Question: If you could show your work that would really help:) 3. Savannah took out a 7/1 variable-rate mortgage for $114,000. The interest rate for the

If you could show your work that would really help:)

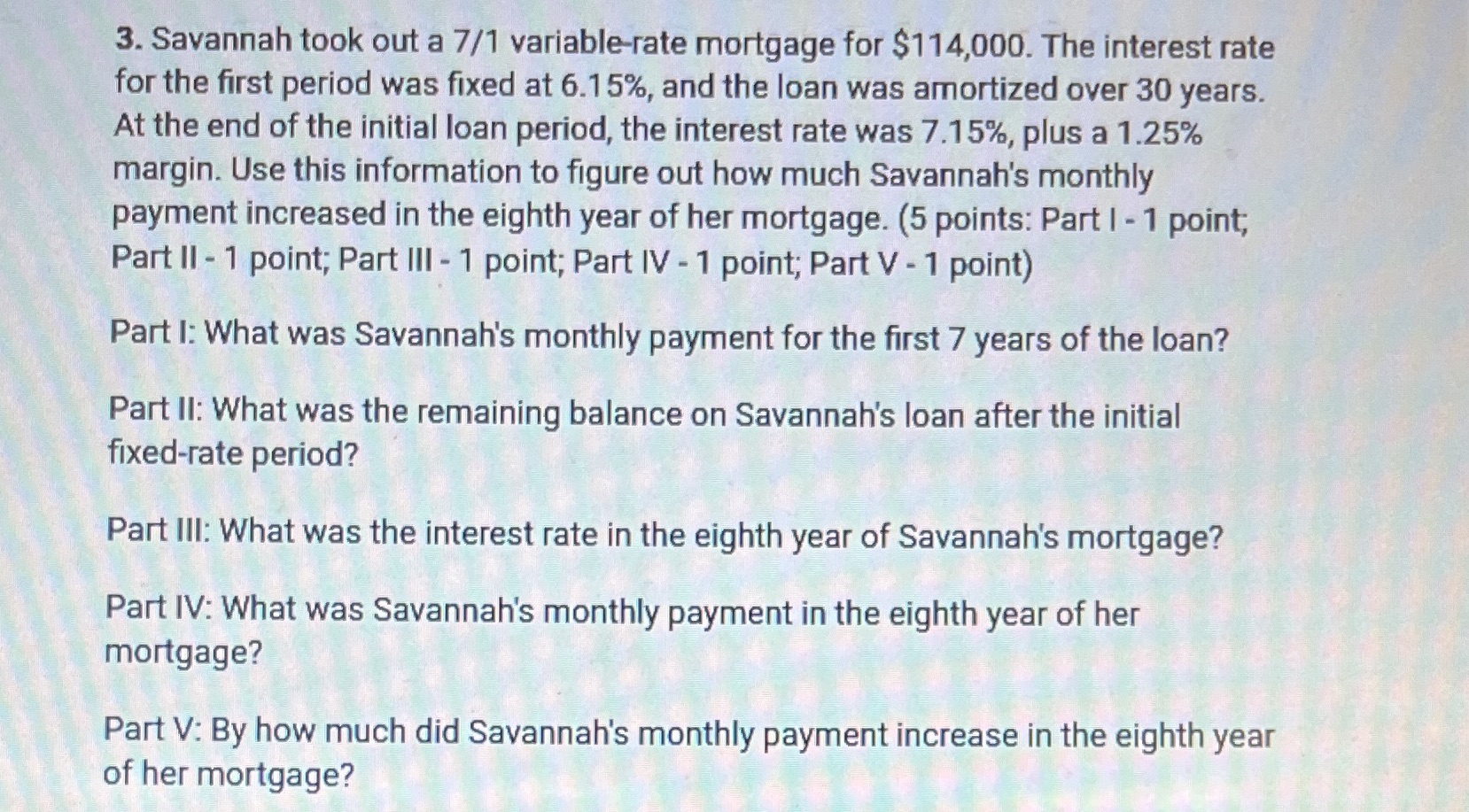

3. Savannah took out a 7/1 variable-rate mortgage for $114,000. The interest rate for the first period was fixed at 6.15%, and the loan was amortized over 30 years. At the end of the initial loan period, the interest rate was 7.15%, plus a 1.25% margin. Use this information to figure out how much Savannah's monthly payment increased in the eighth year of her mortgage. (5 points: Part I - 1 point; Part II - 1 point; Part III - 1 point; Part IV - 1 point; Part V - 1 point) Part I: What was Savannah's monthly payment for the first 7 years of the loan? Part II: What was the remaining balance on Savannah's loan after the initial fixed-rate period? Part III: What was the interest rate in the eighth year of Savannah's mortgage? Part IV: What was Savannah's monthly payment in the eighth year of her mortgage? Part V: By how much did Savannah's monthly payment increase in the eighth year of her mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts