Question: If you could please help solve this problem and also explain how you solved it that would be great. Elysian Fields, Inc., uses a maximum

If you could please help solve this problem and also explain how you solved it that would be great.

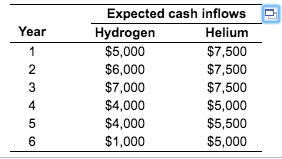

Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $26,000; project Helium requires an initial outlay of $35,000. Using the expected cash inflows given for each project in the following table, calculate each project's payback period. Which project meets Elysian's standards? The payback period of project Hydrogen isyears. Round to two decimal places.) Expected cash inflows Helium $7,500 $7,500 $7,500 $5,000 $5,500 $5,000 E Year Hydrogen $5,000 $6,000 $7,000 $4,000 $4,000 $1,000 4 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts