Question: IF YOU DO IT CORRECTLY I WILL GIVE THUMBS UP! Your manager has asked you to determine an intrinsic value for Utica Manufacturing Company's stock.

IF YOU DO IT CORRECTLY I WILL GIVE THUMBS UP!

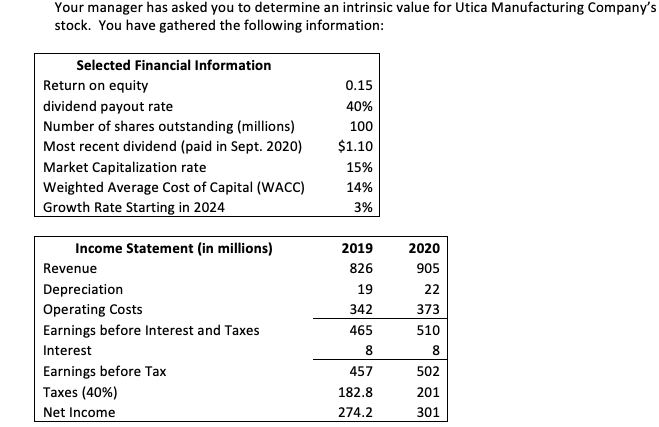

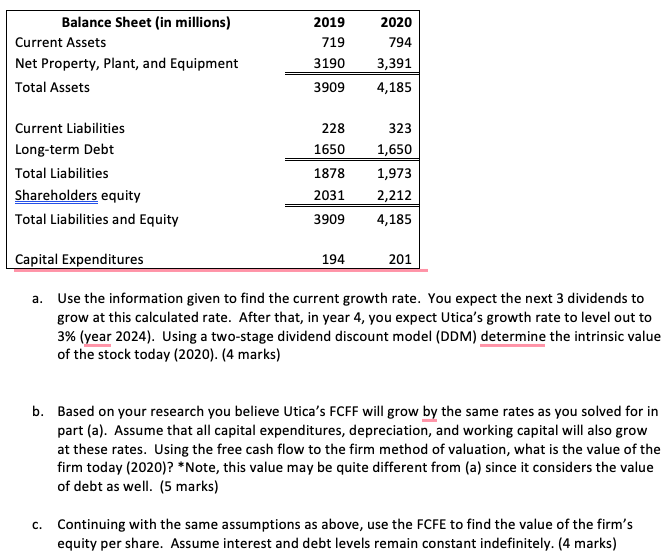

Your manager has asked you to determine an intrinsic value for Utica Manufacturing Company's stock. You have gathered the following information: Selected Financial Information Return on equity dividend payout rate Number of shares outstanding (millions) Most recent dividend (paid in Sept. 2020) Market Capitalization rate Weighted Average Cost of Capital (WACC) Growth Rate Starting in 2024 0.15 40% 100 $1.10 15% 14% 3% Income Statement (in millions) Revenue Depreciation Operating costs Earnings before Interest and Taxes Interest Earnings before Tax Taxes (40%) Net Income 2019 826 19 342 465 8 2020 905 22 373 510 8 502 201 301 457 182.8 274.2 Balance Sheet (in millions) Current Assets Net Property, Plant, and Equipment Total Assets 2019 719 3190 3909 2020 794 3,391 4,185 Current Liabilities Long-term Debt Total Liabilities Shareholders equity Total Liabilities and Equity 228 1650 1878 323 1,650 1,973 2,212 4,185 2031 3909 Capital Expenditures 194 201 a. Use the information given to find the current growth rate. You expect the next 3 dividends to grow at this calculated rate. After that, in year 4, you expect Utica's growth rate to level out to 3% (year 2024). Using a two-stage dividend discount model (DDM) determine the intrinsic value of the stock today (2020). (4 marks) b. Based on your research you believe Utica's FCFF will grow by the same rates as you solved for in part (a). Assume that all capital expenditures, depreciation, and working capital will also grow at these rates. Using the free cash flow to the firm method of valuation, what is the value of the firm today (2020)? *Note, this value may be quite different from (a) since it considers the value of debt as well. (5 marks) C. Continuing with the same assumptions as above, use the FCFE to find the value of the firm's equity per share. Assume interest and debt levels remain constant indefinitely. (4 marks) Your manager has asked you to determine an intrinsic value for Utica Manufacturing Company's stock. You have gathered the following information: Selected Financial Information Return on equity dividend payout rate Number of shares outstanding (millions) Most recent dividend (paid in Sept. 2020) Market Capitalization rate Weighted Average Cost of Capital (WACC) Growth Rate Starting in 2024 0.15 40% 100 $1.10 15% 14% 3% Income Statement (in millions) Revenue Depreciation Operating costs Earnings before Interest and Taxes Interest Earnings before Tax Taxes (40%) Net Income 2019 826 19 342 465 8 2020 905 22 373 510 8 502 201 301 457 182.8 274.2 Balance Sheet (in millions) Current Assets Net Property, Plant, and Equipment Total Assets 2019 719 3190 3909 2020 794 3,391 4,185 Current Liabilities Long-term Debt Total Liabilities Shareholders equity Total Liabilities and Equity 228 1650 1878 323 1,650 1,973 2,212 4,185 2031 3909 Capital Expenditures 194 201 a. Use the information given to find the current growth rate. You expect the next 3 dividends to grow at this calculated rate. After that, in year 4, you expect Utica's growth rate to level out to 3% (year 2024). Using a two-stage dividend discount model (DDM) determine the intrinsic value of the stock today (2020). (4 marks) b. Based on your research you believe Utica's FCFF will grow by the same rates as you solved for in part (a). Assume that all capital expenditures, depreciation, and working capital will also grow at these rates. Using the free cash flow to the firm method of valuation, what is the value of the firm today (2020)? *Note, this value may be quite different from (a) since it considers the value of debt as well. (5 marks) C. Continuing with the same assumptions as above, use the FCFE to find the value of the firm's equity per share. Assume interest and debt levels remain constant indefinitely. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts