Question: If you could show your work that would be much appreciated! On January 1, 2020, Oriole Company purchased $310,000, 6% bonds of Aguirre Co. for

If you could show your work that would be much appreciated!

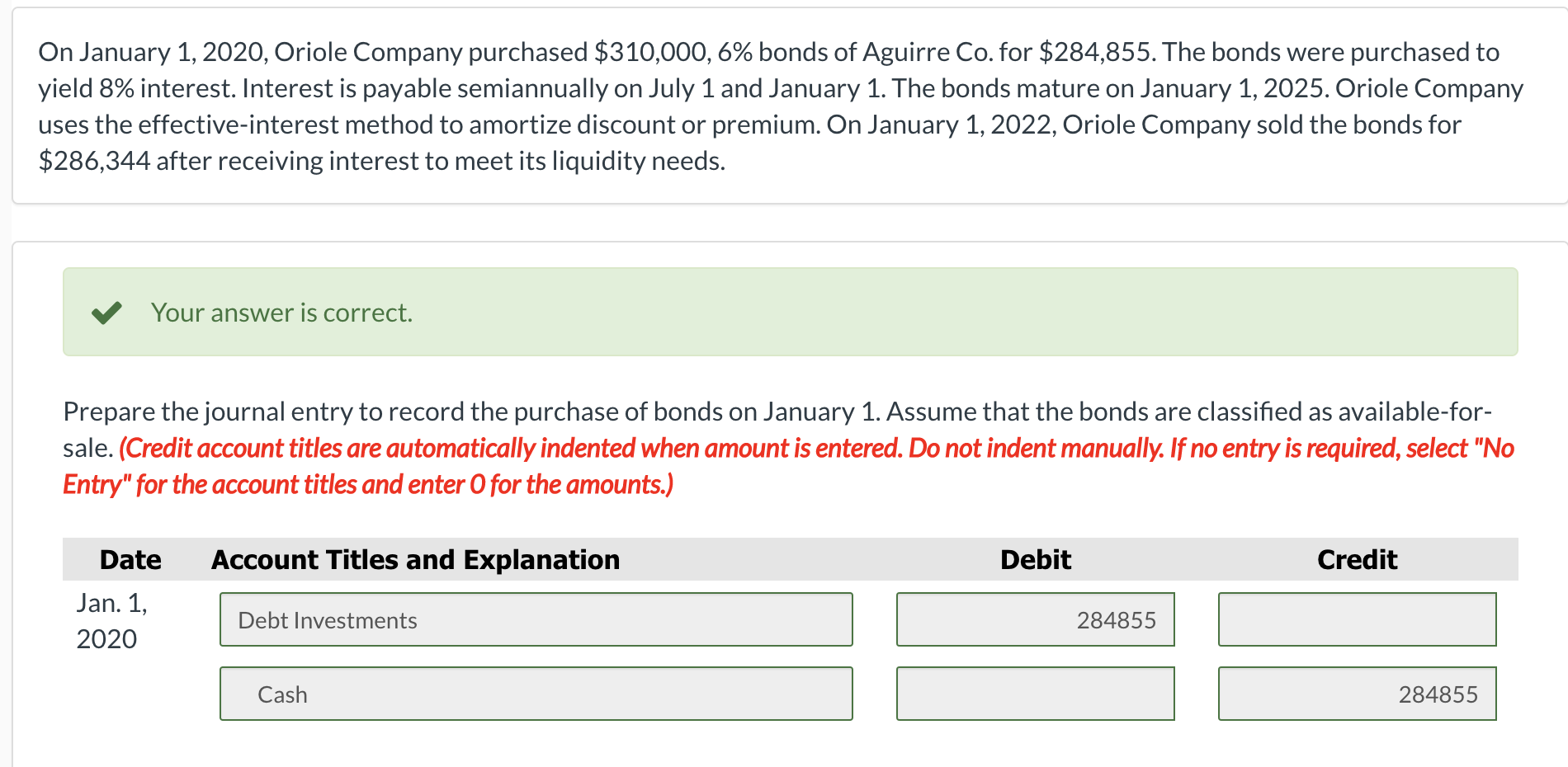

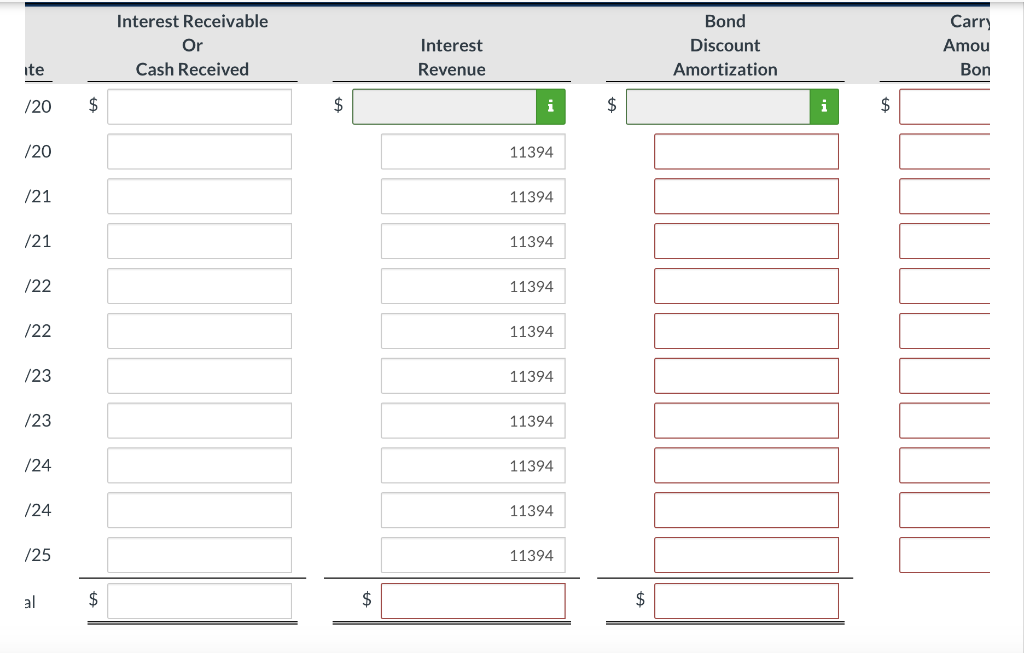

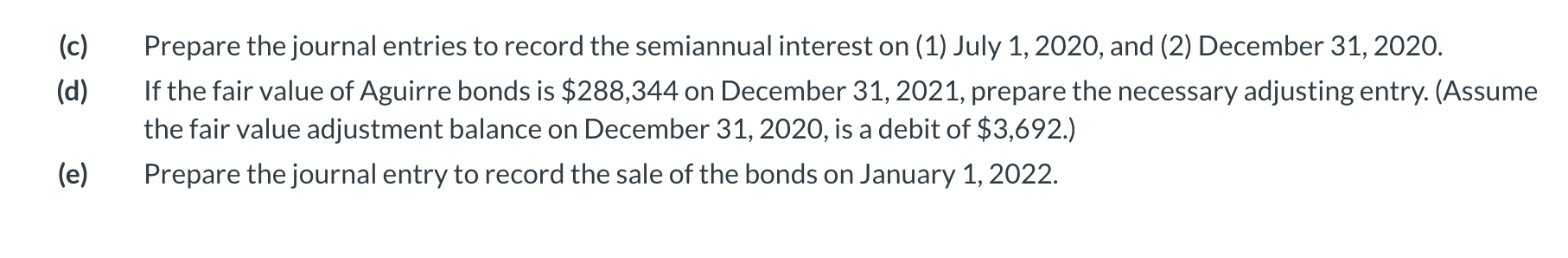

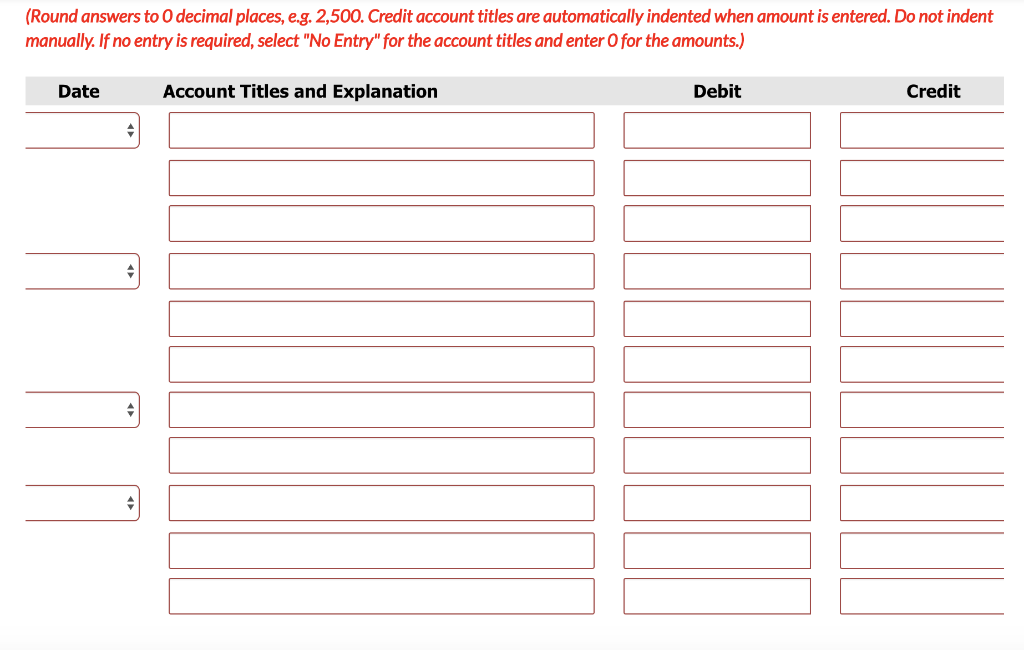

On January 1, 2020, Oriole Company purchased $310,000, 6% bonds of Aguirre Co. for $284,855. The bonds were purchased to yield 8% interest. Interest is payable semiannually on July 1 and January 1. The bonds mature on January 1, 2025. Oriole Company uses the effective-interest method to amortize discount or premium. On January 1, 2022, Oriole Company sold the bonds for $286,344 after receiving interest to meet its liquidity needs. Your answer is correct. Prepare the journal entry to record the purchase of bonds on January 1. Assume that the bonds are classified as available-for- sale. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1, 2020 Debt Investments 284855 Cash 284855 Prepare the amortization schedule for the bonds. (Round answers to O decimal places, e.g. 1,250.) Interest Receivable Or Cash Received Interest Revenue Bond Discount Amortization Carn Amou Bon ite /20 $ $ i $ i $ /20 11394 /21 11394 /21 11394 /22 11394 /22 11394 /23 11394 /23 11394 /24 11394 /24 11394 /25 11394 al $ $ $ (c) (d) Prepare the journal entries to record the semiannual interest on (1) July 1, 2020, and (2) December 31, 2020. If the fair value of Aguirre bonds is $288,344 on December 31, 2021, prepare the necessary adjusting entry. (Assume the fair value adjustment balance on December 31, 2020, is a debit of $3,692.) Prepare the journal entry to record the sale of the bonds on January 1, 2022. (e) (Round answers to 0 decimal places, e.g. 2,500. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts