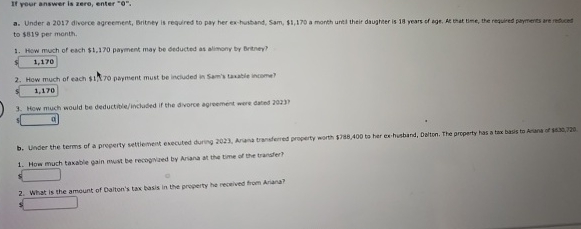

Question: If your answer is zero, enter 0 . to $ 8 1 9 per month. Hew much of each $ 1 . 1

If your answer is zero, enter to $ per month.

Hew much of each $ payment may be seducted as alimony by Brtner?

How much of each $ hito payment must be included in Sart's tawasie income?

How much would be deductibleinclubed if the avorce agivement mere dated

b Lider the terms of a property settiement esecuted during Arand cranderited property worth to her exihushand, Daliton, The property has a tax basis to Aana of isxo,

How much taxable gain mwst be recognated by Ariana at the time of the transter?

What is the amount of Calton's tax hasis in the property he recelved from Ariana?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock