Question: If you could work it out step by step that would be incredible. Thank you The Campbell Company is considering adding a robotic paint sprayer

If you could work it out step by step that would be incredible. Thank you

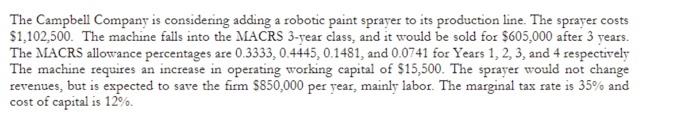

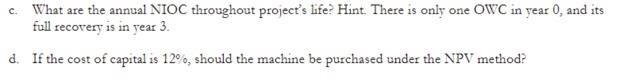

The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer costs $1,102,500. The machine falls into the MACRS 3-year class, and it would be sold for $605,000 after 3 years. The MACRS allowance percentages are 0.3333, 0.4445,0.1481, and 0.0741 for Years 1, 2, 3, and 4 respectively The machine requires an increase in operating working capital of $15,500. The sprayer would not change revenues, but is expected to save the firm $850,000 per year, mainly labor. The marginal tax rate is 35% and cost of capital is 12% c. What are the annual NIOC throughout project's life? Hint. There is only one OWC in year 0, and its full recovery is in year 3. d. If the cost of capital is 12%, should the machine be purchased under the NPV method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts