Question: if you only can answer one question, just answer the expected return, and show the specific calculation process. QUESTION 11 The insurance firm has two

if you only can answer one question, just answer the expected return, and show the specific calculation process.

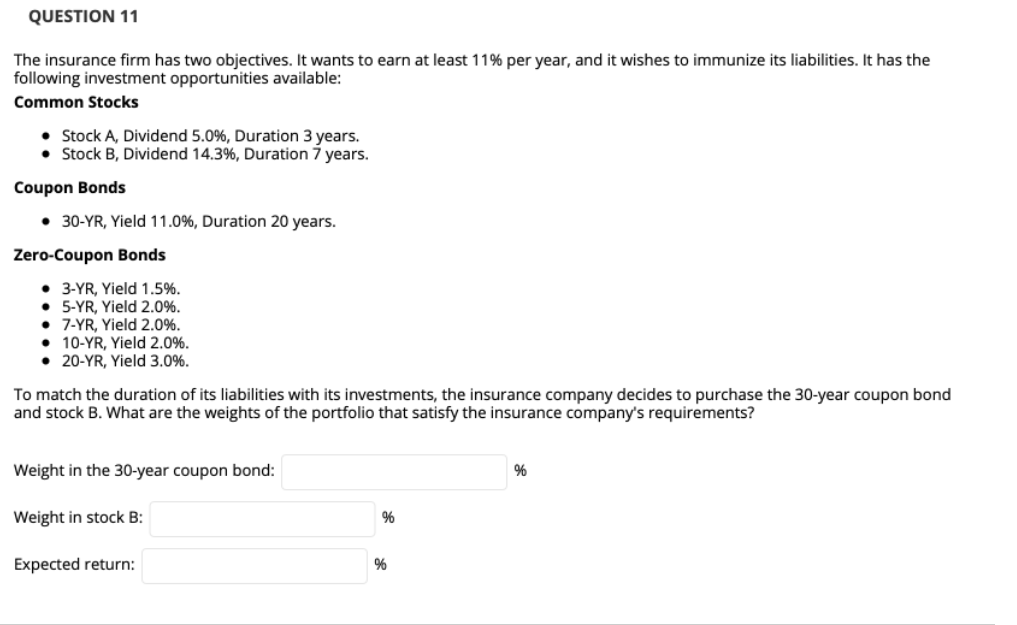

QUESTION 11 The insurance firm has two objectives. It wants to earn at least 11% per year, and it wishes to immunize its liabilities. It has the following investment opportunities available: Common Stocks Stock A, Dividend 5.0%, Duration 3 years. Stock B, Dividend 14.3%, Duration 7 years. Coupon Bonds 30-YR, Yield 11.0%, Duration 20 years. Zero-Coupon Bonds 3-YR, Yield 1.5%. 5-YR, Yield 2.0%. 7-YR, Yield 2.0%. 10-YR, Yield 2.0%. 20-YR, Yield 3.0%. To match the duration of its liabilities with its investments, the insurance company decides to purchase the 30-year coupon bond and stock B. What are the weights of the portfolio that satisfy the insurance company's requirements? Weight in the 30-year coupon bond: % Weight in stock B: % Expected return: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts