Question: If you could please show how to do it on excel that would be great. Will be sure to leave a like. E28 A B

If you could please show how to do it on excel that would be great. Will be sure to leave a like.

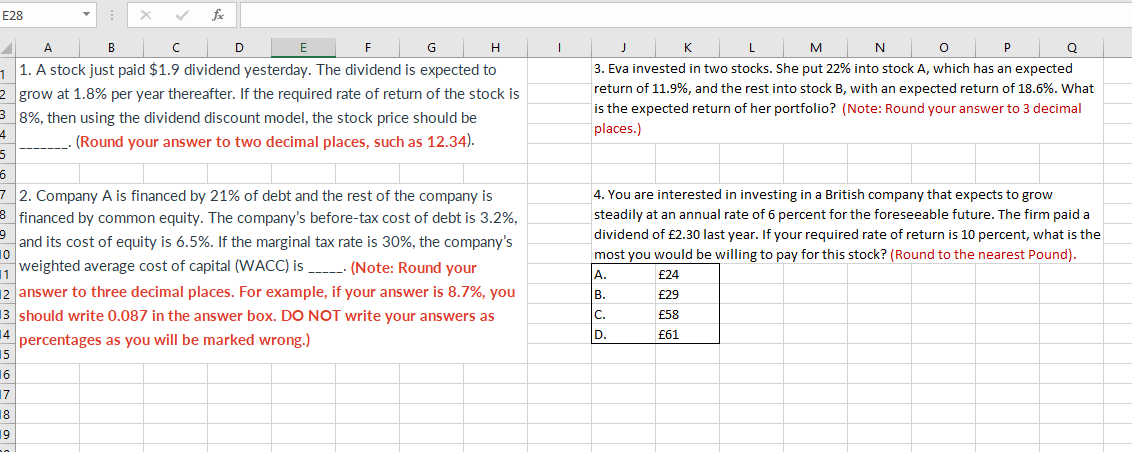

E28 A B D F H 1 K L M N O P Q 3. Eva invested in two stocks. She put 22% into stock A, which has an expected return of 11.9%, and the rest into stock B, with an expected return of 18.6%. What is the expected return of her portfolio? (Note: Round your answer to 3 decimal places.) 9 G 1 1. A stock just paid $1.9 dividend yesterday. The dividend is expected to 2 grow at 1.8% per year thereafter. If the required rate of return of the stock is 38%, then using the dividend discount model, the stock price should be 4 (Round your answer to two decimal places, such as 12.34). 5 6 7 2. Company A is financed by 21% of debt and the rest of the company is 8 financed by common equity. The company's before-tax cost of debt is 3.2%, and its cost of equity is 6.5%. If the marginal tax rate is 30%, the company's 10 weighted average cost of capital (WACC) is ____ (Note: Round your 11 2 answer to three decimal places. For example, if your answer is 8.7%, you 13 should write 0.087 in the answer box. DO NOT write your answers as percentages as you will be marked wrong.) 15 16 17 18 19 4. You are interested in investing in a British company that expects to grow steadily at an annual rate of 6 percent for the foreseeable future. The firm paid a dividend of 2.30 last year. If your required rate of return is 10 percent, what is the most you would be willing to pay for this stock? (Round to the nearest Pound). 24 A B. 29 C. 58 61 14 D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts