Question: if you could provide excel functions and explanations eill upvote. green cells are needed B C G H 1 2 Risk free rate 3 Beta

if you could provide excel functions and explanations eill upvote. green cells are needed

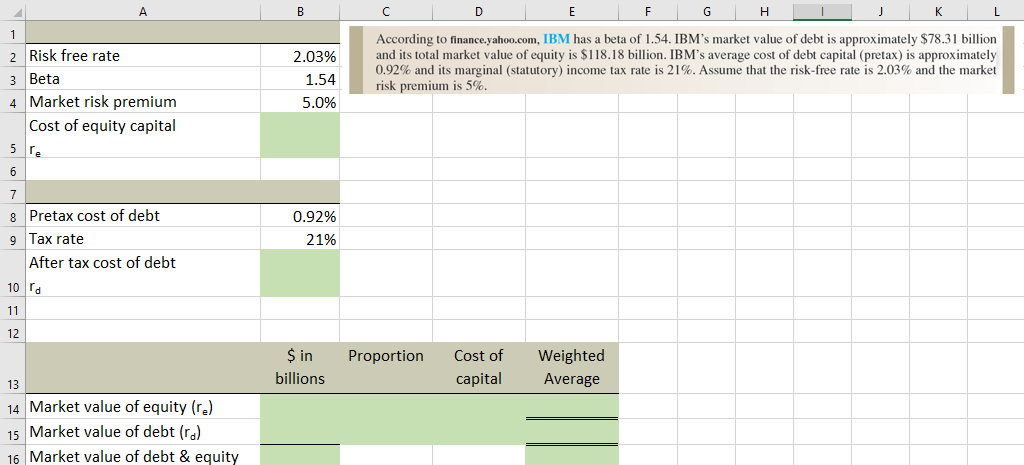

B C G H 1 2 Risk free rate 3 Beta 4 Market risk premium Cost of equity capital 2.03% 1.54 5.0% According to finance.yahoo.com, IBM has a beta of 1.54. IBM's market value of debt is approximately $78.31 billion and its total market value of equity is $118.18 billion. IBM's average cost of debt capital (pretax) is approximately 0.92% and its marginal (statutory) income tax rate is 21%. Assume that the risk-free rate is 2.03% and the market risk premium is 5%. 5 re 6 7 8 Pretax cost of debt 9 Tax rate After tax cost of debt 0.92% 21% 10 rd 11 12 Proportion Cost of $ in billions Weighted Average capital 13 14 Market value of equity (re) 15 Market value of debt (ra) 16 Market value of debt & equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts