Question: If you could please just answer with a balance sheet for the end of month 3 that would be really helpful. Anything to get me

If you could please just answer with a balance sheet for the end of month 3 that would be really helpful. Anything to get me started, thank you.

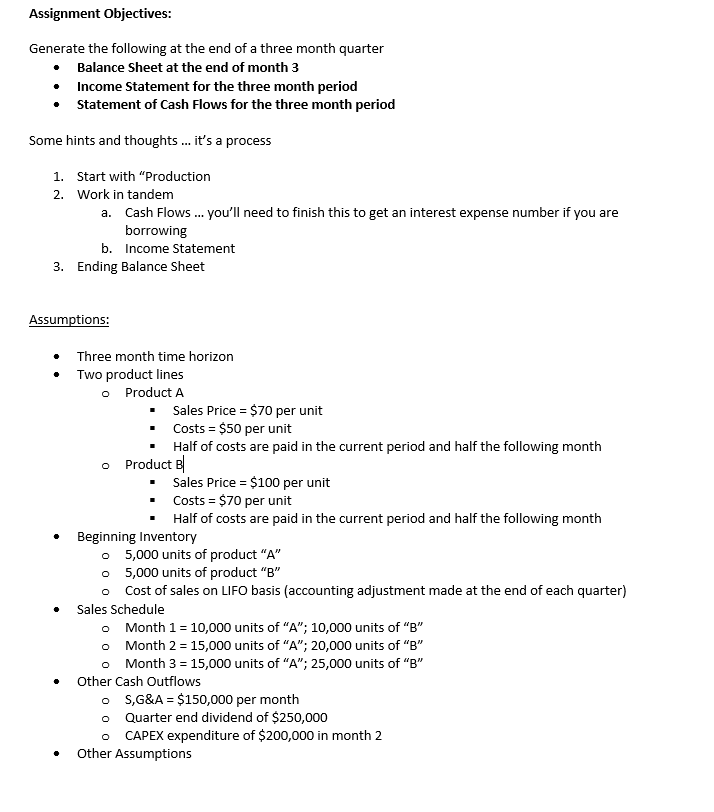

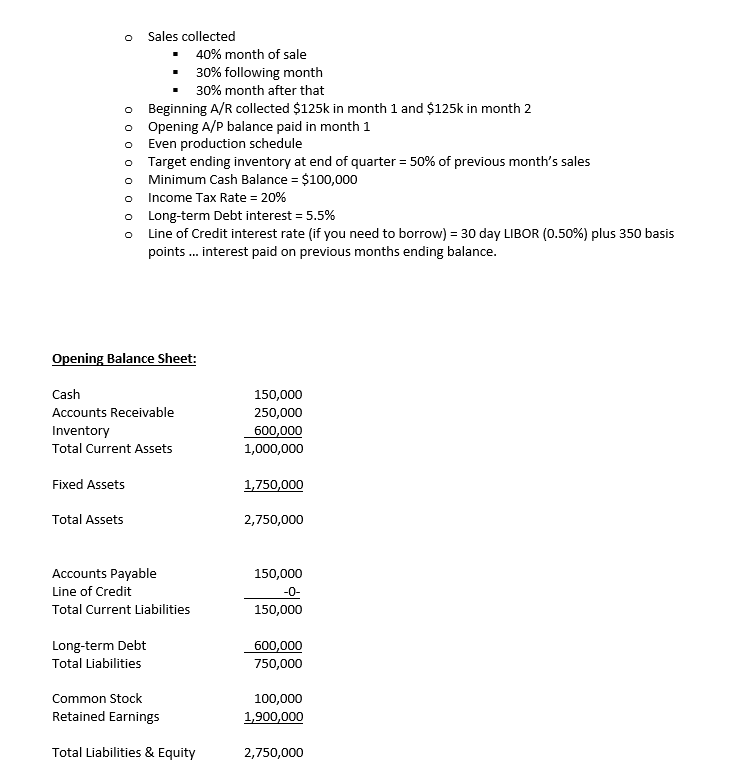

Assignment Objectives: Generate the following at the end of a three month quarter Balance Sheet at the end of month 3 Income Statement for the three month period Statement of Cash Flows for the three month period Some hints and thoughts... it's a process 1. Start with "Production 2. Work in tandem a. Cash Flows ... you'll need to finish this to get an interest expense number if you are borrowing b. Income Statement 3. Ending Balance Sheet Assumptions: Three month time horizon Two product lines o Product A Sales Price = $70 per unit Costs = $50 per unit Half of costs are paid in the current period and half the following month o Product B Sales Price = $100 per unit Costs = $70 per unit Half of costs are paid in the current period and half the following month Beginning Inventory o 5,000 units of product "A" o 5,000 units of product "B" o Cost of sales on LIFO basis (accounting adjustment made at the end of each quarter) Sales Schedule Month 1 = 10,000 units of "A"; 10,000 units of "B" Month 2 = 15,000 units of "A"; 20,000 units of "B" Month 3 = 15,000 units of "A"; 25,000 units of "B" Other Cash Outflows oS,G&A = $150,000 per month Quarter end dividend of $250,000 CAPEX expenditure of $200,000 in month 2 Other Assumptions 0 0 o Sales collected 40% month of sale 30% following month 30% month after that Beginning A/R collected $125k in month 1 and $125k in month 2 o Opening A/P balance paid in month 1 o Even production schedule o Target ending inventory at end of quarter = 50% of previous month's sales Minimum Cash Balance = $100,000 Income Tax Rate = 20% o Long-term Debt interest = 5.5% o Line of Credit interest rate (if you need to borrow) = 30 day LIBOR (0.50%) plus 350 basis points ... interest paid on previous months ending balance. Opening Balance Sheet: Cash Accounts Receivable Inventory Total Current Assets 150,000 250,000 600,000 1,000,000 Fixed Assets 1,750,000 Total Assets 2,750,000 Accounts Payable Line of Credit Total Current Liabilities 150,000 -0- 150,000 Long-term Debt Total Liabilities 600,000 750,000 Common Stock Retained Earnings 100,000 1,900,000 Total Liabilities & Equity 2,750,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts