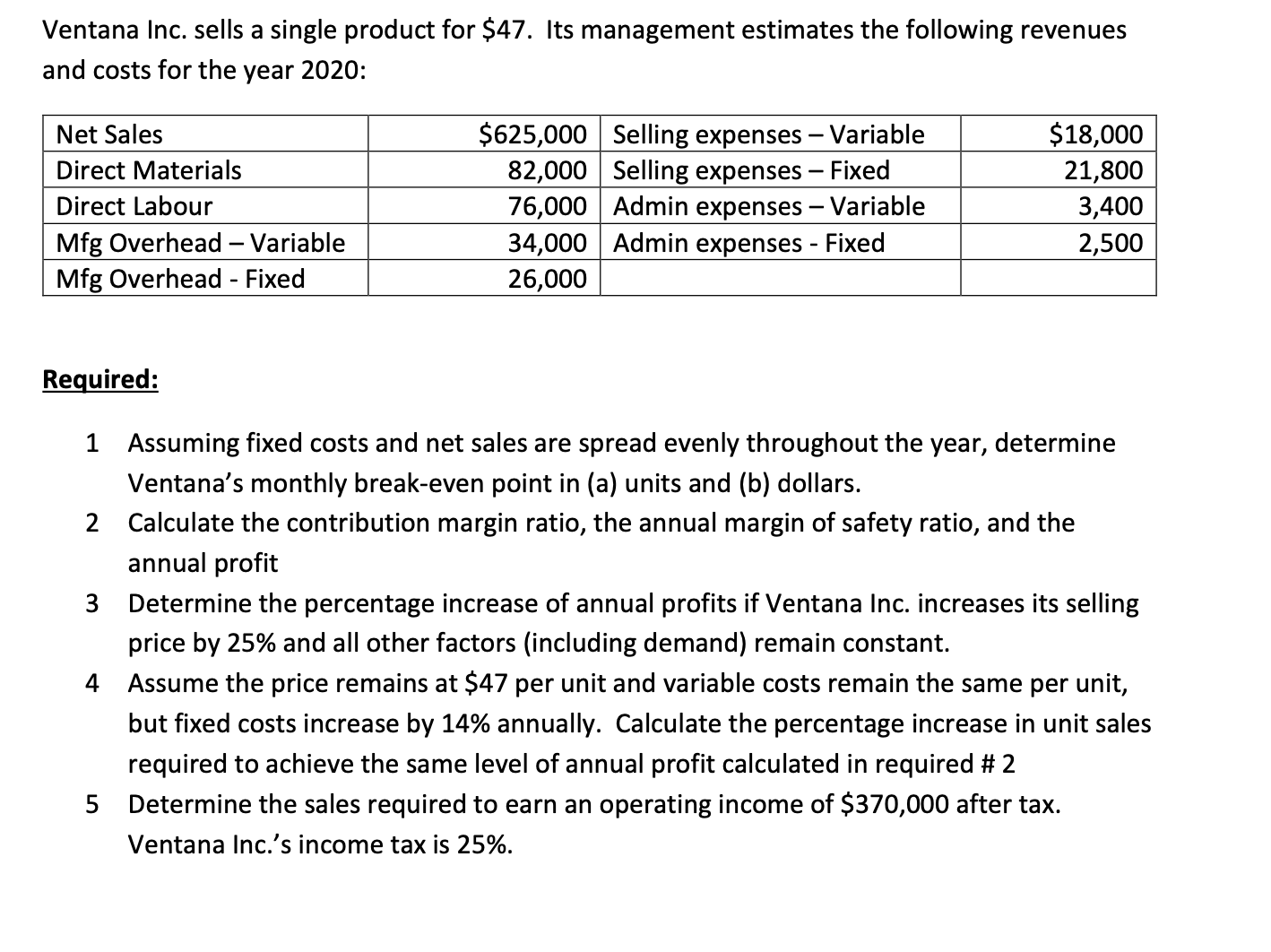

Ventana Inc. sells a single product for $47. Its management estimates the following revenues and costs for the year 2020: Net Sales $625,000 Selling expenses - Variable $18,000 82,000 Selling expenses - Fixed 21,800 76,000 Admin expenses - Variable 3,400 Mfg Overhead - Variable 34,000 Admin expenses - Fixed 2,500 Mfg Overhead - Fixed 26,000 Required: 1 Assuming fixed costs and net sales are spread evenly throughout the year, determine Ventana's monthly break-even point in (a) units and (b) dollars. 2 Calculate the contribution margin ratio, the annual margin of safety ratio, and the annual profit 3 Determine the percentage increase of annual profits if Ventana Inc. increases its selling price by 25% and all other factors (including demand) remain constant. 4 Assume the price remains at $47 per unit and variable costs remain the same per unit, but fixed costs increase by 14% annually. Calculate the percentage increase in unit sales required to achieve the same level of annual profit calculated in required # 2 5 Determine the sales required to earn an operating income of $370,000 after tax. Ventana lnc.'s income tax is 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts