Question: If you could please show work. thank you! Question 1 - 13 [Q1-5] The debt-to-equity ratio of your firm is currently 1/2. Under this capital

![13 [Q1-5] The debt-to-equity ratio of your firm is currently 1/2. Under](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe25fca6e15_90066fe25fc3c6ca.jpg)

If you could please show work. thank you!

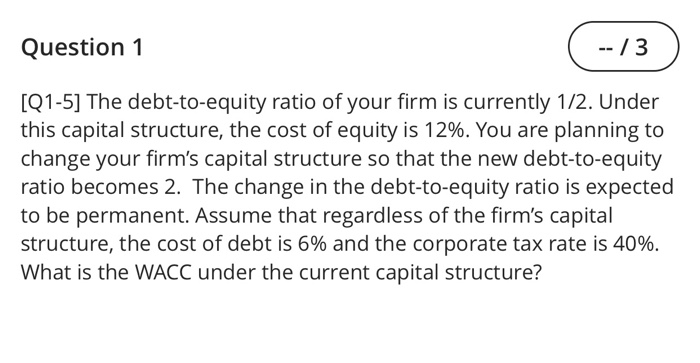

Question 1 - 13 [Q1-5] The debt-to-equity ratio of your firm is currently 1/2. Under this capital structure, the cost of equity is 12%. You are planning to change your firm's capital structure so that the new debt-to-equity ratio becomes 2. The change in the debt-to-equity ratio is expected to be permanent. Assume that regardless of the firm's capital structure, the cost of debt is 6% and the corporate tax rate is 40%. What is the WACC under the current capital structure? QueSLIUI IU What is Firm X's cost of equity? * 10% Question 11 If the corporate tax rate is 50%, what is Firm X's WACC? @ 10%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock